The Worry-Free Purchase app, provided by Seel , helps safeguard customers from potential issues that can arise during shipping, such as delays, lost packages, or damage. This guide outlines the key policy status definitions and how premiums are calculated to help you manage this service effectively in your Shoplazza store.

Key policy status definitions

Understanding the different stages of a policy is important for managing the shipping protection service. Below are the key definitions to help you stay informed about the policy status at each stage.

1. Policy creation: The policy is established when a customer successfully completes the payment for their order, but it is not yet active.

2. Policy activation: The policy becomes active once the insured package shows tracking updates after shipment.

- Your responsibility ends once the customer confirms receipt of the goods. Any further actions, such as claims, will be handled directly between the customer and the insurance company.

- If a claim is initiated, the policy remains active until the claim process is completed.

3. Premium refund: If the insured items have not been shipped and a full refund is issued for the order, the premium will automatically be returned to the customer through their original payment method.

4. Policy cancellation: Once the premium has been successfully refunded, the policy is considered canceled, and the contractual relationship ends.

5. Policy expiration: The policy expires 90 days after its creation. After this period, customers cannot request a premium refund or file a claim.

Notes:

- Initiate a refund early: To initiate a premium refund, the request must be made before the product is shipped and the policy is activated. Once a refund is issued, it will not be included in future billing deductions.

- Understand contract termination: The insurance contract is terminated immediately once a refund is issued.

6. Changes to coverage status: You can modify the shipping address before the order is shipped with the customer’s agreement. The following rules apply:

- If the address is changed from an eligible region (e.g., the US) to an ineligible region (e.g., Mexico), the policy remains valid. However, frequent changes like this may lead to restrictions on using the Shipping Protection service.

- If the address is changed from an ineligible region to an eligible region, you cannot add insurance coverage for that order.

Premium calculation

Premiums are calculated using a set formula to ensure fair pricing for both customers and your store. Below are the rules for premium calculations and common scenarios:

1. How premium amounts are rounded:

- When calculating premiums and coverage amounts, the values are always rounded down to the nearest cent. For example, if the amount is $5.678, it will be rounded down to $5.67. For non-USD orders, the coverage amount is calculated by multiplying the insured value by the exchange rate.

- When calculating your revenue share, values are rounded up to the nearest cent (two decimal places), ensuring you receive the highest possible amount.

2. Orders with insured amounts of $50 or less: The premium for orders where the insured value is $50 or less is set at $0.98.

3. Orders with insured amounts over $50: If the insured value is more than $50, the premium is 2% of the total insured value. This includes sales tax but excludes discounts.

4. Discounted value: This is the price after applying any discounts or promotions, like discount codes or bulk purchase discounts.

5. Sales tax: Premium calculations include sales tax but do not include shipping taxes.

6. Shipping costs: Shipping costs are not included when calculating the insured value.

Note:

- No discounts on premiums: Discounts and coupons cannot be used to lower the premium amount.

- Payment method discounts: Discounts tied to specific payment methods (like PayPal) do not affect the premium calculation and are treated separately from product discounts.

Example premium calculation

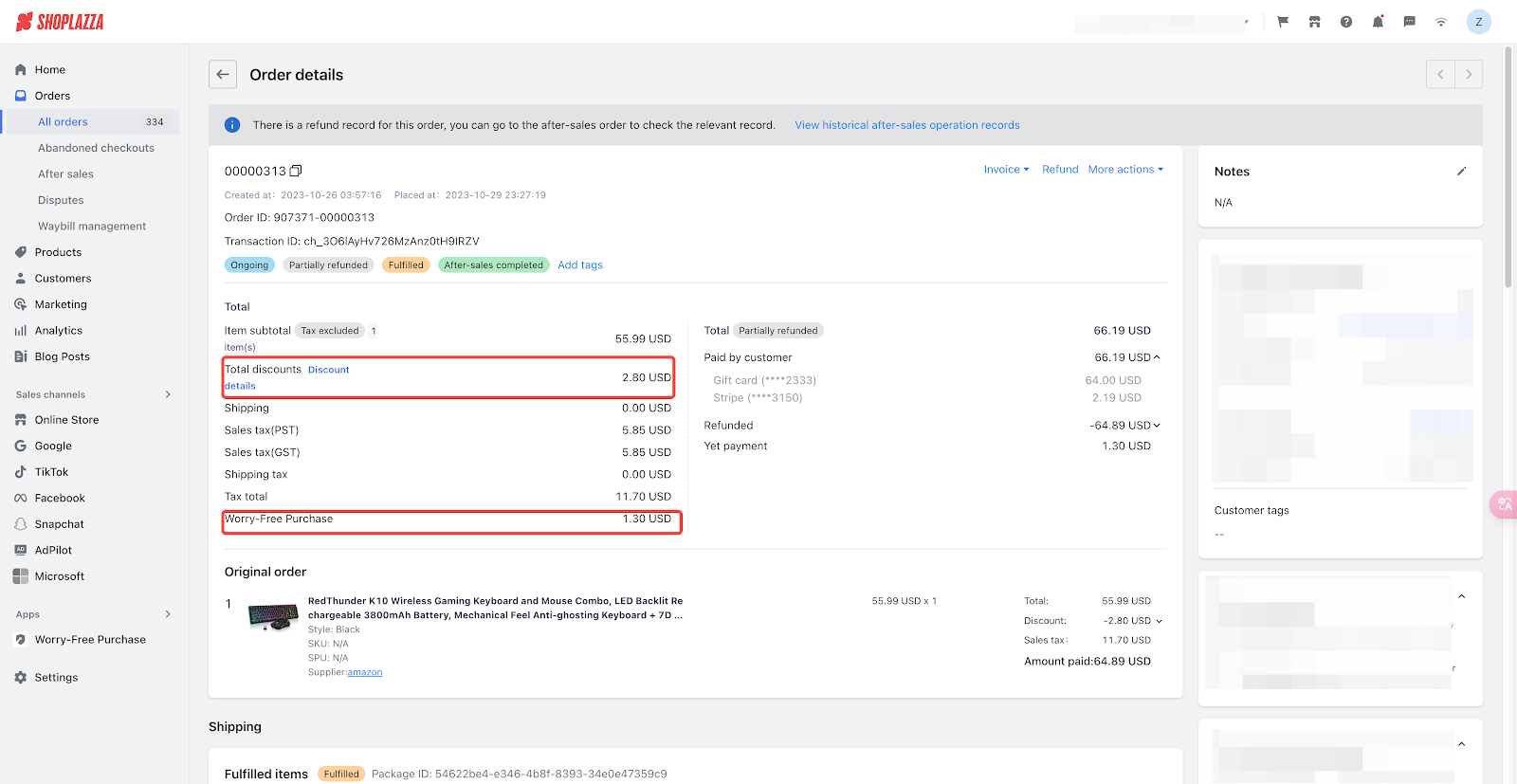

To make sure you're calculating premiums accurately and charging the correct amount, here's an example of how to calculate the premium for orders over $50. This step-by-step guide will help you avoid common errors and ensure you're applying the right premium.

Example details:

- Item Total: $55.99

- Discount: $2.80 (this excludes any payment method discounts, like PayPal discounts)

Sales Tax: $11.70

Step-by-step calculation:

1. Calculate the insured value:

- Add the item total and sales tax, then subtract any discounts.

- Formula: $55.99 + $11.70 - $2.80 = $64.89

2. Calculate the premium:

- Multiply the insured value by 2% (for orders over $50).

- Formula: $64.89 × 0.02 = $1.2978, which rounds to $1.30.

In this example, the premium for an insured value of $64.89 would be $1.30.

Related articles

Introduction to the Worry-Free purchase app

Worry-Free Purchase | Set up and Configuration

Worry-Free Purchase | Coverage and Claims Process

Worry-Free Purchase | FAQs

Comments

Please sign in to leave a comment.