(26 min read) - last updated 04/11 EST)

Sales tax compliance in the United States can be complex and time-consuming to navigate. Each state has its own sales tax authority that sets tax regulations for when businesses need to collect tax. These regulations have undergone many changes in the past few years and continue to change, making it challenging to determine when and where you are required to charge sales tax on transactions.

This article is intended for US merchants who sell in the US. To ensure you are accurately applying local and provincial tax rates, as well as properly filing and submitting your taxes, consulting with tax authorities or a professional is advised. This will help you determine when you need to register to collect tax in the US so you can avoid the penalties and interest that come with non-compliance.

Note

The information presented on this page is not intended to serve as tax, legal, or any other professional advice, and should not be used as such. If you have any questions or concerns, it is strongly recommended that you seek the advice of a qualified tax professional. It's also important to note that Shoplazza does not file or remit sales taxes on your behalf, and therefore can not be held responsible for any resulting actions.

General steps to set up taxes in the US

Follow the links for more detailed information:

- If you're running a Shoplazza store, then set up the countries you will be shipping to.

- Set up the tax rates in the states to which you will be selling and shipping your products.

- Override tax rates or exempt products from taxes where necessary. Any overrides that you set apply to online sales.

As you set up taxes, you can access and review your settings on the Taxes page in your Shoplazza admin.

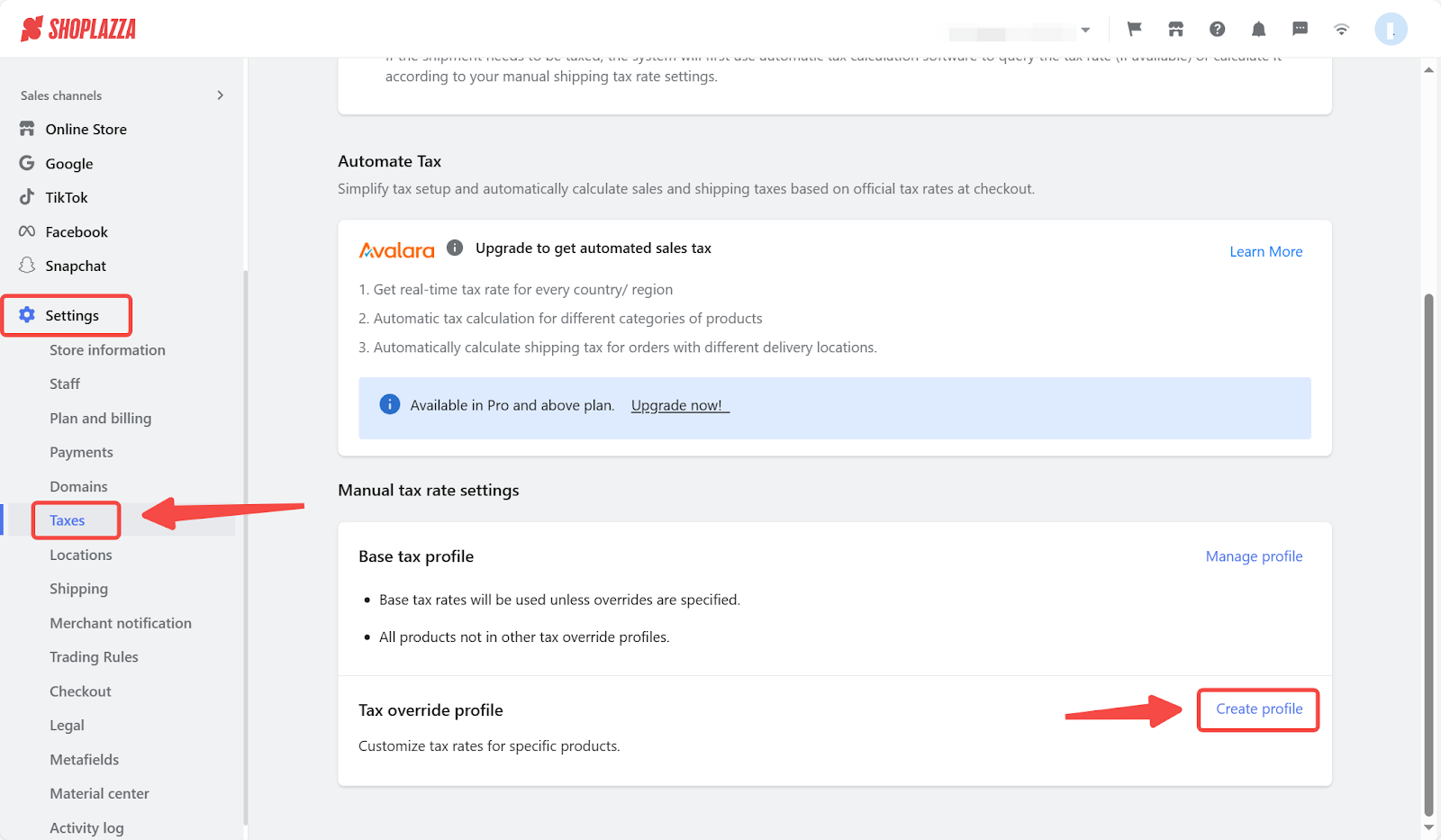

Setting up or reviewing tax settings on your store

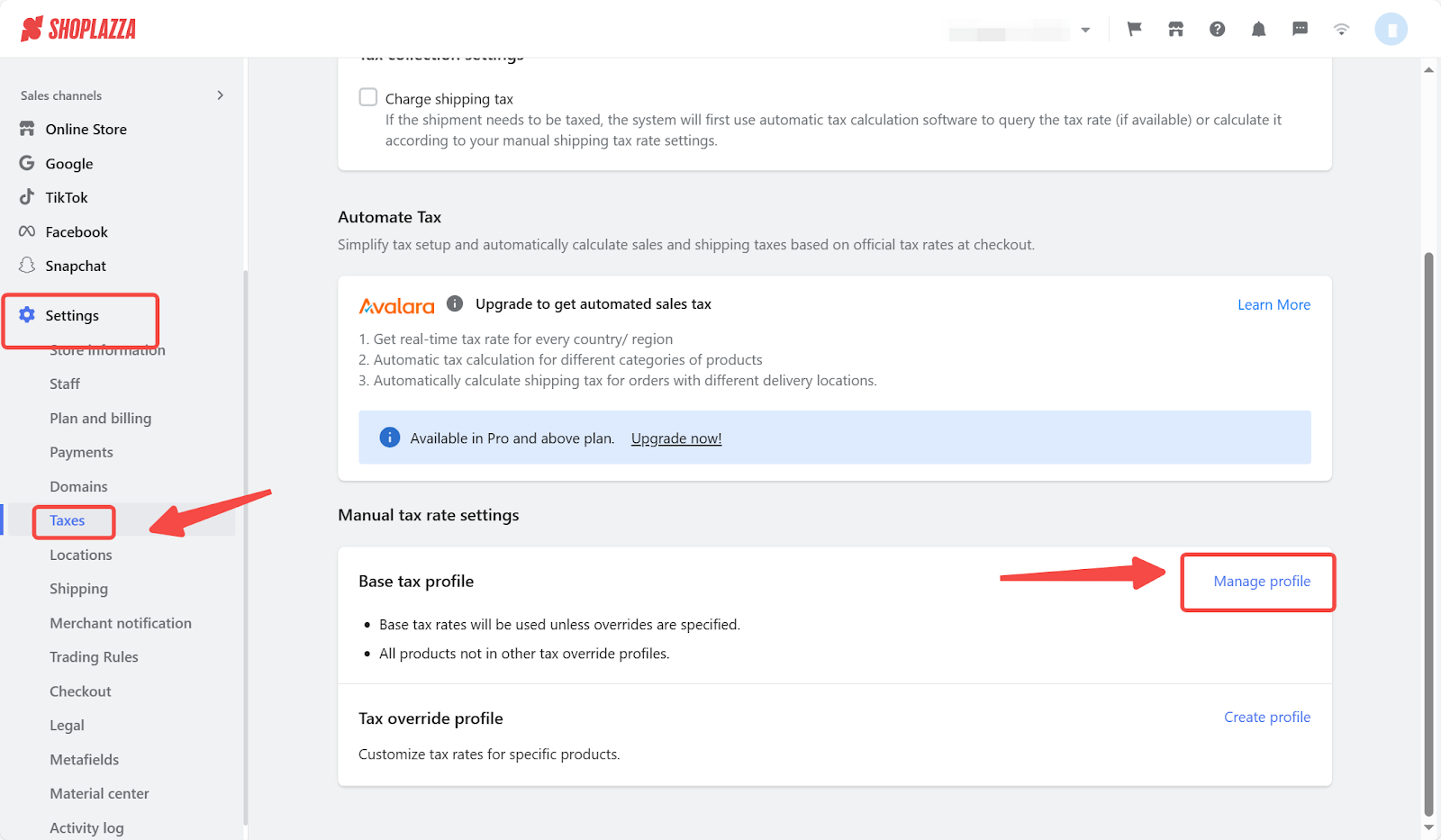

1. From your Shoplazza admin > Settings > Taxes, scroll down to Manual tax rate settings and click on Manage Profile.

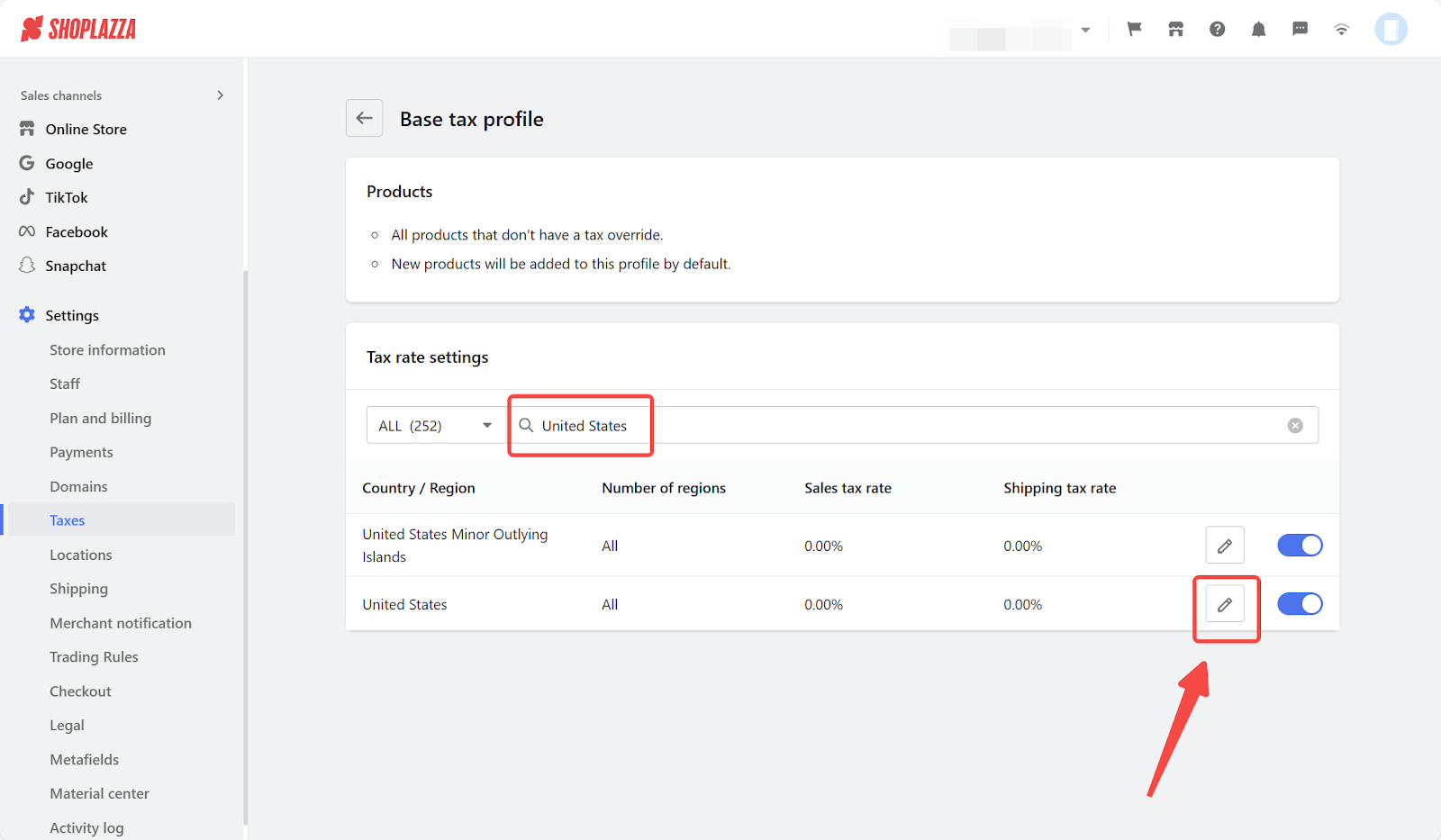

2. Under the Tax rate settings, search the United States then click the pen icon to edit.

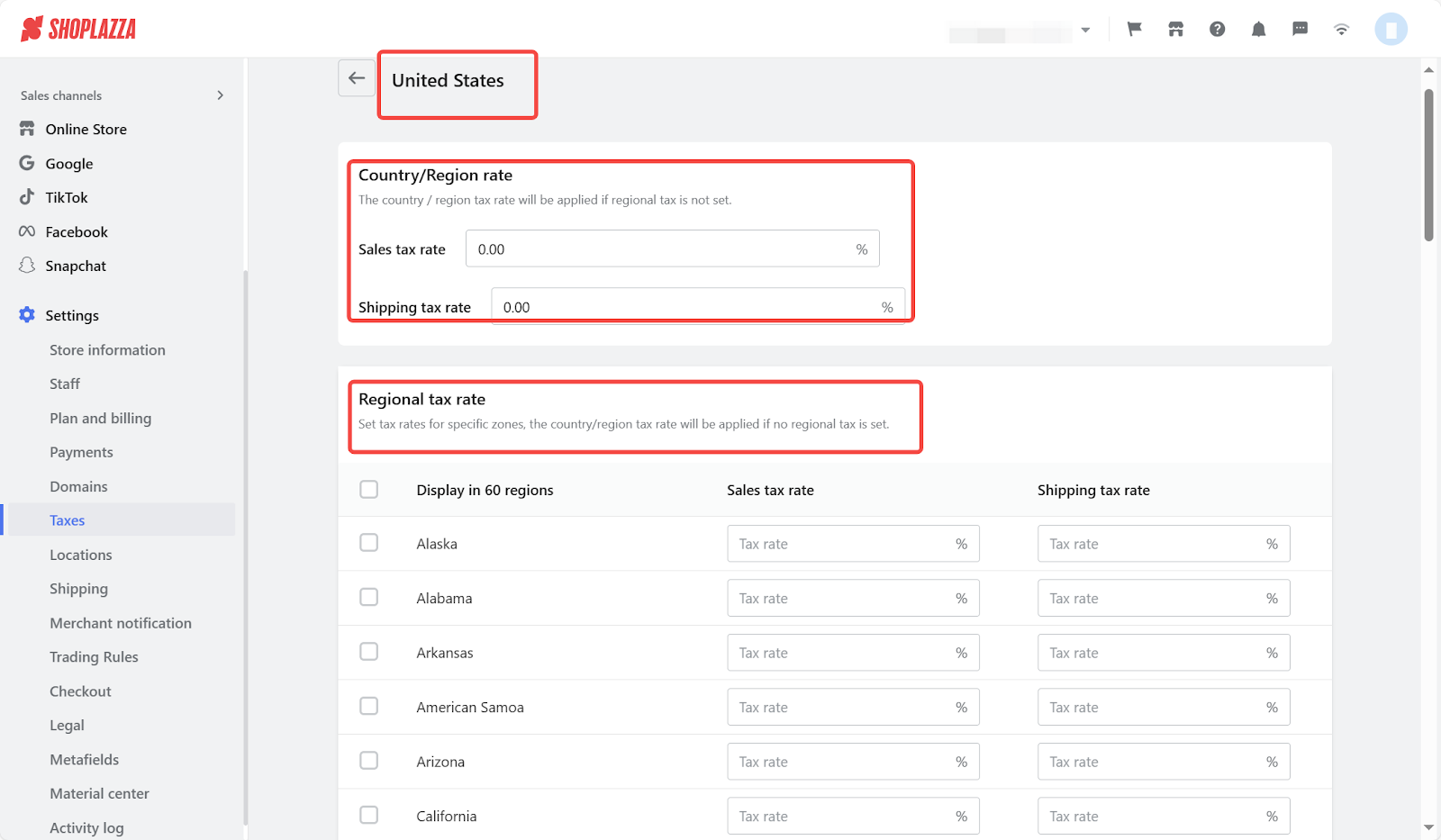

3. In the United States section, click the state that applies, and add the proper tax rate for that state.

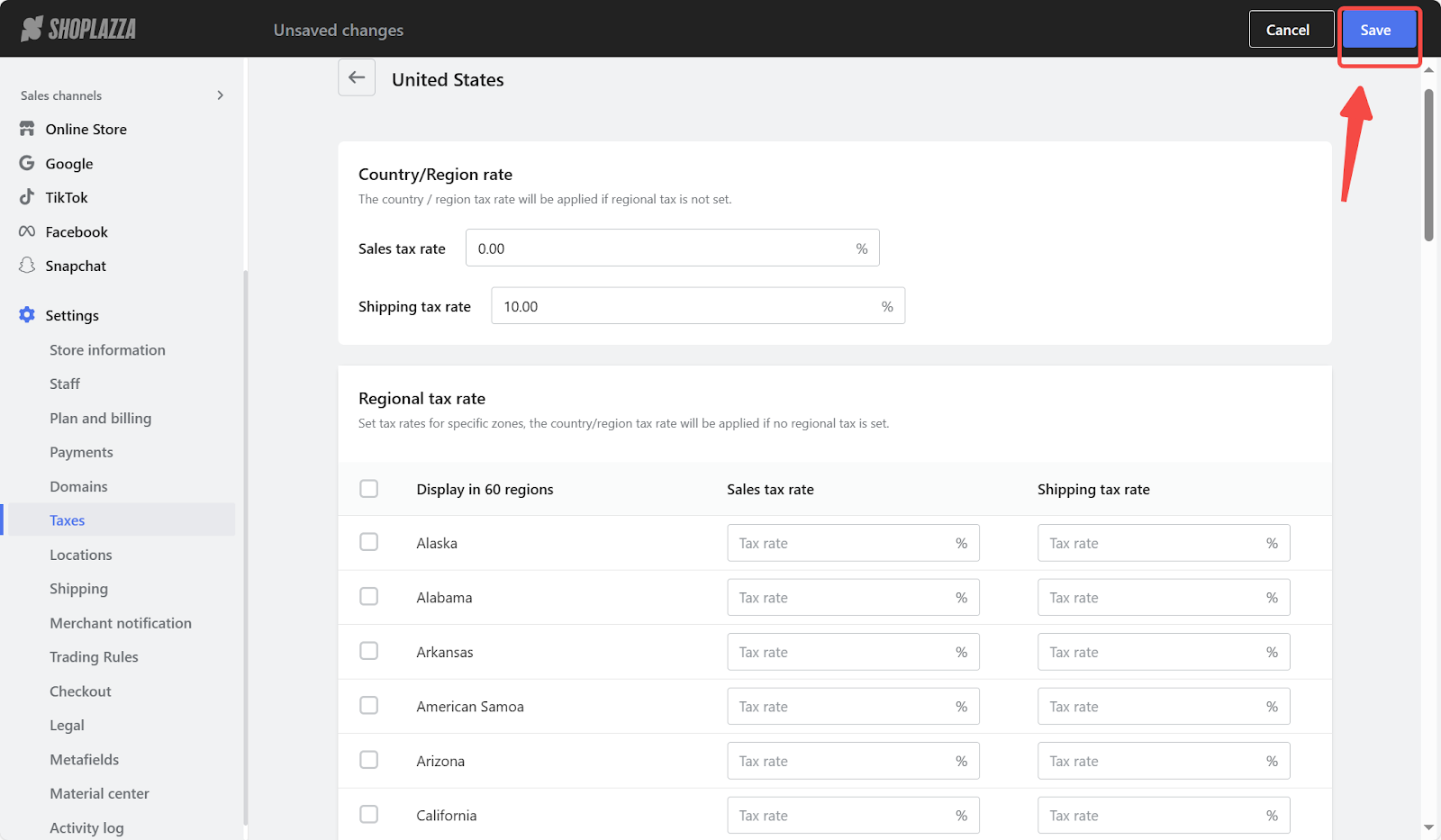

4. Click Save after making adjustments.

Note

You should set your taxes up after you have registered in the states where you have nexus.

Currently, our tax setup system does not allow you to separately enter the state base range and the local range (each jurisdiction has their own local taxes within the state ) , you can only enter total sales taxes for each state . You must put the total sales taxes for each. It is best to consult a tax professional and the local taxes for each jurisdiction to accurately enter the amount in your Shoplazza admin. Currently, Alaska, Delaware, Montana, New Hampshire, and Oregon do not have sales tax.

Selling in the United States

What is US sales tax?

Sales tax is a consumption tax paid to the government on the sales of goods and services. It’s typically paid by the end customer of a product at the point of sale, collected by the seller, and remitted to the government on a regular basis, depending on the seller’s volume, products, and state requirements.

When do I need to register to collect US sales tax?

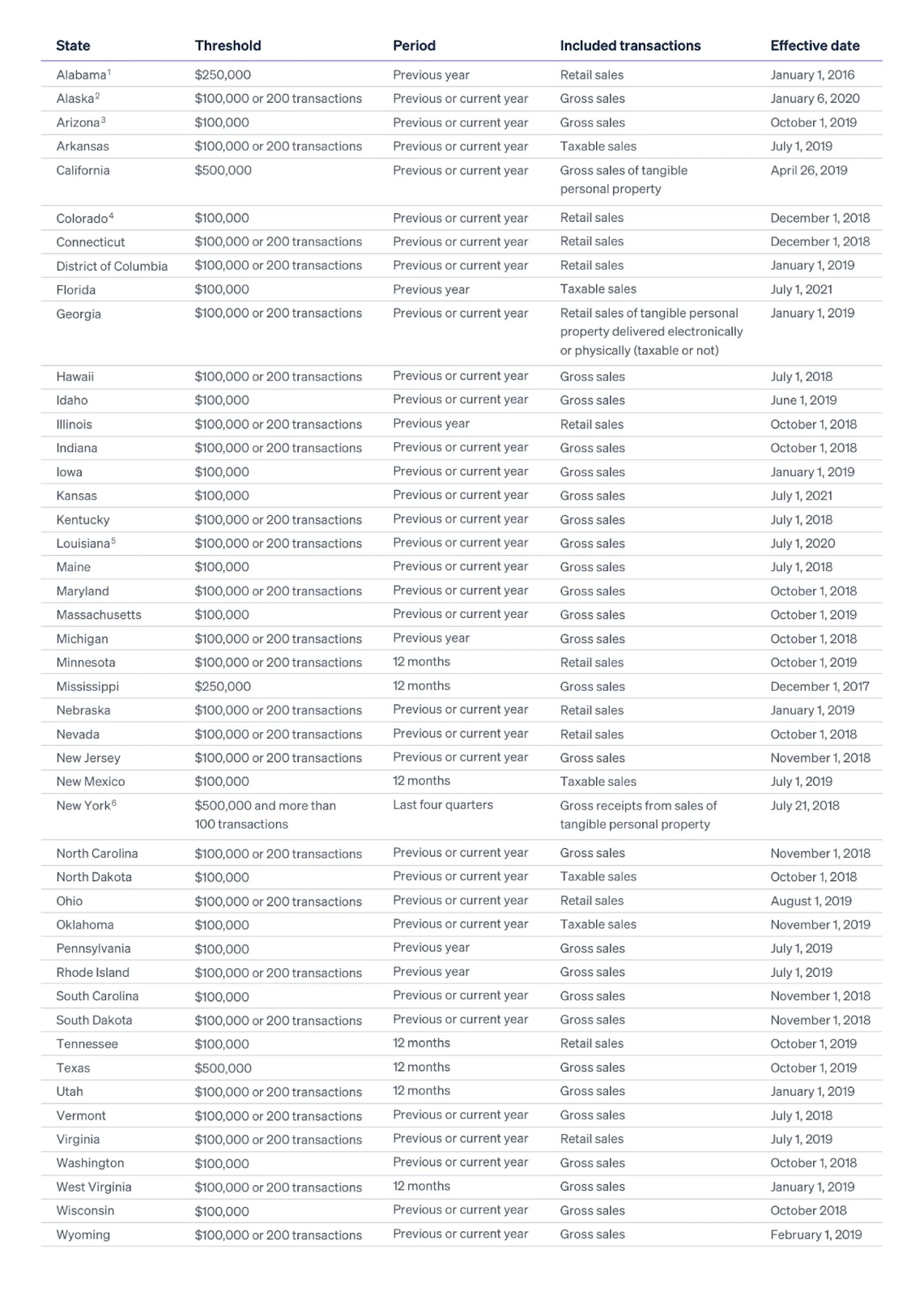

As a US merchant, you are required to register for sales tax in each state in which you have met the physical or economic nexus standards or any other requirement of the state. For out-of-state sellers, economic nexus is generally the applicable standard for determining when to register to collect sales tax. Economic nexus thresholds are based on either sales revenue or transaction volume and sometimes both. For example, in California, you must register and collect sales tax once you exceed $500,000 in sales revenue from customers in California. However, in Georgia, you must begin collecting sales tax once you exceed $100,000 in sales revenue or complete 200 transactions from customers in Georgia.

Note

The information presented on this page is not intended to serve as tax, legal, or any other professional advice, and should not be used as such. If you have any questions or concerns, it is strongly recommended that you seek the advice of a qualified tax professional. It's also important to note that Shoplazza does not file or remit sales taxes on your behalf, and therefore can not be held responsible for any resulting actions.

Do all states collect US sales tax?

It’s important to note that five states do not have a state-wide sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. This means that you do not need to collect general sales tax in these states. However, Alaska does authorize the levy of sales tax at the municipal level. In most situations, merchants will only need to register at the state level for sales tax purposes with a few exceptions that's mentioned in the threshold chart below.

How to register for a sales tax permit in the US

In general, these are the steps to register with a state to collect sales tax:

- Gather business and contact information.

- Visit your state’s department of revenue website.

- Click on the “Sales and Use Tax” section of the website to register your business.

States where you have nexus require you to secure a sales tax permit before you begin collecting sales tax. To register for a sales tax permit, go to your state’s Department of Revenue website or give them a call.

States use sales tax funds to pay for things like schools, roads, and public safety, so they are very invested in any merchants with nexus in their state collecting and remitting sales tax.

Sales tax permits are free in most states, while others cost a small fee ranging from $10 to $100. Just Google “apply for sales tax permit” and the name of the state.

Once you’ve registered, your state will tell you when and how often they want you to file taxes. This is generally monthly, quarterly, or annually, with most annual due dates falling in January.

What is nexus?

Sales tax nexus is the connection between a seller and its local jurisdiction (usually a state), which requires the seller to register to collect and pay sales tax. The most common types of nexus are physical and economic.

Physical nexus

The most common form of physical presence in a state is a brick-and-mortar location or storefront, but may also include physical presence through employee activities, payroll, property, performance of services, or trade show attendance. With the United States Supreme Court ruling in 2018, the buzz around nexus has been all about economic activity and remote sellers, though it’s important for all businesses to not forget about physical presence.

A physical nexus, depending on the state, can be anything from:

- An office

- An employee resigning in or traveling to the state

- A warehouse

- A distribution center

- A third-party affiliate

- Stored inventory

- Temporary physical business in a state, such as at a trade show or craft fair

Note

Any activity a state considers related to physical presence still establishes nexus and results in the requirement to register, collect, and remit sales tax to the appropriate tax jurisdiction. Not fulfilling this obligation results in non-compliance.

Economic nexus

In 2018, the Supreme Court weighed in and set a new precedent in the South Dakota vs. Wayfair ruling. A state can now require a business to collect sales tax even if they don’t have a physical store or sales representative there. Since then, an “economic” presence, or reaching a set level of transactions or sales activities, is enough to trigger nexus status for that state. And of course, you are required to register in any state in which you have a physical presence. This impacts businesses with no physical presence in a state, also known as remote sellers, who sell goods and services in that state that meet or exceed the state's economic nexus threshold.

An economic nexus is a connection between a state and business when annual sales revenue and/or transaction quantity reach a threshold set by the state requiring you to register for sales tax. Economic thresholds vary by state and begin at $100,000 in annual sales and 200 in annual sales transactions.

Note

There is no physical presence required to meet the economic nexus definition.

Economic nexus thresholds by state

Home rule states

Home rule states allow individual home rule cities to administer their own sales taxes as well as define their own tax bases. These cities can define their own tax rules and sellers may be required to complete additional registrations in these areas. The following are home rule states:Alabama ,Alaska , Arizona ,Colorado , and Louisiana (known as parishes). As for New York, sellers must meet both the sales and transaction number thresholds

What are the consequences of not complying with nexus laws?

Business owners need to understand their sales tax nexus and corresponding liability to avoid needing to pay uncollected taxes plus fines and interest. You are required to file taxes in all states where you are registered to collect taxes, even if you have no sales tax liability during that period.

In the event that you did not collect sales tax from your customers as required, you will be responsible for paying the outstanding sales tax along with interest and penalties, which typically amount to about 30% of the unpaid sales tax, from your own funds. For more information, refer to the IRS' guide .

How to comply with sales tax rules and regulations

Complying with nexus is a multipart process that depends on the state where your business and your customers are located, your sales volume, and the products you sell. Here are the three key steps to adhering to tax laws in the US as a business:

Determine where you have nexus

As of May 2021, all US states except Missouri have some form of economic nexus laws. Meeting economic nexus status usually occurs after you've passed a specific transaction or revenue threshold. Most of these thresholds are based on the past 12 months of activity, with requirements and deadlines for registering with the state to pay tax that also vary.

In most states, the threshold for economic nexus is $100,000 in sales or 200 transactions over 12 months. There are exceptions, though; for example, in Texas and California the threshold is $500,000.

Taking a complimentary assessment can provide you with a better understanding of your tax obligations, including:

- An explanation of state-specific economic nexus rules.

- Information on how each state calculates tax liabilities.

- Recommended next steps for achieving compliance.

Please also note that the information provided via a third party can only be taken for guidance purposes. It is highly recommended to consult your professional tax advisor if you have any questions.

What should businesses do if they meet the sales tax nexus threshold?

Once businesses meet the threshold for economic nexus in a local jurisdiction, they should register to collect taxes on the website for the state agency that is responsible for sales taxes. Businesses should not collect taxes if they have not yet registered with the applicable jurisdiction. There are differences in each state’s registration requirements. For example, in Texas, out-of-state businesses would need to register by the first day of the fourth month after they reach the economic nexus threshold. In Rhode Island, businesses have until January 1 of the year after they reach the economic nexus threshold to register, collect, and begin remitting sales tax.

The specific laws also vary depending on whether you’re selling physical products, digital products, or software as a service (SaaS) products. Digital products—such as e-books, online courses, music files, and website memberships—can be especially complex. Not all states tax digital goods. Jurisdictions that do tax these goods have their own definitions of what constitutes a digital product.

Although SaaS products count as digital products, they often have unique regulations because they're not necessarily downloaded. For example, SaaS sales are 100% taxable in Connecticut but non-taxable in California. And in Texas, SaaS products are taxed at 80% of the sale price, while downloaded software is fully taxed.

Check your jurisdiction and determine your tax rates

There are more than 11,000 tax jurisdictions in the US, all with different regulations. In Alabama alone, there are more than 900 tax jurisdictions, and Texas has more than 1,900. Unfortunately, states with fewer tax jurisdictions aren't necessarily less complicated because there can be enormous variation in administrative processes and enforcement. You need to research each state and jurisdiction individually to ensure you're filing correctly.

Tax rates vary depending on what you're selling and where, and they are constantly updated. Virginia, for example, is exempting some gun safes (yes, a safe) from sales tax, while the city of Chicago will begin taxing ecommerce sales of wine and bottled water. Some states also exempt groceries or prescription drugs from sales tax, while others do not. Additionally, local governments within a state may also impose their own sales tax on top of the state tax.

Is there a tax calculator tool I can use?

Avalara provides a tax calculator tool that allows you to find out the sales tax rate for your location in the United States. To use this tool, all you have to do is enter your actual street address. It's important to use your address instead of just your ZIP code because ZIP codes often have more than one tax rate associated with them. By using your address, you can get a more accurate sales tax rate for your specific location.

Note

The information presented on this page is not intended to serve as tax, legal, or any other professional advice, and should not be used as such. If you have any questions or concerns, it is strongly recommended that you seek the advice of a qualified tax professional. It's also important to note that Shoplazza does not file or remit sales taxes on your behalf, and therefore can not be held responsible for any resulting actions.

Origin-based vs. destination-based sales tax rates

Once businesses meet the threshold for economic nexus, it’s important to understand the difference between origin-based and destination-based sales tax rates.

If your business is located in an origin-based state, you would charge the state and local sales tax rate for where your business is located.

For a destination-based state, you would calculate the sales tax rate for where your buyer is located (or where the items are being shipped to).

As a seller, it is important to know whether you are located in an origin-sourced state or a destination-sourced state. Most states and Washington, D.C., are destination-based. There are 12 origin-based states.

- Arizona

- California -- (considered a "mixed sourcing state" as city, county and state sales taxes are origin-based, while district sales taxes - supplementary local taxes - are destination-based)

- Illinois

- Mississippi

- Missouri

- New Mexico

- Ohio

- Pennsylvania

- Tennessee

- Texas

- Utah

- Virginia

Twenty-four states are participating in the Streamlined Sales and Use Tax Agreement (SSUTA), a board that was established to help businesses manage their tax obligations across jurisdictions. However, since many states don't participate, it doesn't create a uniform system across states. You still need to pay close attention to each state's specific guidelines.

Selling in Canada

What is USMCA?

The United States, Mexico, and Canada updated NAFTA to create the newUSMCA . The USMCA is mutually beneficial for North American workers, farmers, ranchers, and businesses. The agreement, which entered into force on July 1, 2020, will create a more balanced environment for trade, will support high-paying jobs for Americans.

Currently, US online sellers, including eBay and Amazon, shipping to consumers in Mexico are sales tax and import duty free up to $50 per shipment.

The Mexican VAT threshold has been maintained at $50, but the customs duties limit raised to $117. The Canadian import duty and GST threshold is currently $20CAD per parcel. It will be raised to $40CAD for GST/HST, and $150CAD for duties.

Canadian sales taxes: GST, HST, PST

All U.S. companies that sell products into Canada must comply with the terms of the United States-Mexico-Canada Agreement, which governs customs duties and requirements at the borders between the three countries. (The USMCA replaced the former North American Free Trade Agreement.)

When it comes to sales tax compliance, however, there are three main things to consider:

- The federal Goods and Services Tax. The 5% GST applies across the whole country.

- Provincial Sales Tax. Four provinces — British Columbia, Manitoba, Quebec, and Saskatchewan — levy their own provincial sales tax (PST) in addition to the federal GST. (In Quebec it’s called the QST.) The tax is applied to the price of a good before the GST is added. Rates vary by province, from 6% to 9.975%.

- Harmonized Sales Tax. New Brunswick, Newfoundland, Nova Scotia, Ontario, and Prince Edward Island levy the Harmonized Sales Tax. Businesses collect and remit one combined tax to the Canada Revenue Agency, which sends the provinces their share of the collected tax. The HST rate is 13% in Ontario and 15% in the other provinces.

Alberta, Nunavut, Yukon, and the Northwest Territories collect no sales tax, so businesses shipping to buyers in those jurisdictions only collect the 5% GST.

Are non-resident vendors required to register and collect taxes in Canada?

Non-resident vendors that have annual sales of taxable goods in Canada of more than $30,000CAD will likely need to register to collect the GST/HST. Most supplies of property, including real property, and services are taxable for GST/HST purposes. This can include the sale and lease of automobiles; legal and accounting services; publications such as books, magazines, and periodicals; hotel accommodations, and many other goods and services.

However, Canada also has “zero-rated supplies,” which are goods that are taxed at a rate of 0%. (That is, they are considered taxable, but Parliament has decided not to tax them.)

These include:

- Basic groceries such as milk, bread, and vegetables

- Agricultural products like wheat, grain, raw wool, and dried tobacco leaves

- Prescription drugs and certain medical devices, including hearing aids and artificial teeth

You can find a comprehensive list on the Canadian government website here .

It’s important for businesses to track sales of zero-rated items, because sales of zero-rated goods count toward determining whether a business has more than $30,000CAD in annual sales. Companies with less than $30,000CAD in annual sales are not required to collect the federal GST.

Companies that have more than $30,000CAD in annual sales are required to register to collect GST; however, no GST is charged on their sales of zero-rated items.

Canada also has a category of services that are exempt from the GST/HST. This includes many educational services (such as tutoring) and most services provided by financial institutions.

The Canadian government has more detailed information about GST/HST requirements .

Can provinces require non-resident vendors to collect tax?

Several provinces in Canada that levy Provincial Sales Tax (PST) have laws that mandate non-resident vendors to register and collect taxes. Below are some examples of these requirements and regulations:

- British Columbia: Businesses must pay PST for goods brought, sent, or received in the province, regardless of whether their business is carried out in B.C.

- Manitoba: Vendors who sell goods or services within Manitoba must register with the provincial Taxation Division and collect the Retail Sales Tax (RST). Small businesses with annual taxable sales under $10,000 CAD are exempt from this requirement.

- Quebec: As of 2019 , foreign suppliers or operators of digital platforms distributing property or services may be required to register and collect the Quebec Sales Tax (QST) if their sales exceed $30,000 CAD over a 12-month period.

- Saskatchewan: Non-Saskatchewan businesses that make retail sales into the province must become licensed and remit the PST. This also applies to operators of electronic distribution and online accommodation platforms, as well as marketplace facilitators.

Factors to consider before you start selling in Canada

Of course, the fact that the United States and Canada are two different countries means there are many more factors involved before a U.S. company can start delivering products to Canadian buyers.

The Canada Border Services Agency identifies a six-step process for companies, which includes steps a business must take before they begin taking orders . This includes obtaining a Business Number issued by the Canada Revenue Agency for an import/export account, determining the country of origin for the goods a company wants to sell across the border, and determining whether those goods are subject to any permits, restrictions, or regulations on the Canada side.

Note

The information presented on this page is not intended to serve as tax, legal, or any other professional advice, and should not be used as such. If you have any questions or concerns, it is strongly recommended that you seek the advice of a qualified tax professional. It's also important to note that Shoplazza does not file or remit sales taxes on your behalf, and therefore can not be held responsible for any resulting actions.

What is a Non-Resident Importer Program (NRI)?

The Non-Resident Importing (NRI) program may be ideal if your business is based in the US and you’re interested in tapping into the Canadian market, becoming a Canadian Non-Resident Importer (NRI) might be your best option.

This program is run by the Canadian Border Services Agency (CBSA), and its purpose is to enable international exporters to sell their products to Canadian customers without having a physical business presence in Canada.

As an NRI, you will relieve your Canadian customers of the responsibilities of importation, making it easier for them to buy from you. The program was developed specifically to assist U.S. vendors access the lucrative Canadian market.

Goods and Services Tax (GST)/Harmonized Sales Tax (HST)

A non-resident importer can register with the Canada Revenue Agency (CRA) for a Canadian GST number which provides certain benefits and, in some cases, is mandatory depending on the type of business being conducted in Canada.

For detailed information, please refer to the CRA's guide .

Selling in the European Union (EU)

What is VAT (value-added tax)?

Consumption tax added to goods and services in almost all countries. VAT is added to all levels of the production and distribution chain. VAT incurred can often be reclaimed by U.S. and Canadian companies. A VAT number, also referred to as a value-added tax identification number (VATIN), is an identifier used in the EU. It's provided to you by a member country's tax authority after you register with them. This number is issued by countries to allow merchants to charge value-added tax.

How is VAT charged?

Value Added Tax (VAT) is charged on most goods and services in many countries, including in the European Union. The VAT rate is a percentage of the price of the goods or services and is usually added to the total amount that the customer pays. VAT is collected by businesses on behalf of the government, and the businesses then remit the VAT they have collected to the tax authorities. The amount of VAT that businesses can claim back from the tax authorities varies, depending on the rules of the country or jurisdiction.

What do I need to know about Brexit (EU)?

If you sell to customers in the UK, then the best way to get information about how Brexit affects your business is by reaching out to a local tax professional. As a starting point, the following are some of the new laws that apply to merchants who sell to customers in the UK:

- You might need a UK EORI number.

- The UK VAT laws that came into force on January 1, 2021 result in new VAT requirements for sales equal to or less than 135 GBP.

- If the sale of goods is equal to or less than 135 GBP, then you must register for VAT in the UK. In this case, VAT is collected at the point of sale and remitted by the merchant. If you use registration-based taxes and have a UK VAT registration, then VAT will be applied to your sales to customers in the UK.

- If the sale of goods is over 135 GBP, then you might not be required to collect VAT at the point of sale. In this case, VAT and duties are remitted by the importer. If you use registration-based taxes and have a UK VAT registration, then VAT will not be applied to your sales to customers in the UK. If you choose to, you can charge your customer for VAT and duties at the time of sale, and then provide these funds to the shipper or importer using a shipping label. Alternatively, you can send the orders without charging VAT and duties, and your customer will pay extra funds at the time of delivery.

What do I need to know about selling in the EU?

When merchants outside the EU ship orders to customers in EU member countries, then the following import and duty rules apply:

- For orders that are equal to or less than 150 EUR, VAT is applied.

- For orders that are greater than 150 EUR, import VAT and duties are applied.

If you don't charge VAT and duties during the checkout process, then your customer pays them to the shipping carrier upon delivery.

One-Stop Shop and Import One-Stop Shop (OSS / IOSS)

One Stop Shop schemes are available that allow merchants to simplify charging and remitting VAT for sales to EU member countries.

- The One-Stop Shop (OSS) scheme, also called the Union OSS, is for merchants within the EU whose sales to other EU member countries require them to charge and remit VAT based on destination countries. You can use the OSS scheme if your annual sales to all other EU member countries are equal or greater than 10,000 EUR.

- If your annual sales to all other EU member countries are less than 10,000 EUR, then you can either use the micro-business exemption to charge your local VAT rate, or register for the OSS if you want to charge VAT based on the location of your customers.

- The Import One-Stop Shop (IOSS) scheme, also called the Non-Union OSS, is for merchants outside the EU that sell to customers located in any EU member country. You can use the IOSS scheme if you are located outside the EU and sell to customers located in an EU member country, and you don't want your customers to be charged tax upon delivery.

How do I register for an EU IOSS VAT number?

If you use the Import One Stop Shop program, it is necessary to register for an IOSS EU VAT number in one EU country, which you may choose. Registering for the IOSS will allow you to consolidate all of your EU VAT monthly filings for each EU country into a single payment in the country where you are registered. When choosing one of the 27 EU countries/member states for IOSS VAT registration, you may want to consider the main language spoken in that country, so you don’t have communication issues down the road. For example, Ireland is a good country to register in for online retailers whose native language is English. If needed, you can change the country at a later date by de-registering in one country and registering in a new country.

Note

The information presented on this page is not intended to serve as tax, legal, or any other professional advice, and should not be used as such. If you have any questions or concerns, it is strongly recommended that you seek the advice of a qualified tax professional. It's also important to note that Shoplazza does not file or remit sales taxes on your behalf, and therefore can not be held responsible for any resulting actions.

Will I be able to override tax settings in my Shoplazza admin?

Sometimes the default tax rates won't apply to certain products. For example, certain types of children's clothing might be exempt from tax or have a lower tax rate. If the default rates don't apply, then you need to create an override.

Create or override tax on your store

1. From your Shoplazza admin > Settings > Taxes, scroll down to Manual tax rate settings and click on Create Profile.

Prepare, file and remit your taxes

As your sales tax filing date approaches, figure out how much sales tax you’ve collected from buyers in every state where you have nexus.

You will need to visit the website for each state's agency responsible for the administration of sales taxes for details on how to file, and perhaps more importantly, when to file. The deadlines will vary from state to state, and the frequency with which you file will also vary significantly based on your location and your tax liability. Not only do they want to know the total amount of sales tax you collected from buyers in their state, they want you to break that amount down by county, city, or district.

To learn more about each state's agency, you can head over to the Streamlined Sales Tax Governing Board website, which is an organization that works to simplify and standardize sales tax administration across multiple states. Their website provides links to the websites of each state's department of revenue or taxation. Alternatively, to find the website for the agency responsible for the administration of sales taxes in a particular state, you can do a search for the state name and "department of revenue" or "department of taxation". For example, if you wanted to find the website for the agency responsible for sales taxes in California, you could search for "California department of revenue" or "California department of taxation".

Ensure that you check with your individual state on when and how to file. Most states make it easy to file online. In fact, some states require you file online or pay a penalty.

Just because you didn't collect any sales tax over this taxable period, many states still require you to file what is known as a “zero return,” even if you don’t have any sales tax funds to remit to them. A zero return is a sales tax return that tells the state you didn’t collect sales tax during that taxable period. They basically want you to check in and assure them you’re still in business. If you forget to file a zero return, you can receive a penalty just like if you forgot to file your taxes when you do have funds to remit.

In summary, filing your taxes on time and accurately is a legal requirement that carries both benefits and consequences. By fulfilling your tax obligations, you avoid penalties and interest charges, maintain your financial reputation, and contribute to funding essential public services and infrastructure. Keeping accurate records, seeking professional advice when needed, and staying informed about any tax law changes are all critical in ensuring a smooth and stress-free tax-filing process. Remember, doing your taxes properly can have a positive impact on your financial well-being and contribute to a healthy economy.

Shoplazza Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting and financial professionals. Please note that Shoplazza does not file or remit your sales taxes on your behalf. Please consult a tax professional for any tax related questions.

Comments

Please sign in to leave a comment.