If you find it too confusing and inefficient to manage the taxes around the world, you can try the new service we launch. Shoplazza now seamlessly integrates with Avalara, a third-party service provider offering real-time and automatic tax rate calculations for you. Thus, you'll be free from dealing with tax issues on your own.

Note

The service is currently available only for Shoplazza Pro users.

Connecting Avalara account

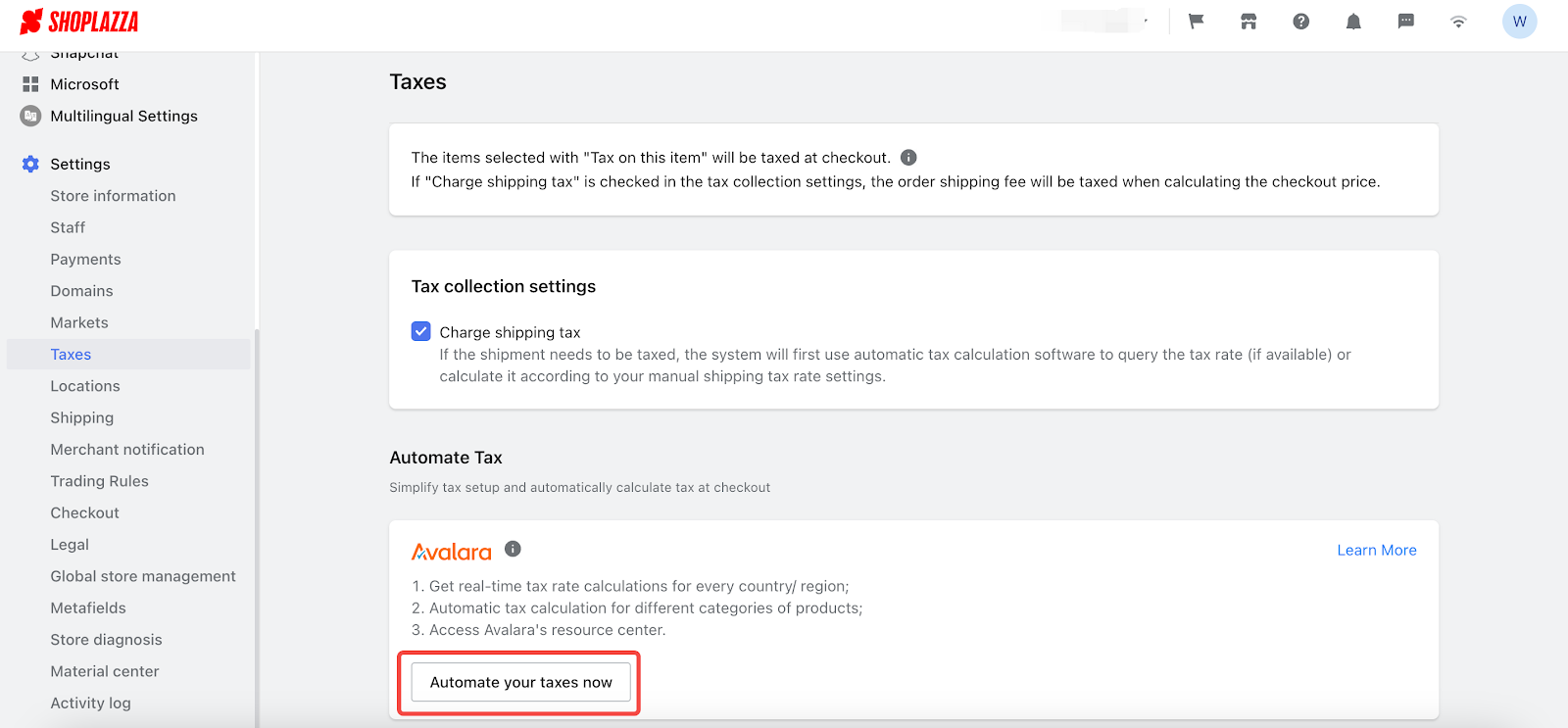

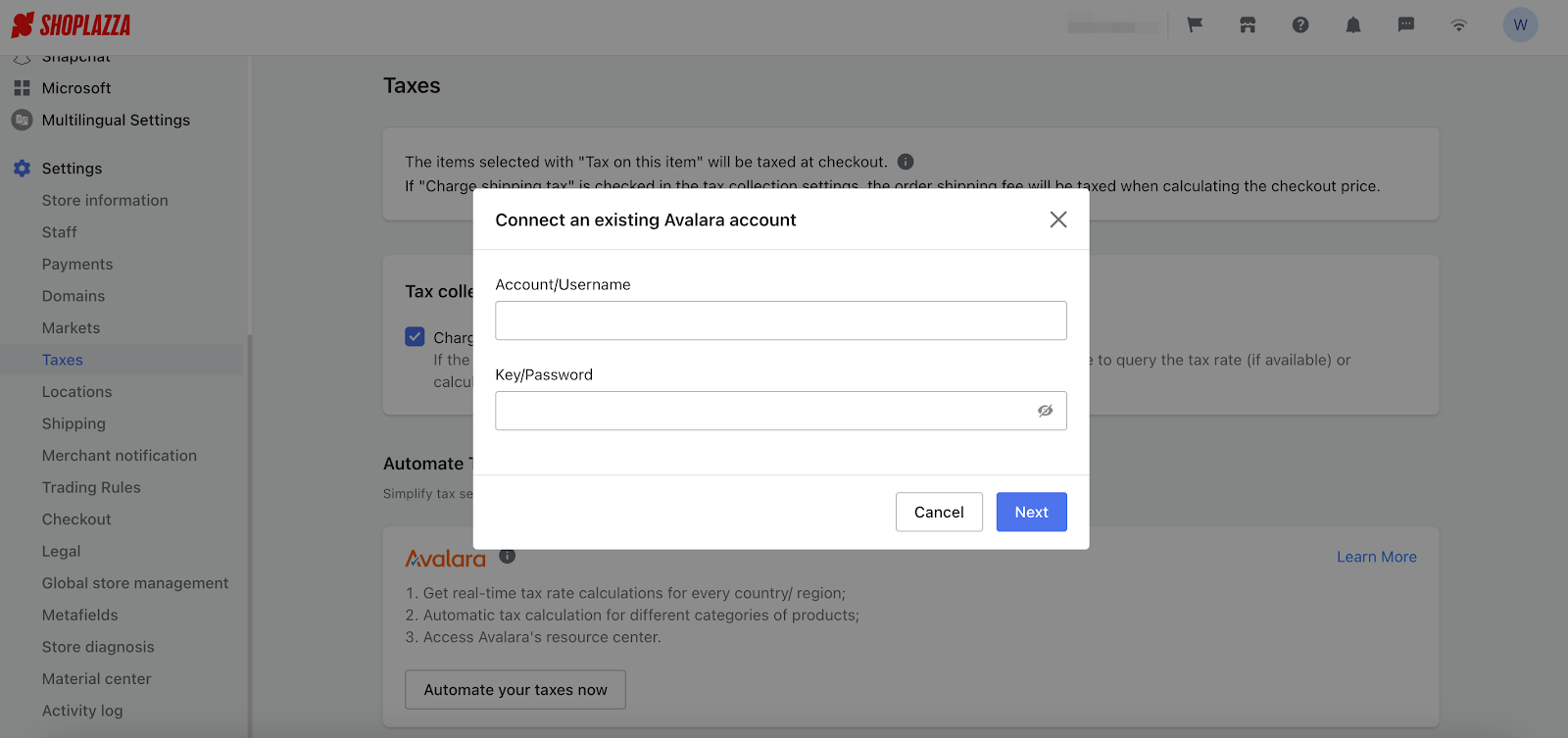

1. From your Shoplazza Admin, go to Settings > Taxes, and click Automate your taxes now to log in.

2. If you do not have an Avalara account, you can visit the Avalara website to register one and follow the prompts to fill in necessary information.

Complete Settings in Shoplazza admin

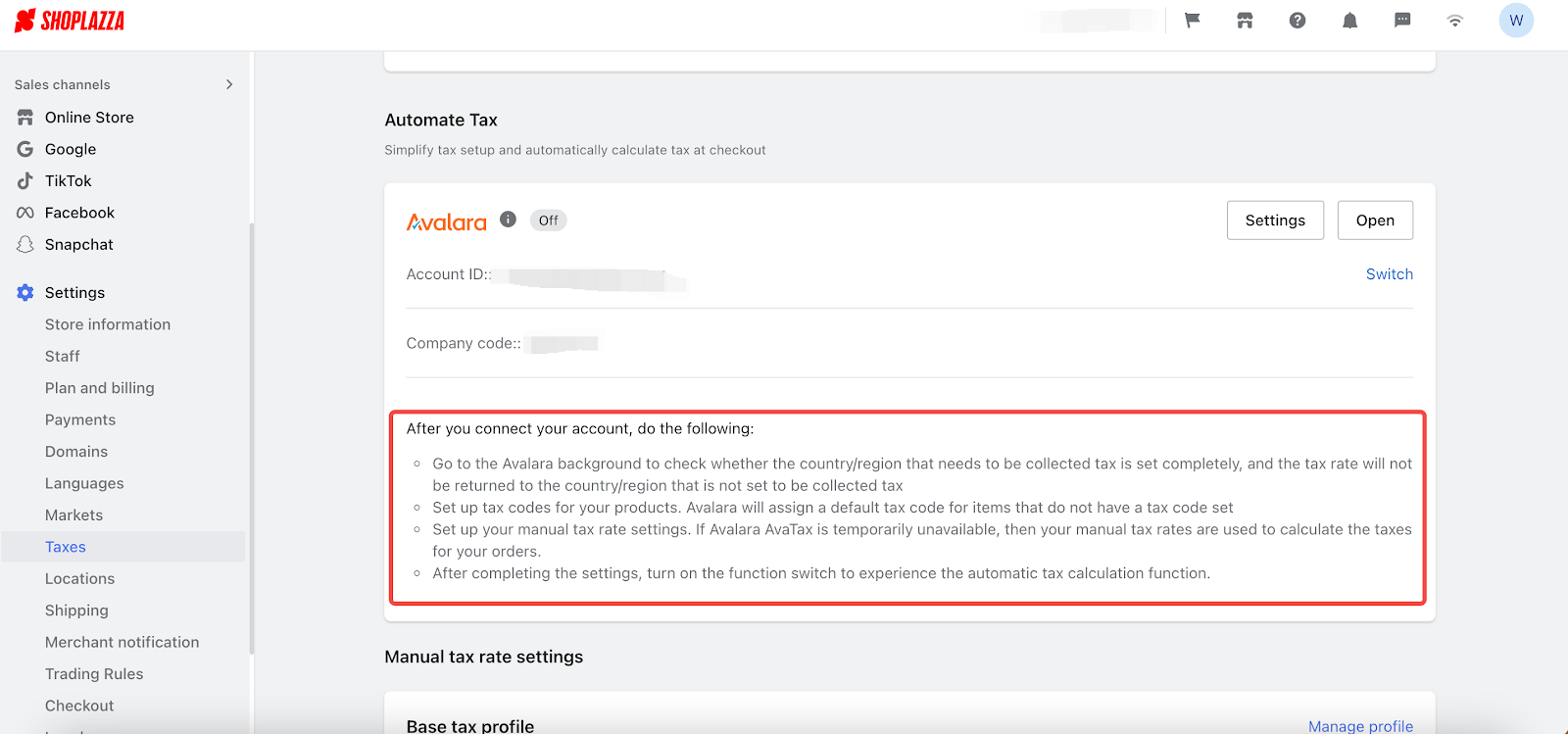

1. From your Shoplazza Admin, go to Settings > Taxes, after connecting your Avalara account, you can follow the prompts to complete the process.

2. Please kindly remind to go to Avalara admin to check if the setting is complete. Without setting taxing countries and regions, tax rates won't show up in Shoplazza admin and the products won't be taxed.

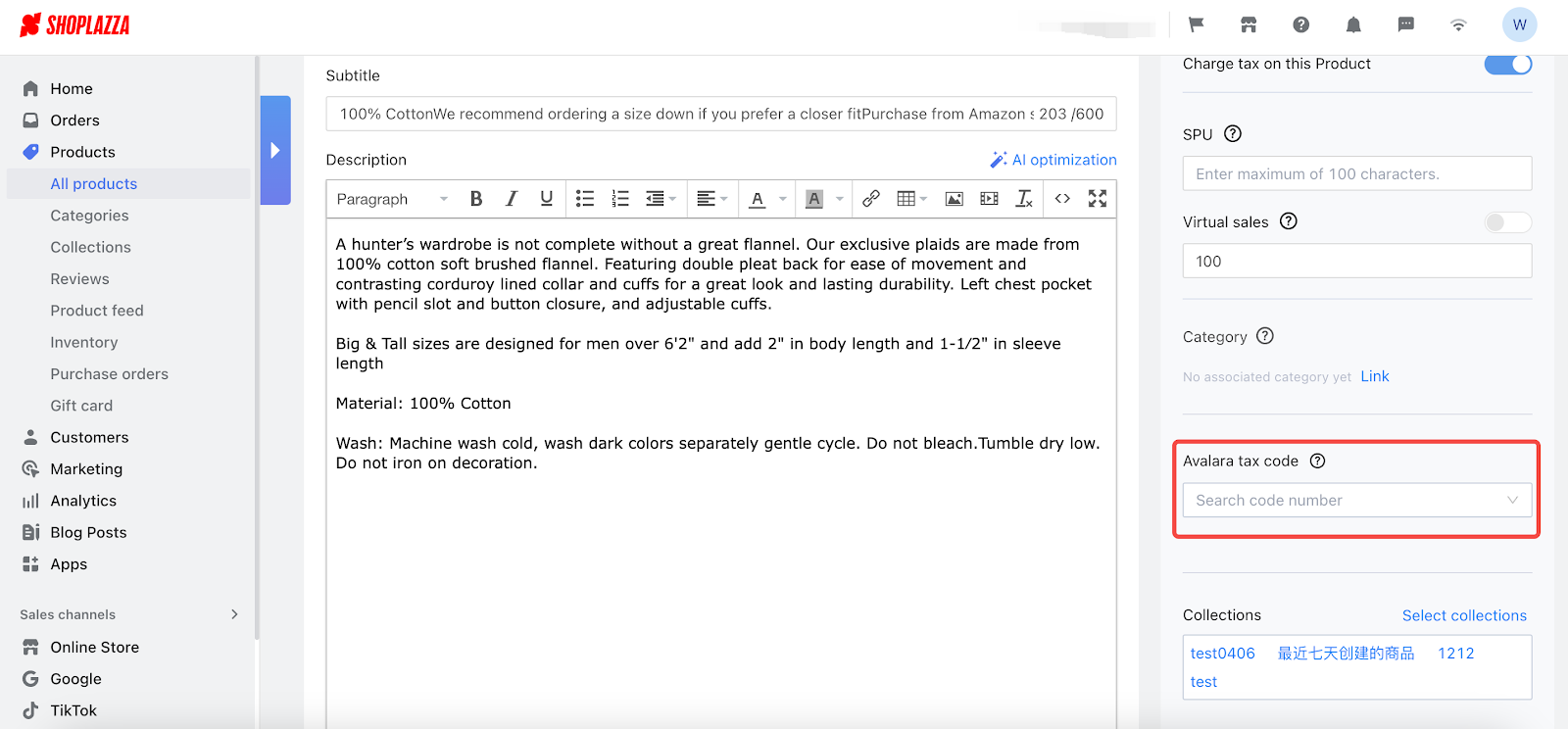

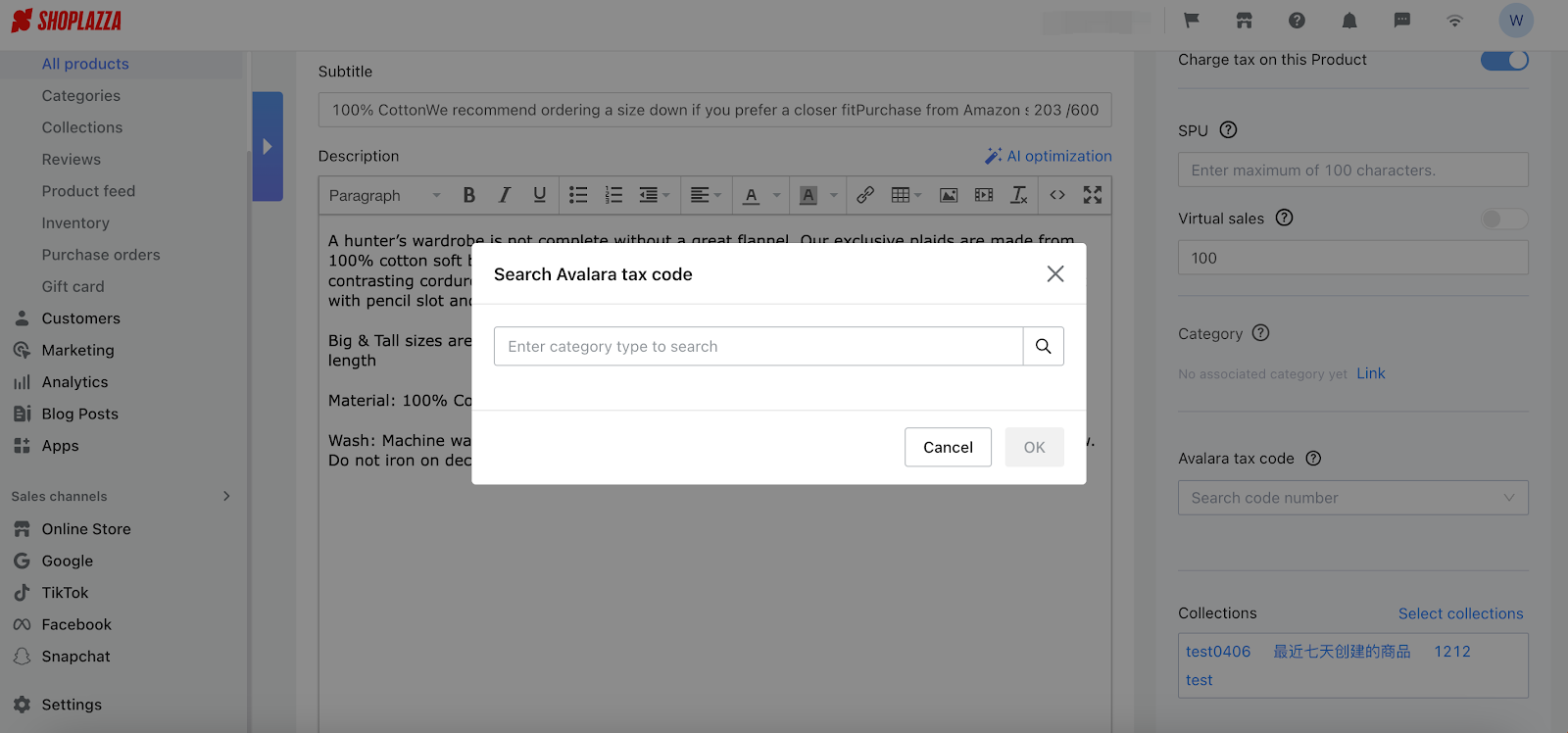

3. To attain a more accurate tax calculation, you can create a tax code for each of your products. If not, Avalara will automatically set a tax code for each product.

- You can input the category type of products here to search for the tax code that Avalara provides.

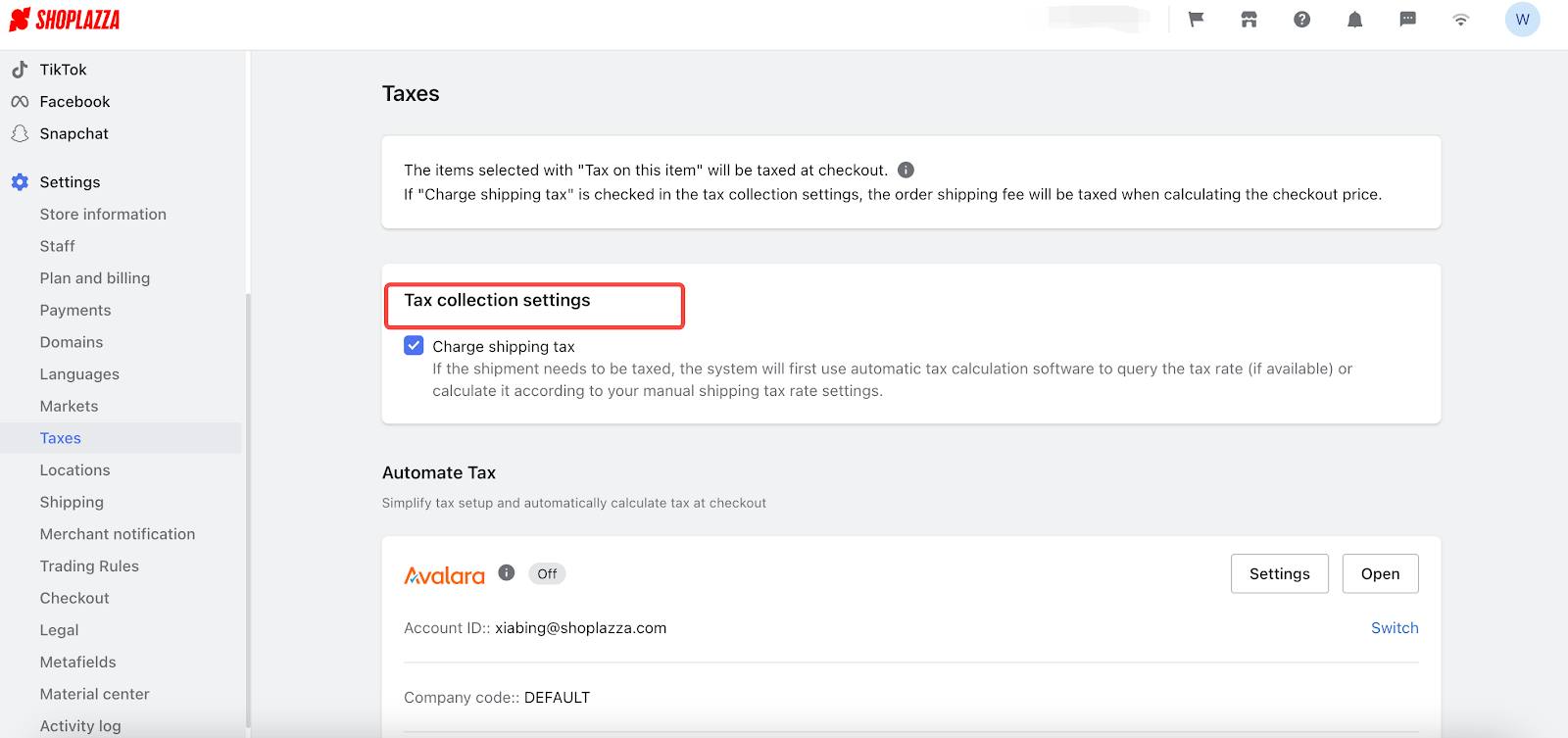

4. If you want to charge the customers shipping tax, please first go to Settings > Taxes > Tax collection settings and allow "Charge shipping tax".

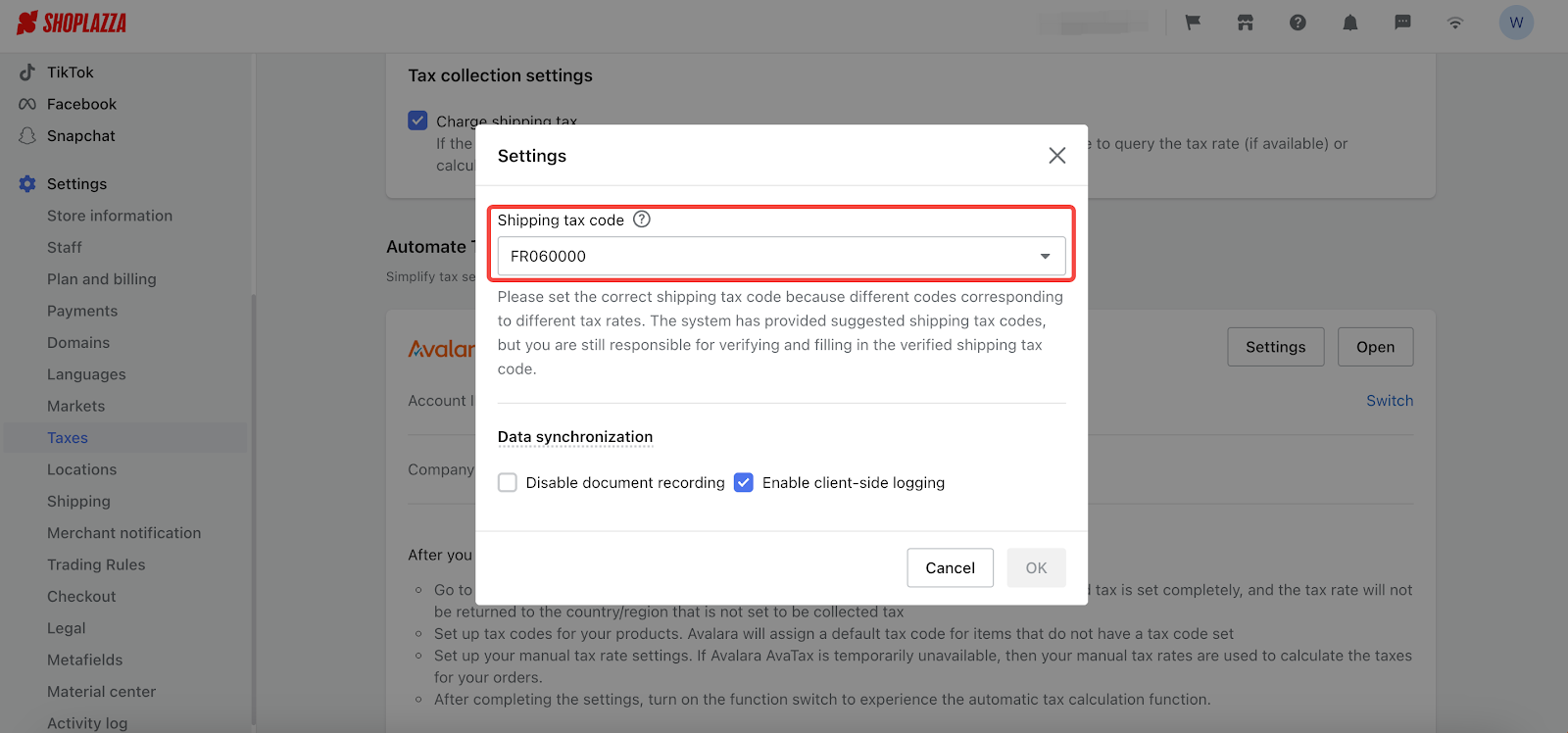

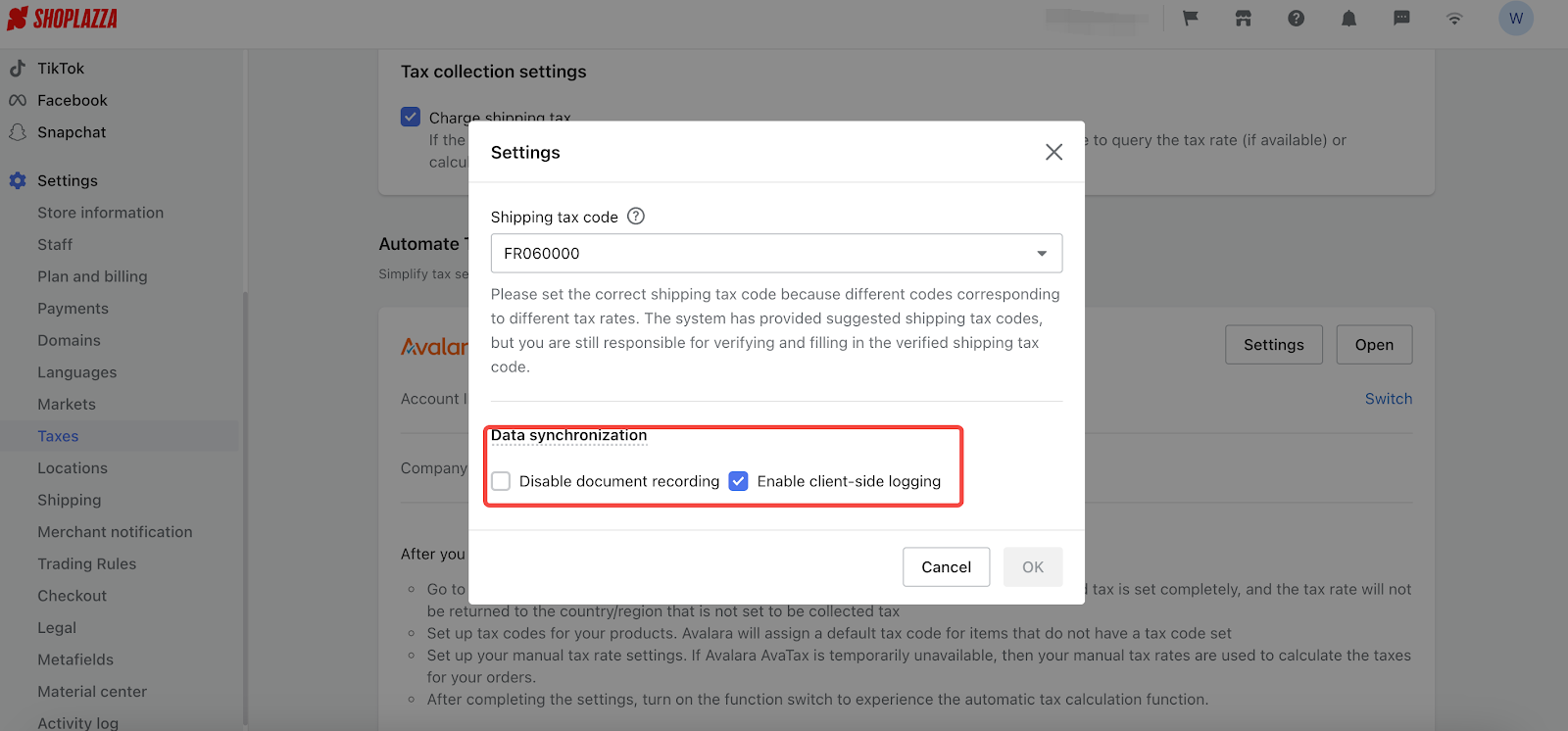

5. Make sure to select the appropriate shipping tax code, as different codes correspond to various tax rates. The system has offered suggestions for shipping tax codes, but it's your responsibility to check and enter the correct and verified shipping tax code.

Note

According to the privacy policy, you have the right to decide whether you can sync your tax calculation recording to Avalara.

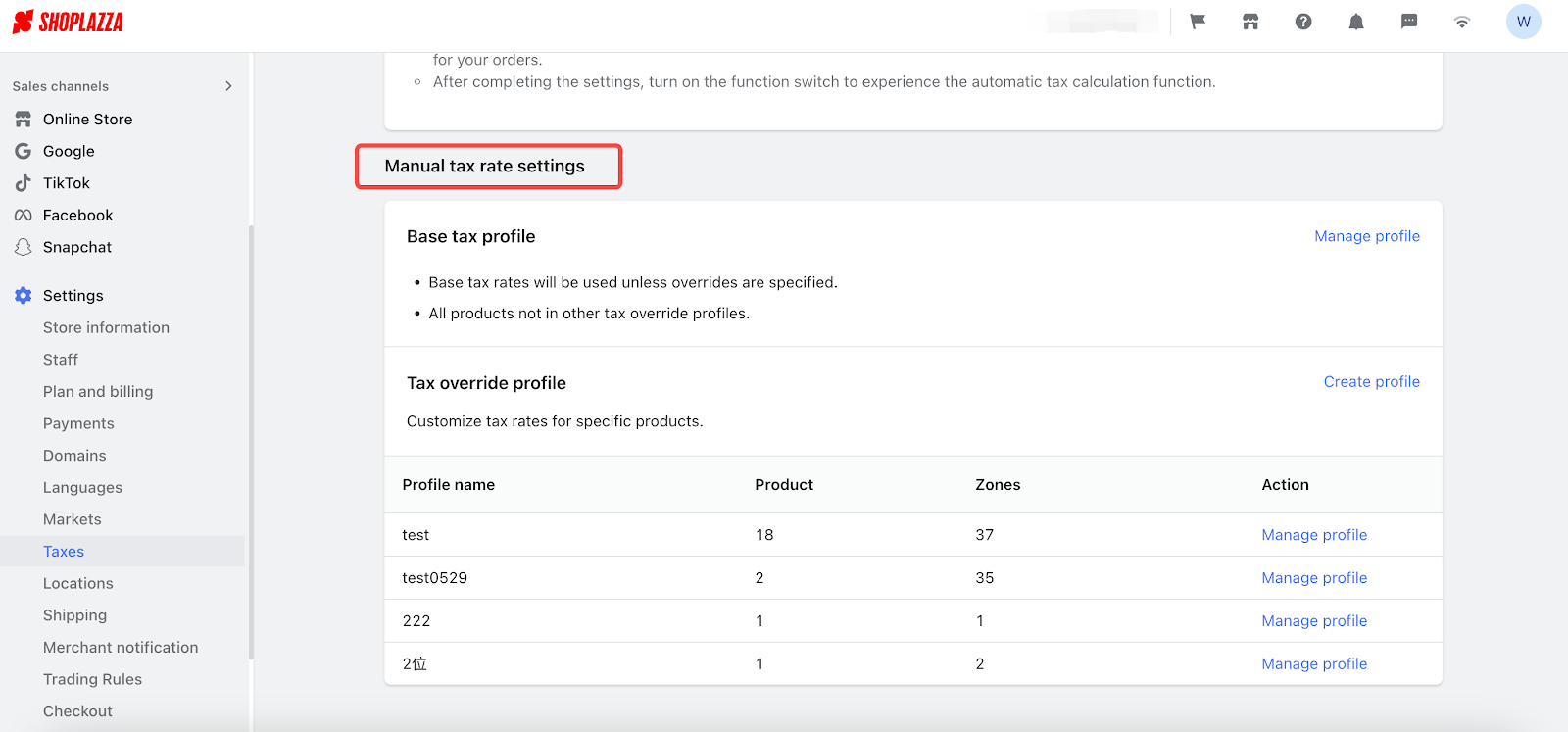

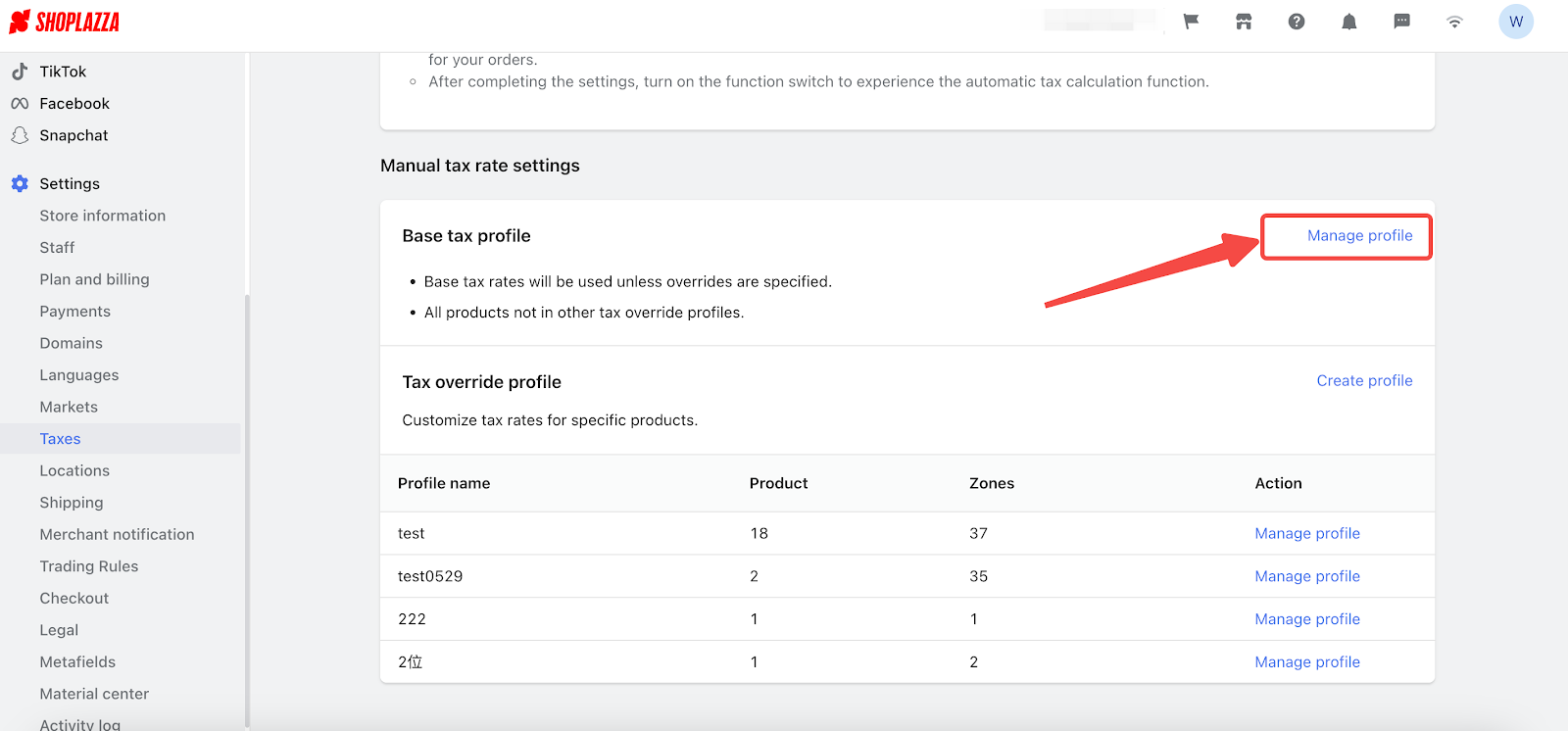

6. Last but not least, you can set up tax rates manually. If Avalara AvaTax happens to be not applicable, you can go to Shoplazza Admin > Settings > Taxes, and click Manage profile to create your own tax rate to calculate tax fee.

Note

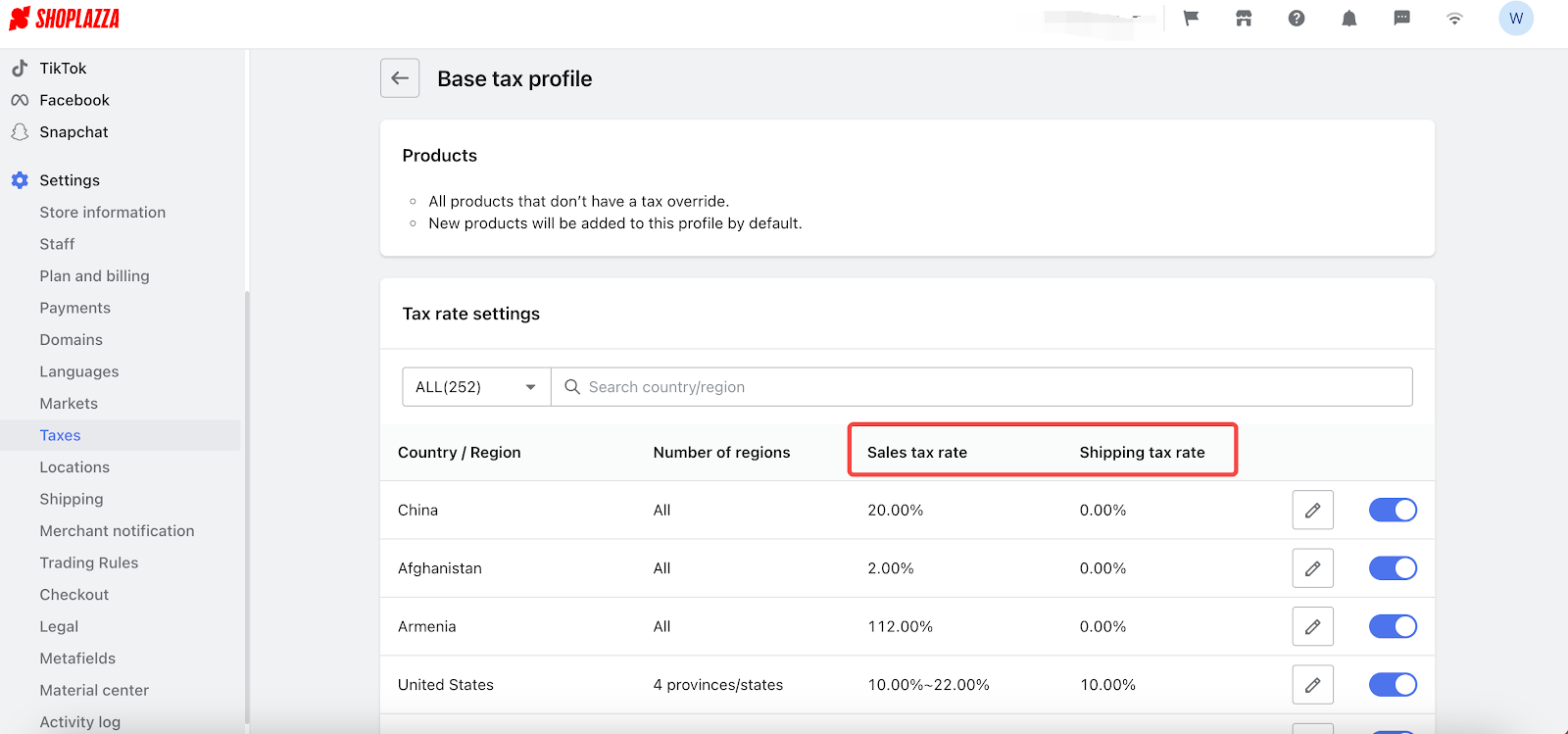

Now Shoplazza can support you to create different tax rates for different countries and regions. You can click Manage profile for both the base tax profile and the tax override profile to create the sales tax rate and shipping tax rate manually.

- If you want to create a tax profile for all products, please kindly refer to: How to create a Base tax profile?

- If you want to create a tax profile for specific products, please kindly refer to: How to create and manage Tax override profiles?

7. If you have completed relevant settings in Avalara admin and sign in your Avalara account in Shoplazza admin, Avalara will provide your customers with the tax rate and tax fee when they purchase certain products.

8. The system will transfer the orders created with Avalara to Avalara admin, where you can view these orders and better manage the tax reports.

Note

When you refund an order taxed by Avalara, relevant information of products and fees will also sync to Avalara, and Avalara will create a relevant tax refund report for you.

Note

If you partially refund an order, the refunded product is not clear to the system. We kindly suggest that you can manually adjust this partial refund in Avalara admin, where a partial refund report will be created.

9. If you want to learn more about Avalara's features, you can find support from the Avalara admin > Account > Support cases. You can also read this article to get more assistance.

Comments

Please sign in to leave a comment.