When selling products around the world, figuring out the tax rules in different countries can be challenging. Here we provide you with easy access to manage the tax profiles in advance. The steps below will guide you in creating a Tax override Profile, which will apply to certain products

How to create a Tax override profile

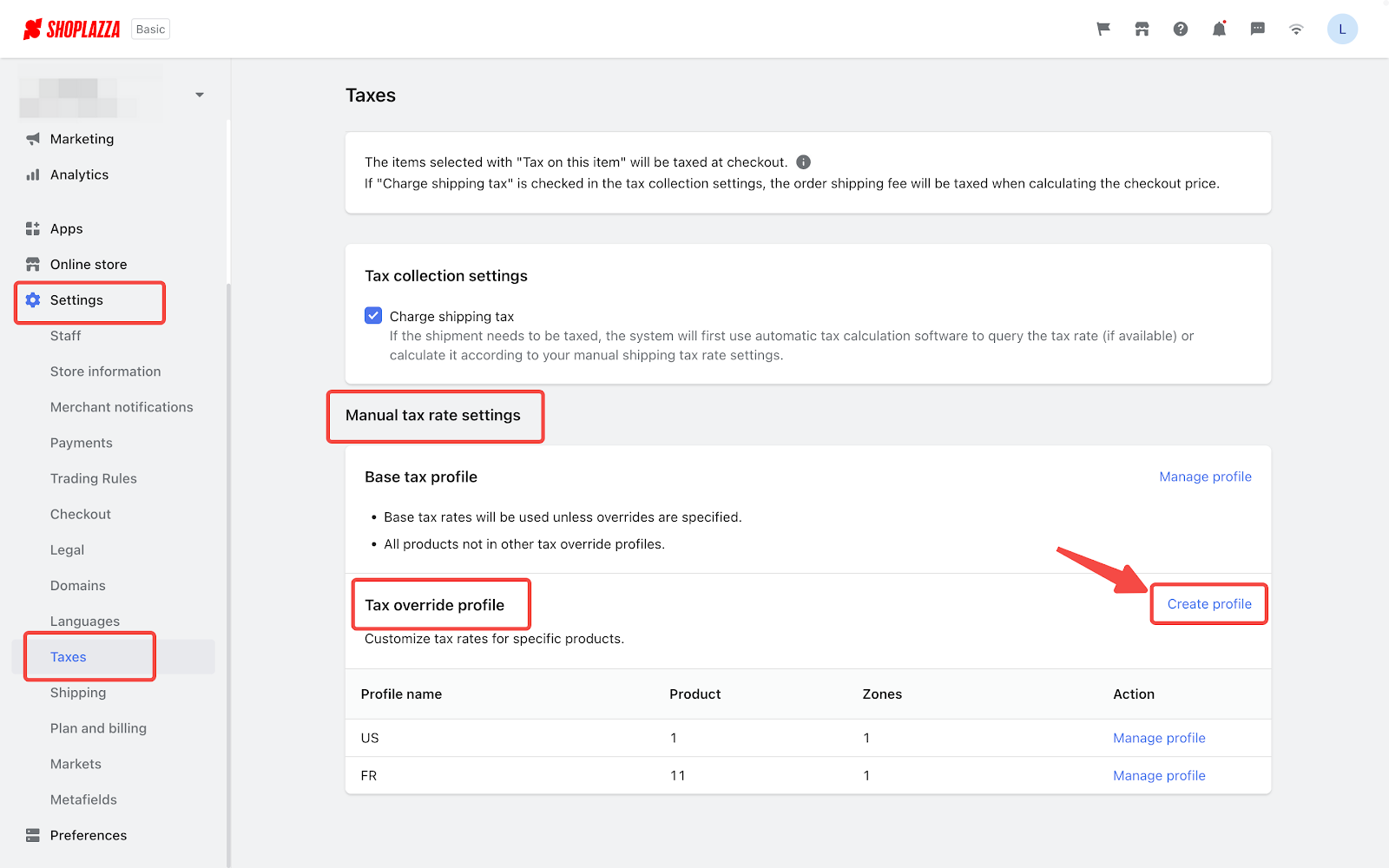

1. From your Shoplazza Admin, go to Settings > Taxes > Manual tax rate settings > Tax override profile, and click Create profile for settings.

Note

If you want to charge the customers shipping tax, please first go to Settings > Taxes > Tax collection settings and allow "Charge shipping tax".

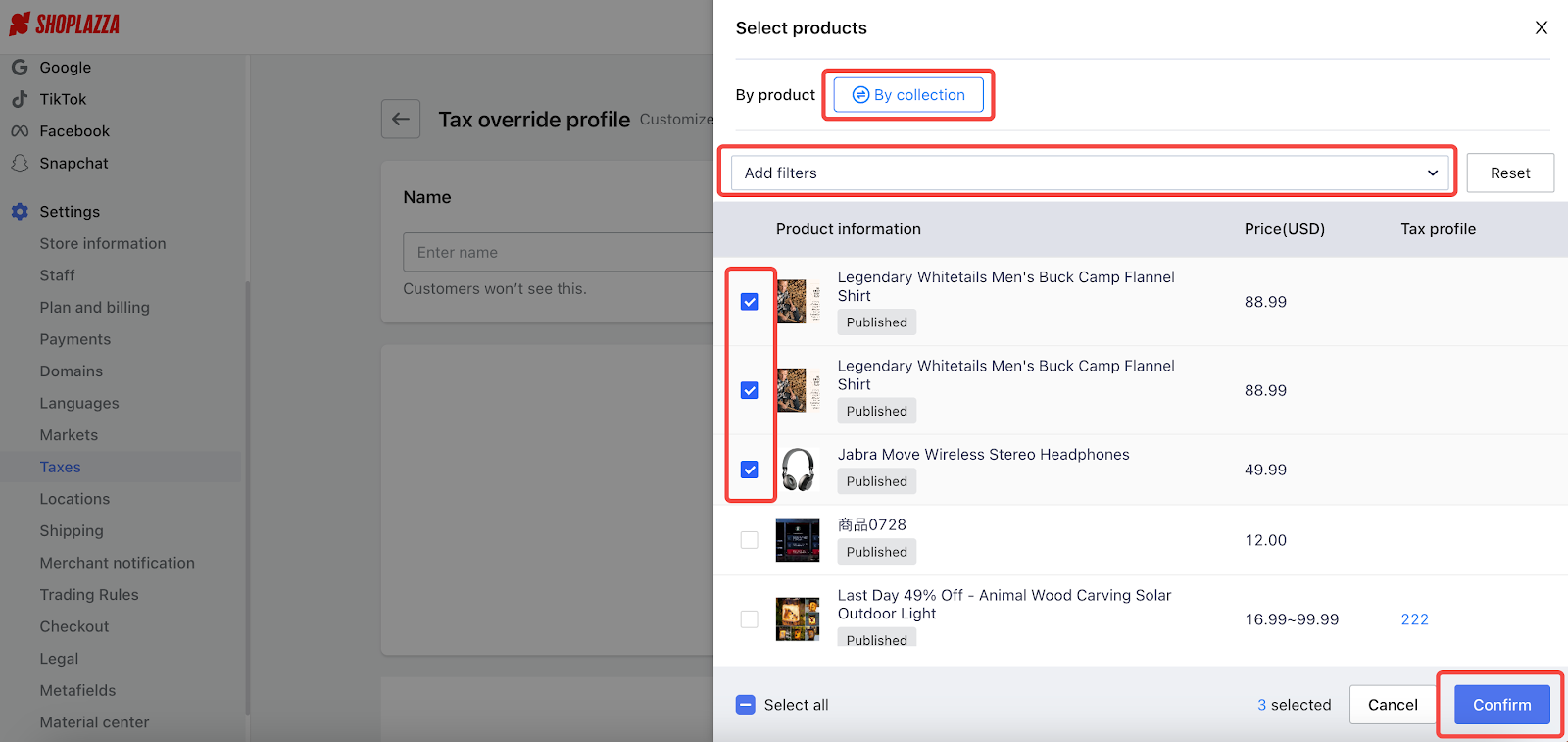

2. You can name the profile and select products, then click Confirm to complete your selection. During the process, you can select By product or By collection as you wish, or Add filters to choose products from a certain range.

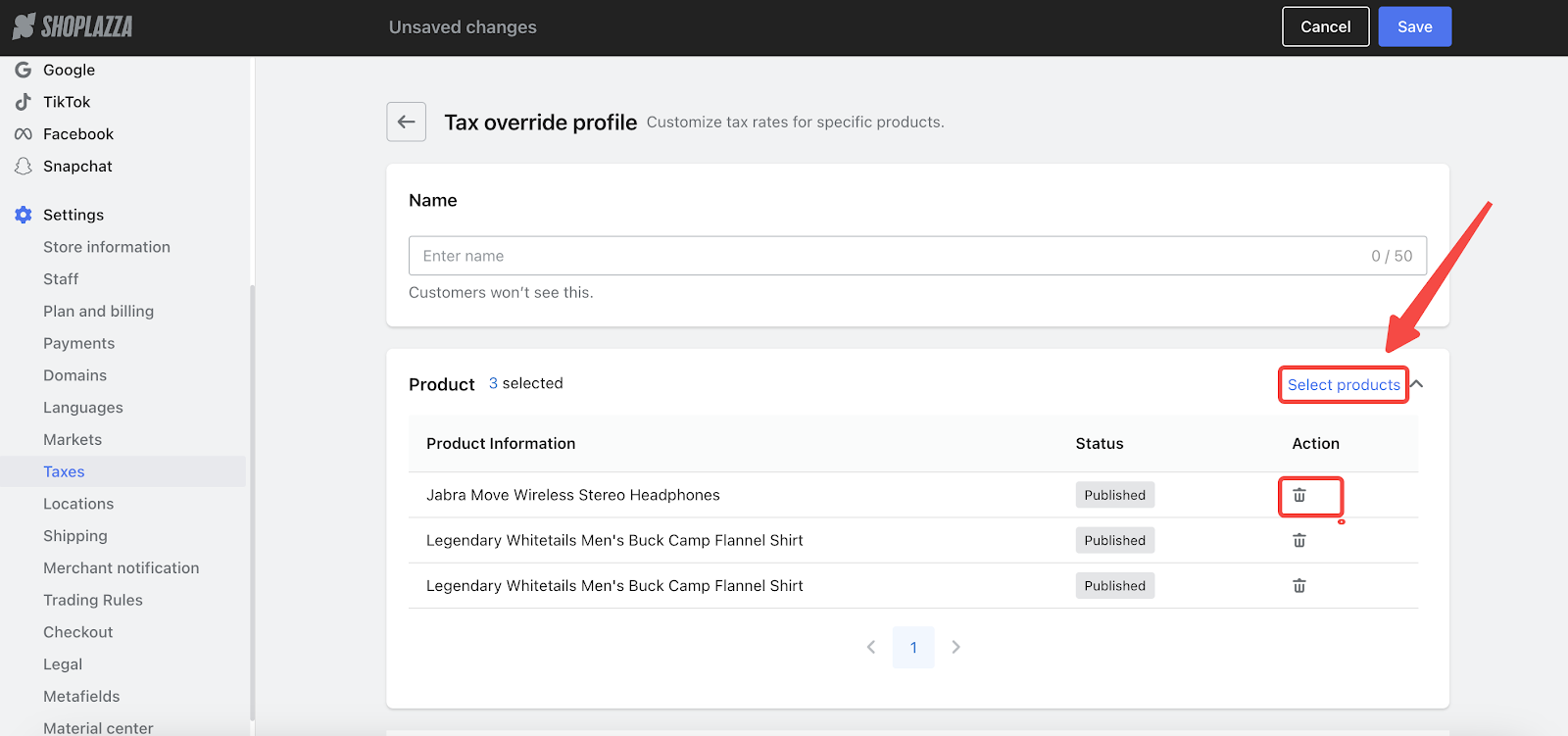

3. After confirmation, you can still click Select products to add more products, or click the trash can icon to delete unwanted products.

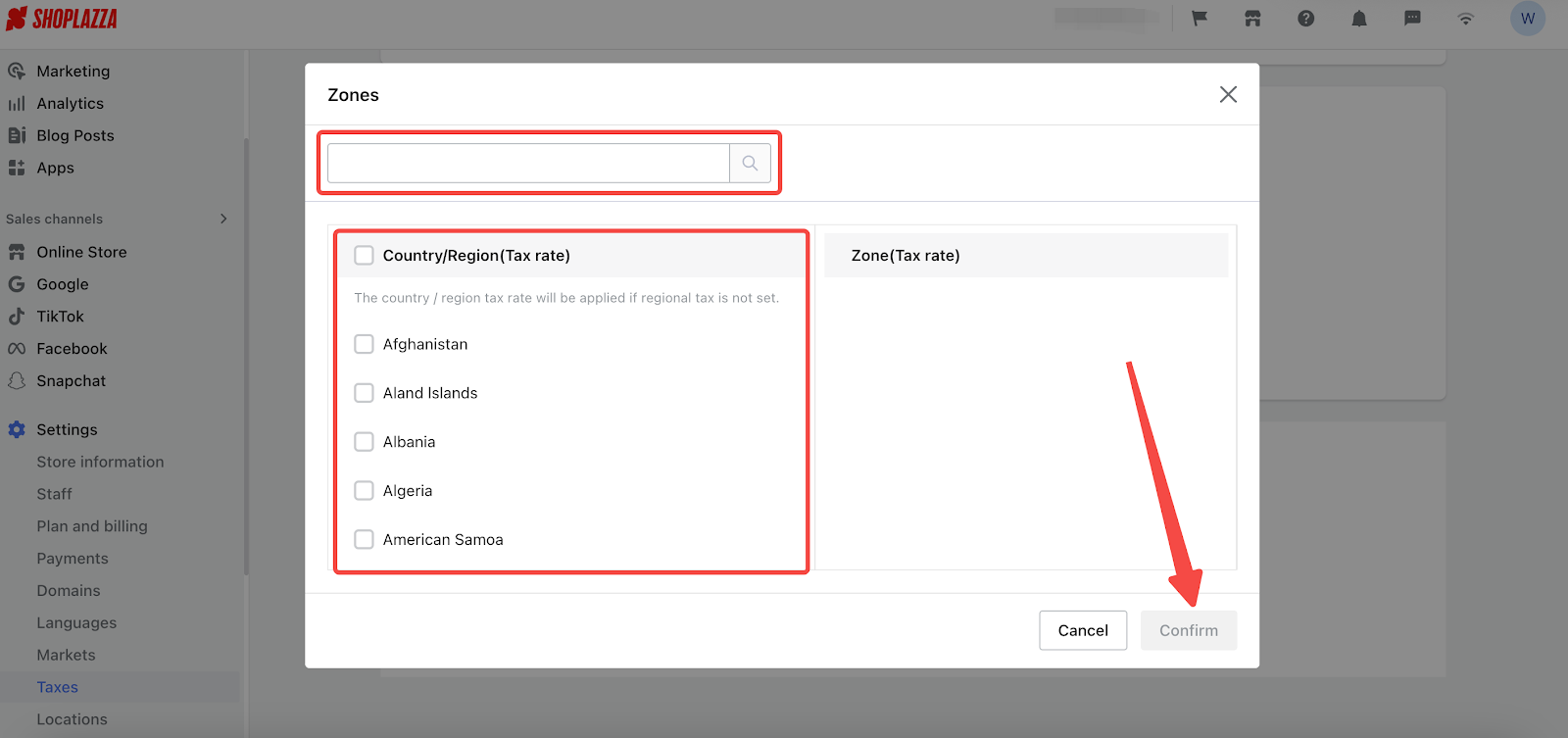

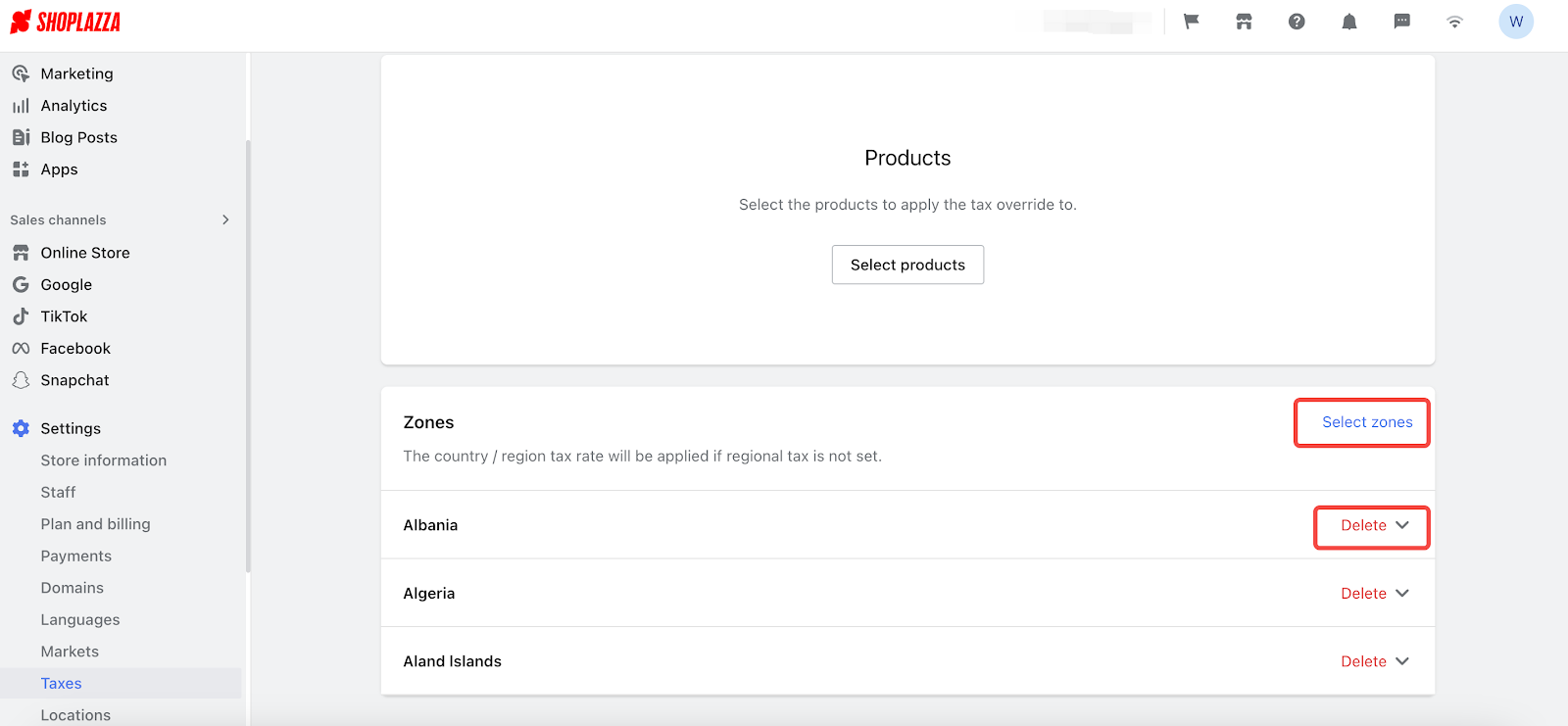

4. When you've finished selecting products, you can go to the section below and click Select zones. You can search for the target country or region in the search box above. Please check the target countries and regions, and click Confirm to save your settings.

Note

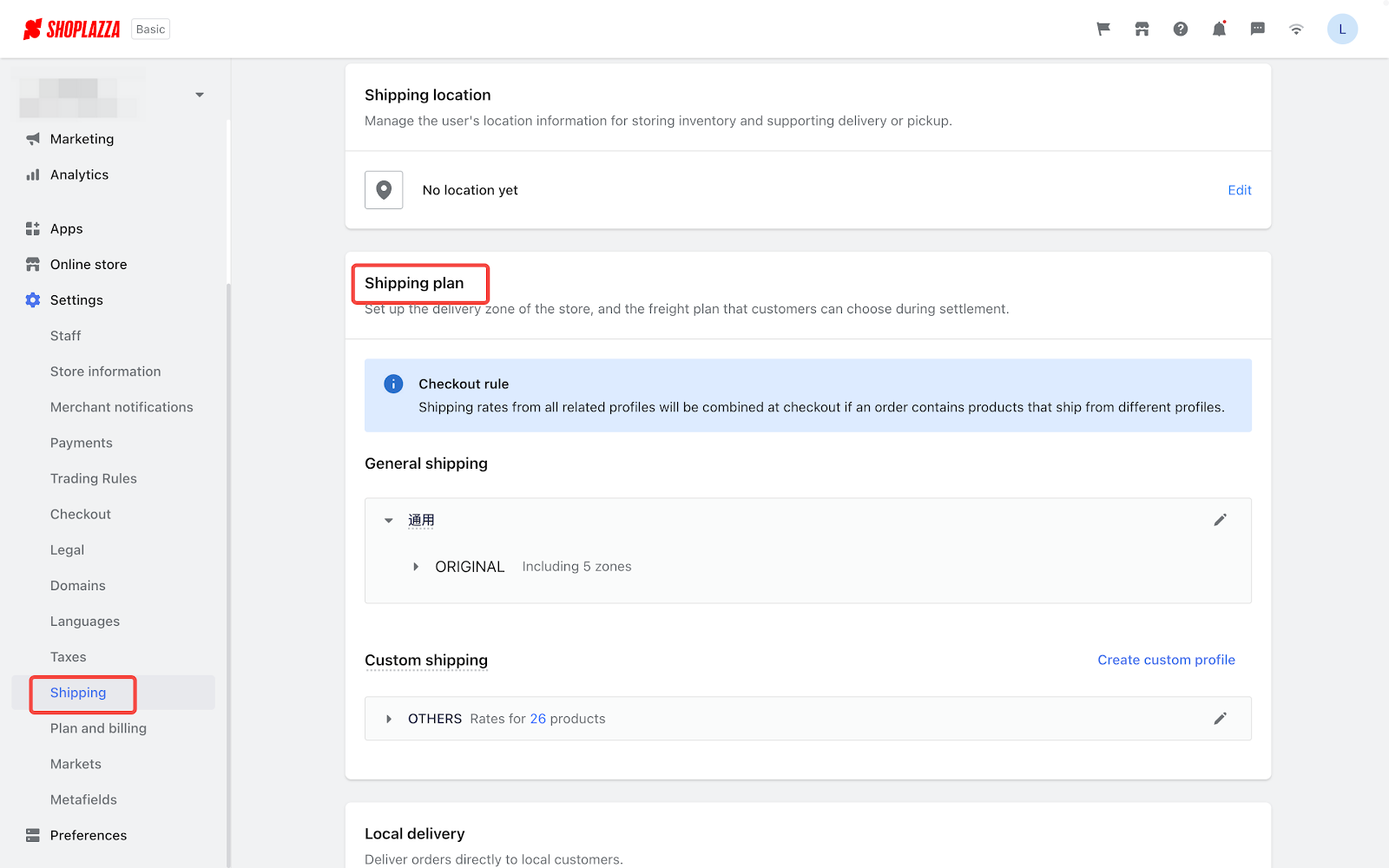

If you cannot find the target country or region in the Country/Region (Tax rate) list, please first navigate to Shipping and create a new shipping plan for the country or region.

5. If you want to reselect the zones or remove the unwanted zones, just click Select zones or Delete.

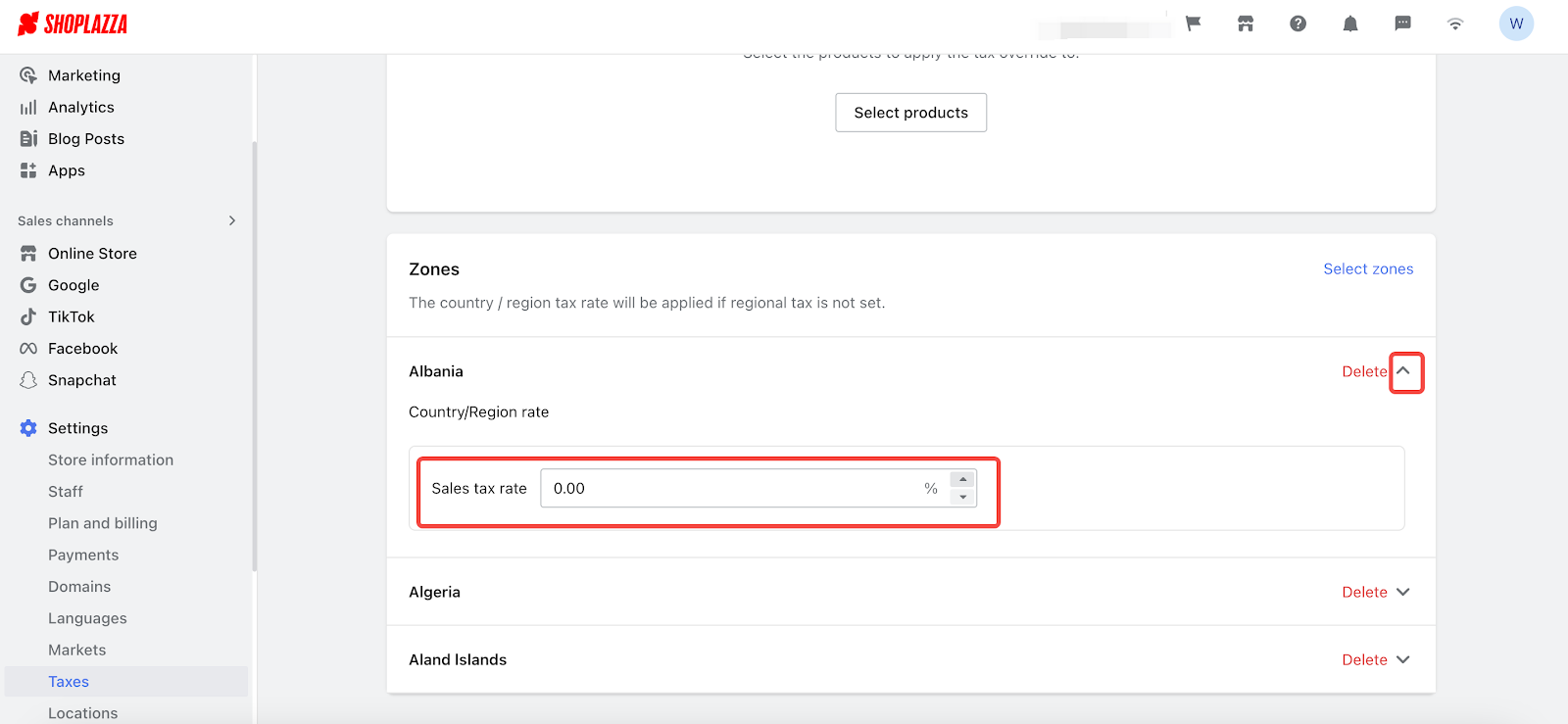

6. After adding target countries and regions, you can click the arrow to reveal the details and set the tax rate for a country or region.

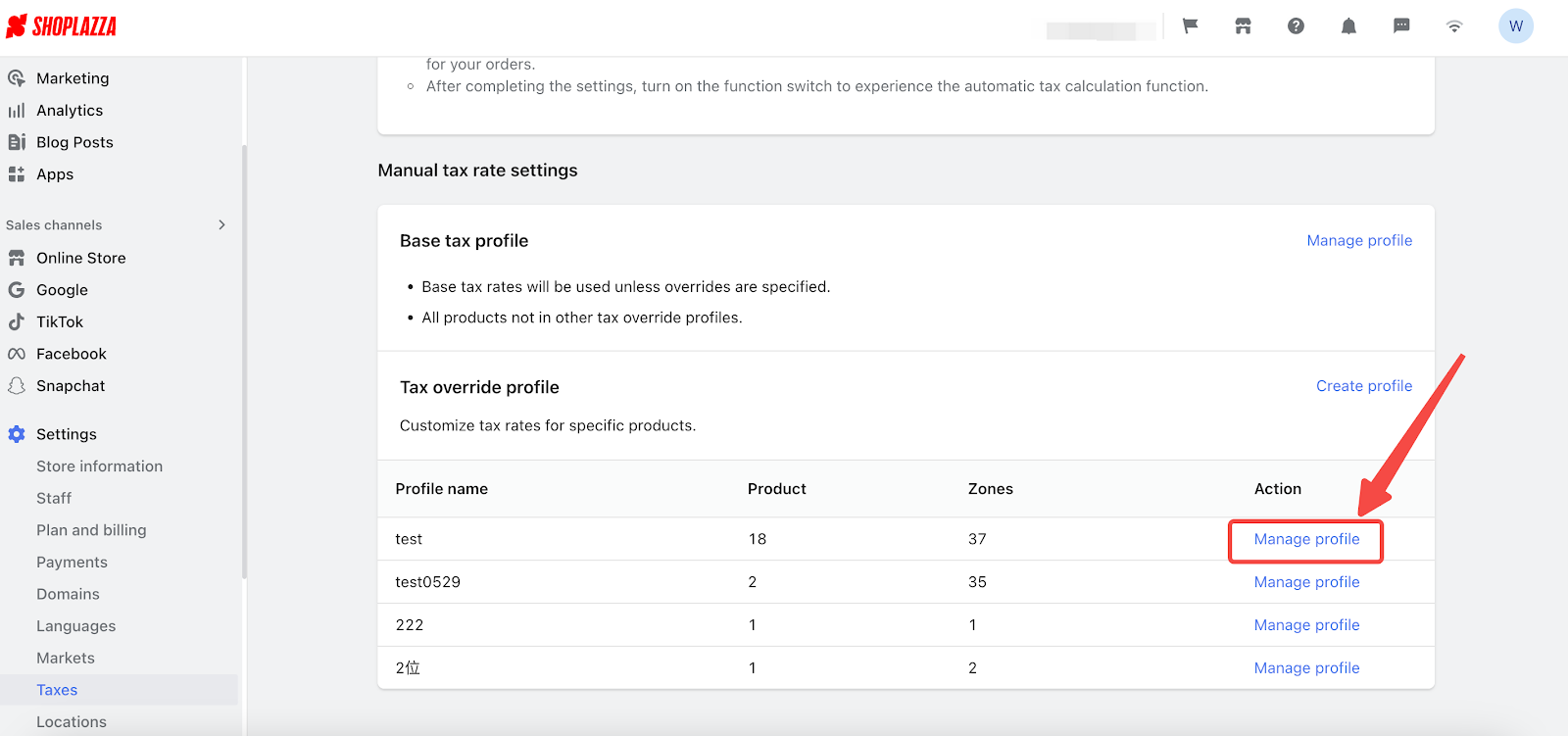

How to manage the Tax override profile

1. After creating tax override profiles, you can click Manage profile to manage specific profiles.

2. Here you can rename the profile, and reselect the products and zones. Please remember to click Save to complete the process.

Comments

Please sign in to leave a comment.