Shipping tax is a tax charged on the shipment cost of products. You need to evaluate whether to charge shipping tax based on your actual needs. Please refer to the following help documentation to manually set the shipping tax.

Steps

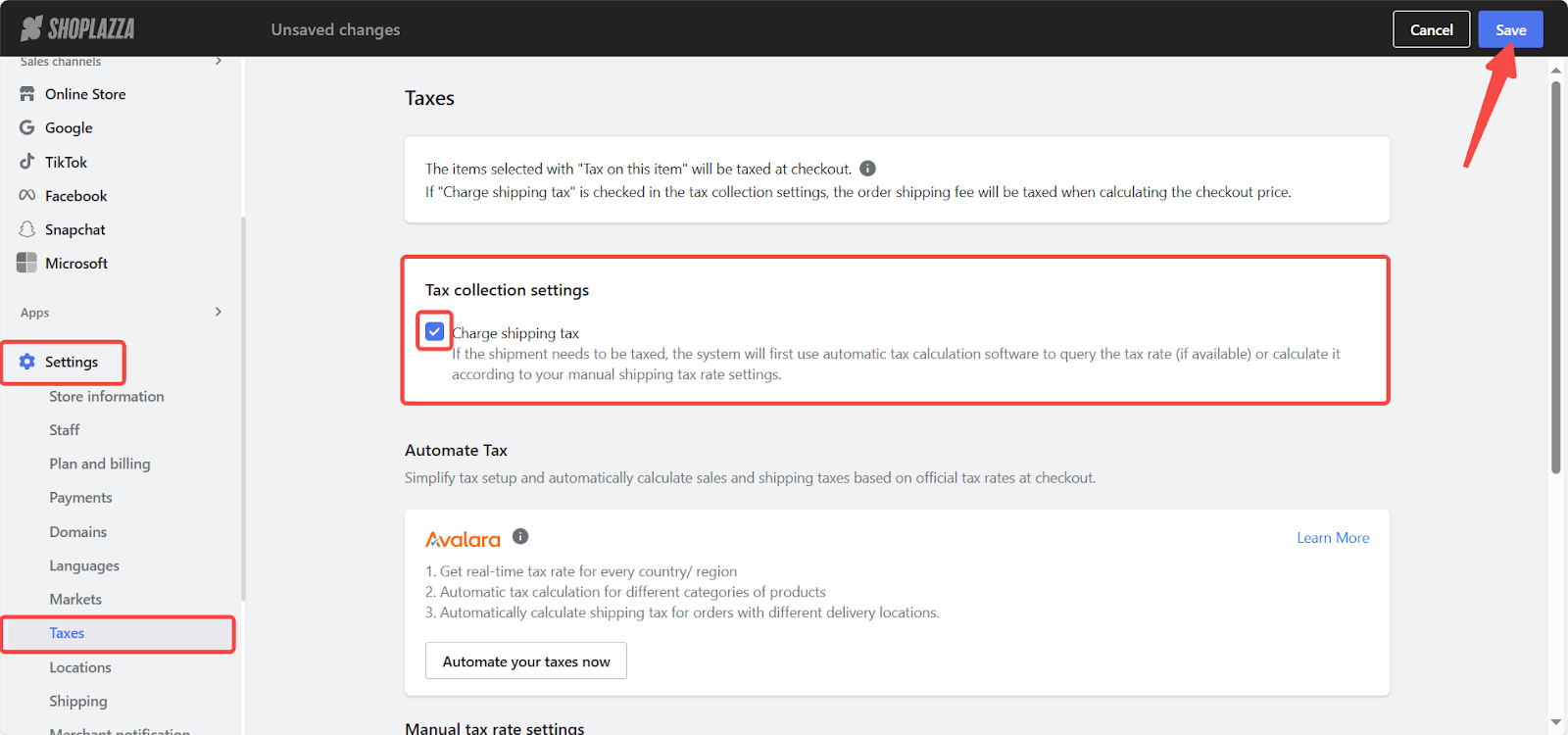

1. Access to tax collection settings: Log into your Shoplazza admin > Settings > Taxes. In the Tax collection settings, select the Charge shipping tax option, and click Save.

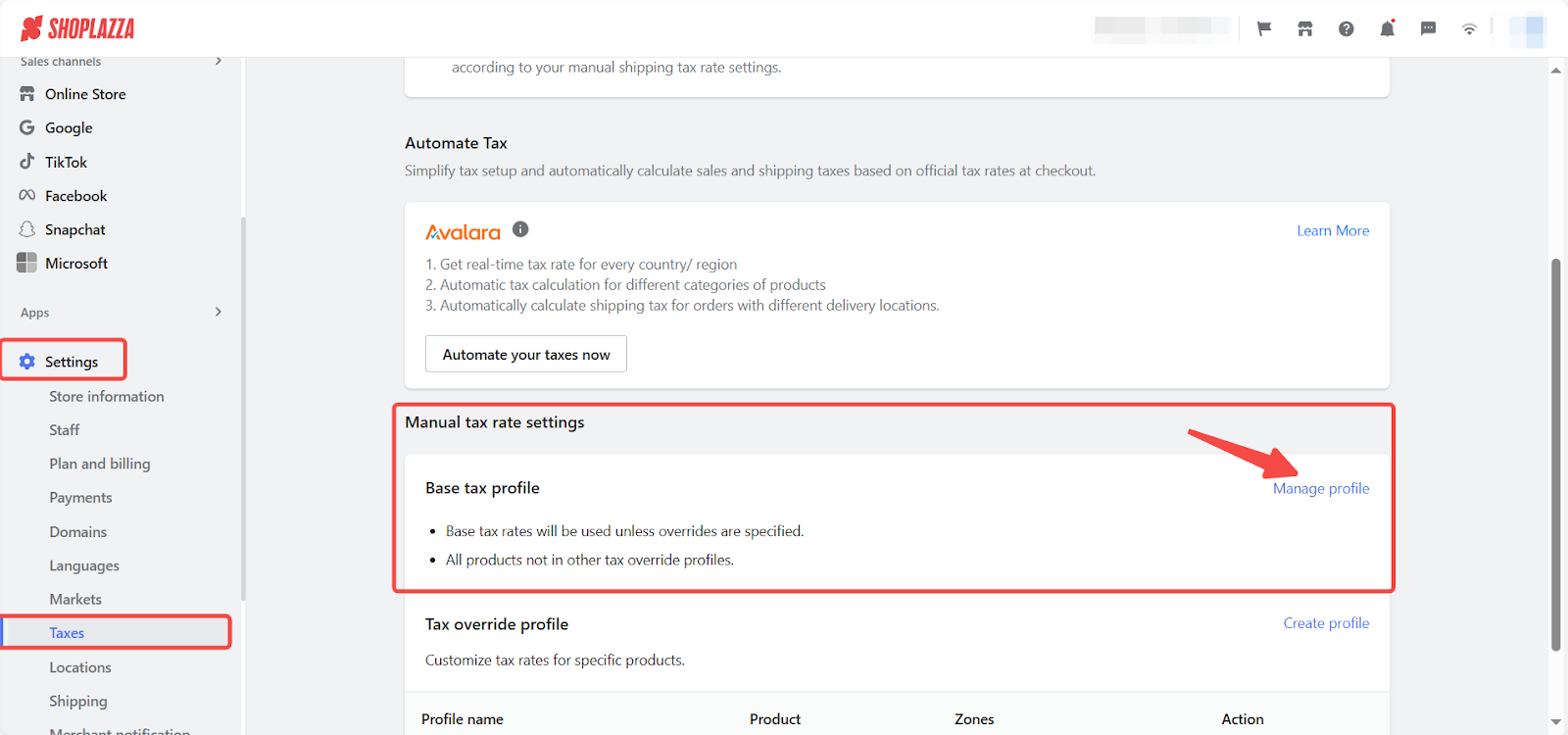

2. Manage the tax profile: Come to the Manual tax rate settings section, click the Manage profile in the right side of the Base tax profile to start configuring.

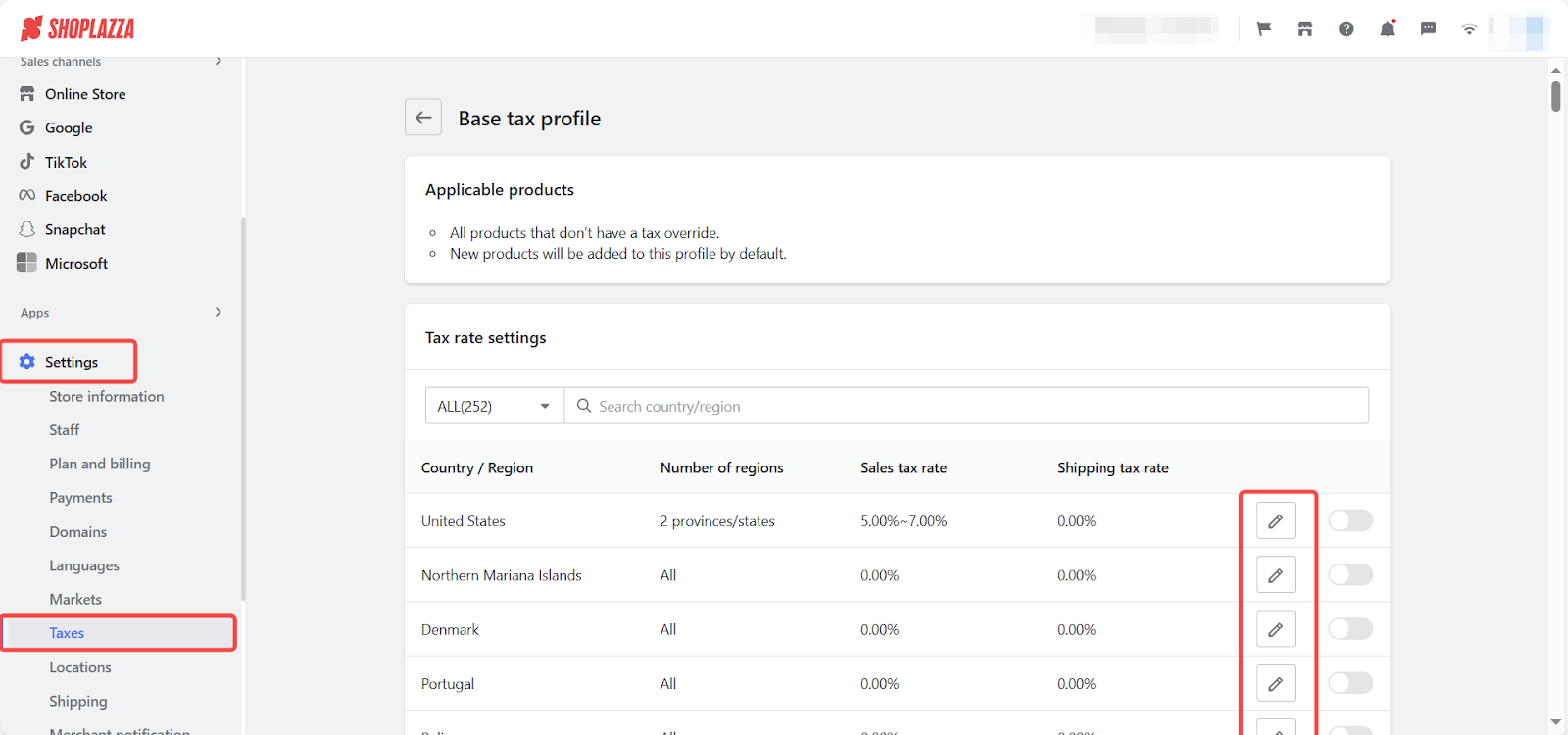

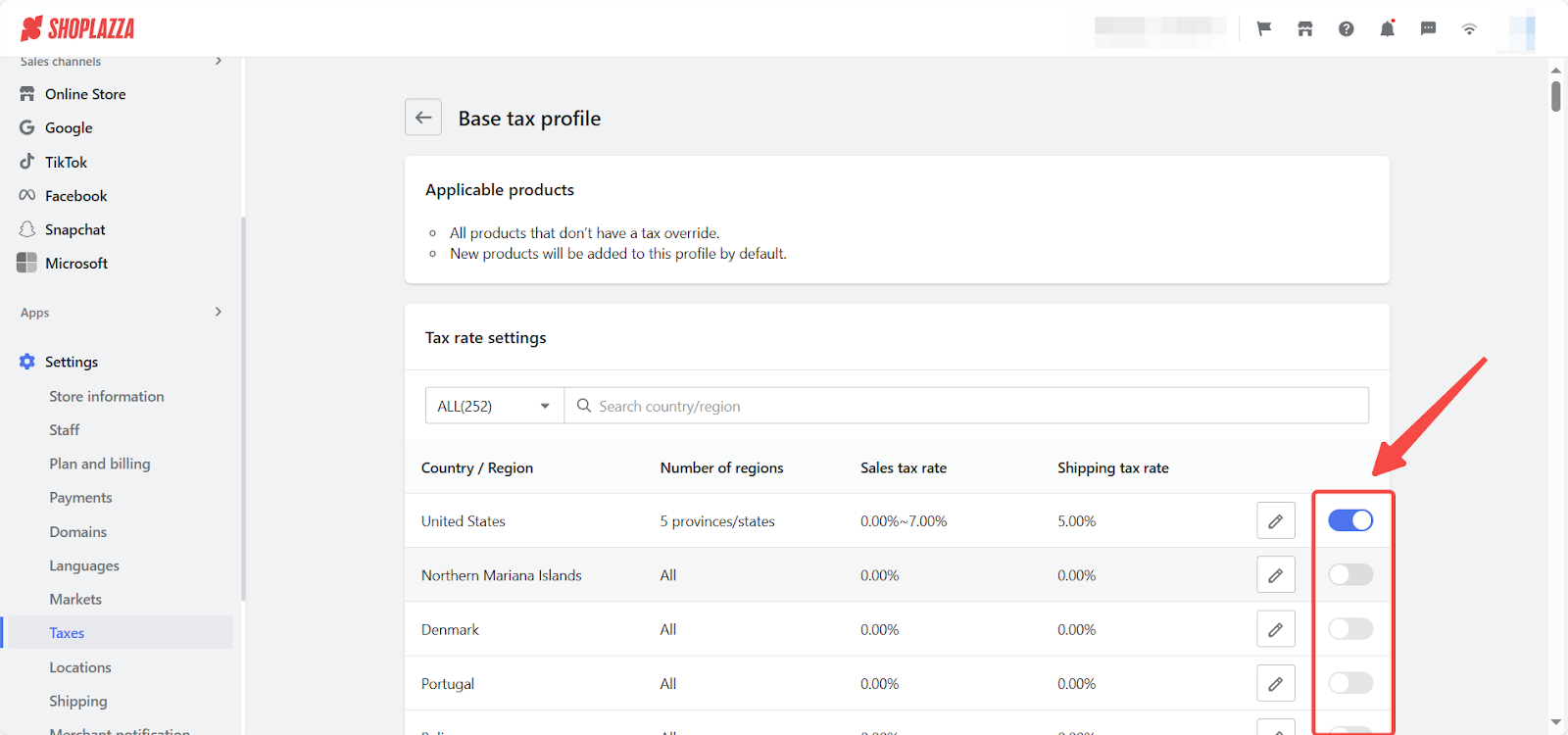

3. Enter into the tax editing page: Choose the country/region that needs to set the shipping tax rate based on actual needs, click the edit icon to enter the tax editing page.

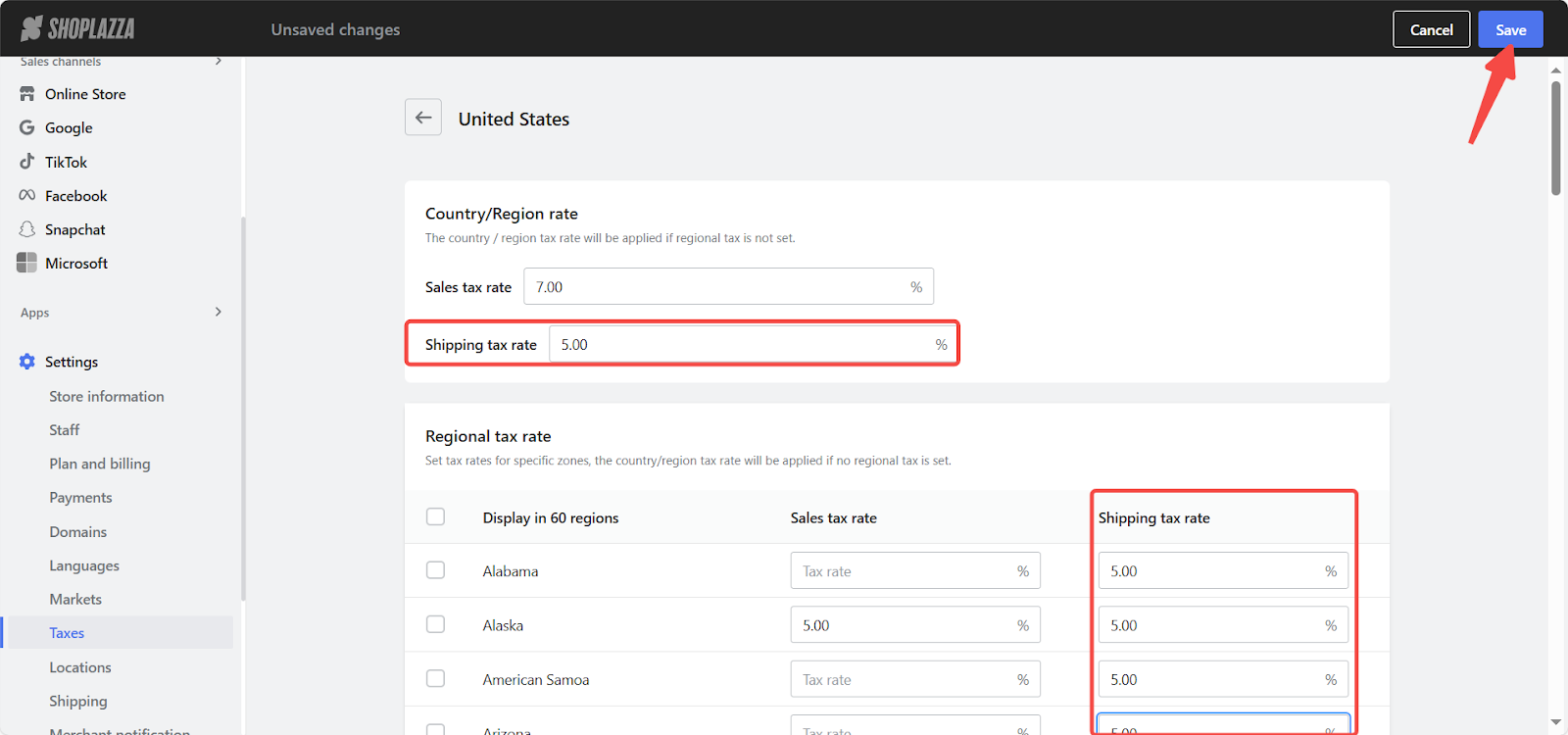

4. Set shipping tax rates: On the shipping tax rates setting page, you can set a unified shipping tax rate for the country/region as a whole, or set specific shipping tax rates for certain regions within that country/region. Remember to click Save to update your modification.

5. Activate tax settings: After setting tax rates in the previous step, click Enable button.

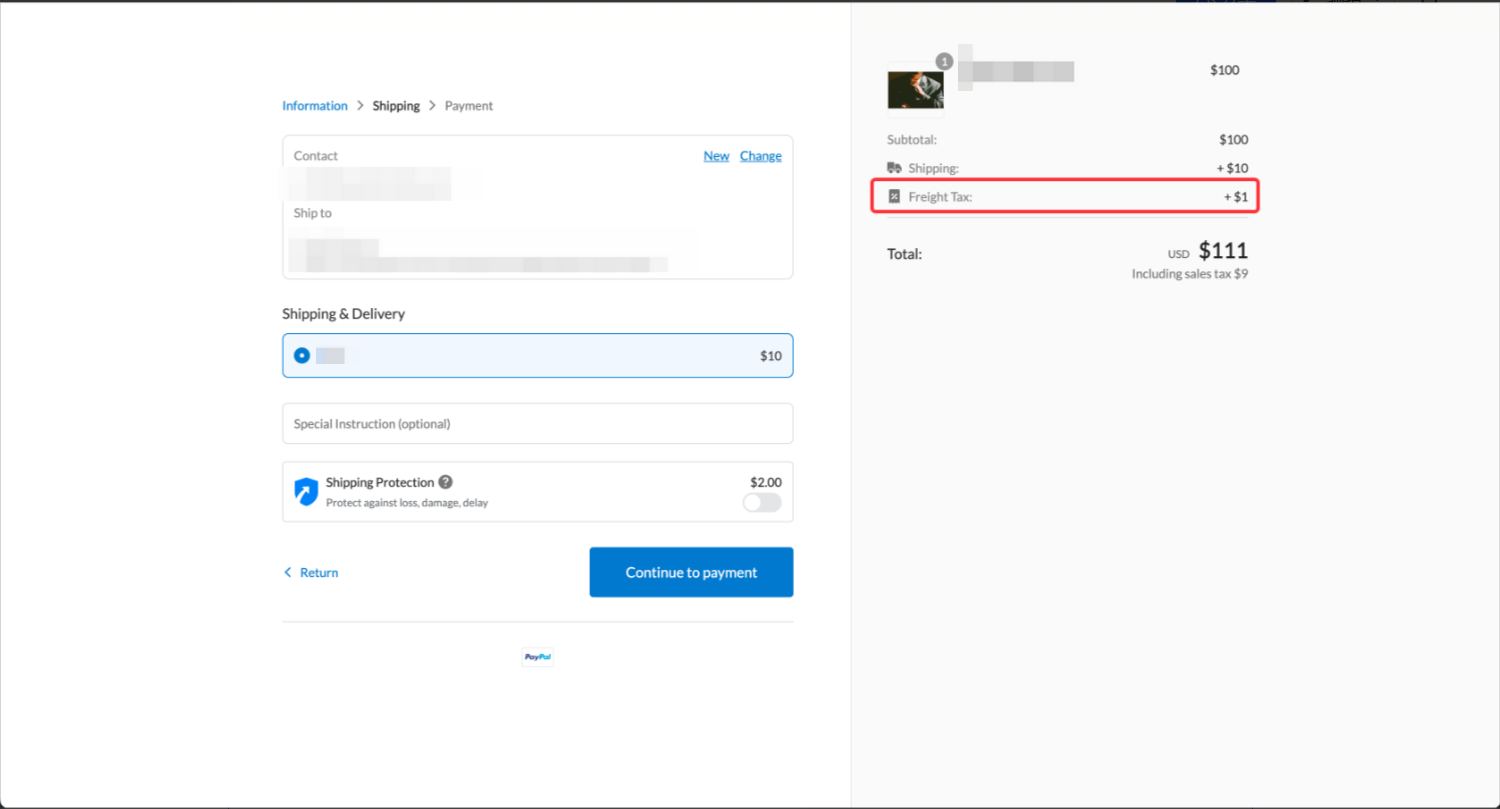

6. Example final display: As shown in the figure below, when the shipping tax rate is 10% and the shipping fee is $10, a $1 shipping tax will be charged to the consumer.

Note

If you have enabled both the freight tax collection and the Avalara automatic tax calculation function (available in the Pro version) along with Manual tax rate settings, the system will prioritize using Avalara to query the tax rate (if any), and then calculate according to your manually set tax rate. Additionally, freight tax is related only to the shipping fee and not to the price of the goods.

This guide outlines how to set shipping taxes for your store's products. This way, customers can directly include shipping tax when paying on the checkout page, which is more efficient and saves time costs.

Comments

Please sign in to leave a comment.