The Worry-Free Purchase service, offered by Seel, helps protect customers from issues like shipping delays, lost packages, or damage. This guide answers common questions that merchants and customers might have about using this service. For more details, visit the Seel website .

Frequently asked questions

Q: Can customers file a claim early if they know their package is lost?

Yes, customers can file an early claim. They'll need the tracking number and a loss confirmation document from the shipping carrier to get started.

Q: What if a customer files a claim with Seel and then tries to file another claim directly with the merchant?

Customers can only receive compensation once. If they've already been reimbursed by Seel, they cannot request additional compensation from the merchant. Refer to the service terms for more details on handling these situations.

Note

For details on managing duplicate claims, refer to Section 17 of the Terms & Conditions.

Q: For high-value items, customers might pay a significant premium but only receive $5 for a delay. Is this fair?

The primary coverage focuses on loss and damage, not delays. If an item is lost or damaged, compensation is based on the purchase amount, including any discounts and sales tax (excluding shipping costs). The $5 compensation for delays is intended to offer reassurance since the item will still be delivered. Seel is planning to update the delay compensation policy to better reflect the order value in the future.

Note

- Review premium calculations: Premiums are calculated as 2% of the total insured value, which includes sales tax and discounts.

- Understand applicable discounts: This includes all in-store promotions, such as discount codes and bulk purchase discounts.

- Know what’s covered under sales tax: Sales tax is factored into the insured value calculation, but shipping taxes are excluded.

- Exclude shipping costs from the insured value: Shipping fees do not contribute to the insured value calculation.

Q: If the merchant already has shipping insurance, can customers still use the Worry-Free Purchase service? Is there a conflict?

No, there’s no conflict. Worry-Free Purchase is an option customers can select at checkout, while the merchant’s shipping insurance is separate. Both policies can be active at the same time since they are covered by different insurance providers.

Q: What should merchants do if a customer files both an insurance claim and a chargeback through the payment platform?

Merchants should gather supporting documents from Seel and use them to dispute the chargeback. These documents can help prove that the customer has already received compensation, protecting the business during the chargeback dispute.

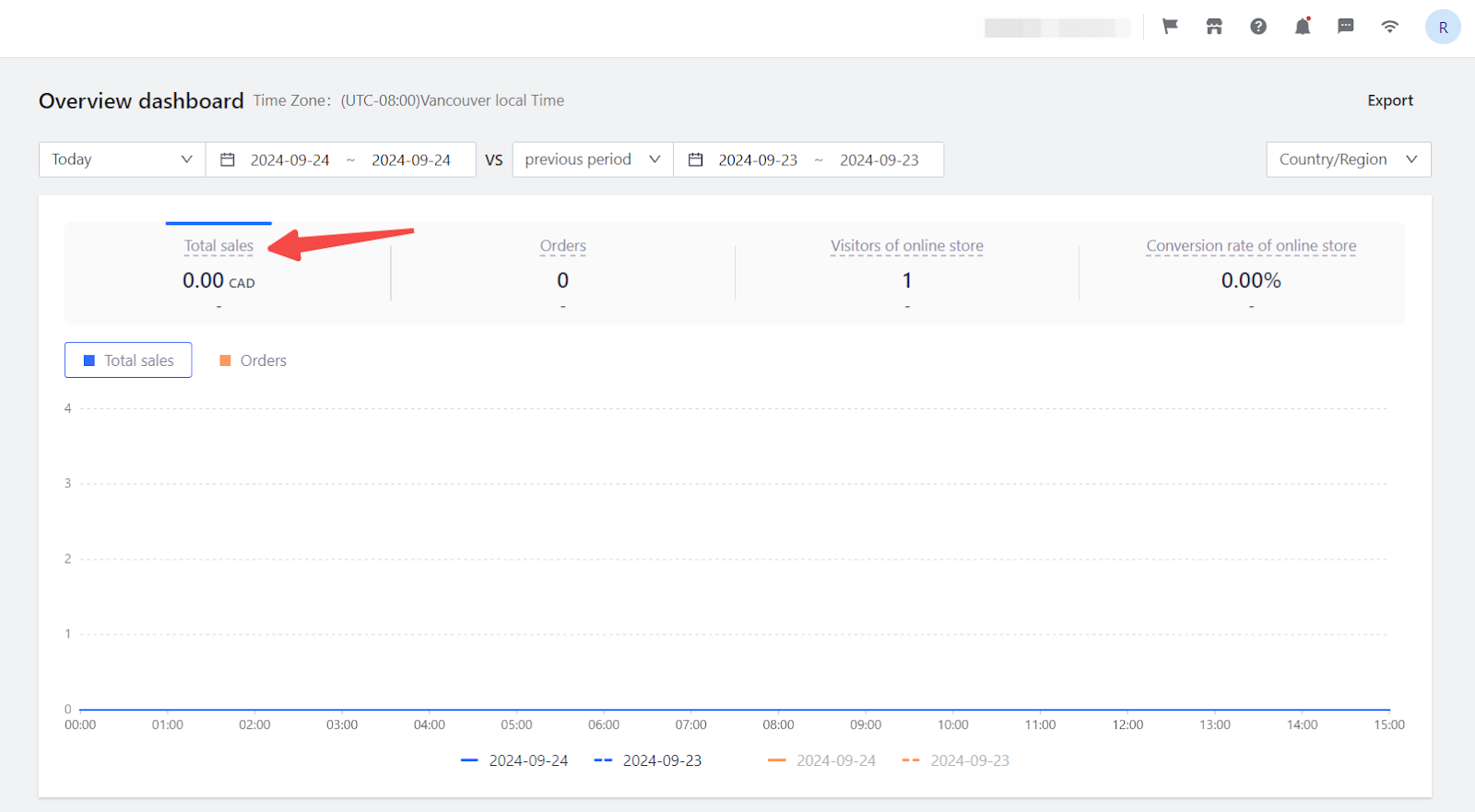

Q: Are fees collected for the Worry-Free Purchase service included in Gross Merchandise Value (GMV) and subject to commissions?

Yes, Worry-Free Purchase fees are included in GMV, but they are not subject to commissions. Commissions are only calculated based on the sales value of the products sold.

For more details or additional questions, visit the Seel website or learn more about Worry-Free Purchase here .

Comments

Please sign in to leave a comment.