Overview of Open API Access Methods

Shoplazza provides a variety of access methods for payment partners. In order to facilitate payment partners to access the Shoplazza developer platform efficiently and conveniently, payment partners can apply to become the external developers of Shoplazza and access independently through Open API.

Access via Open API is applicable to the following payment methods.

- Pay by credit card(Visa/Mastercard/Amex/JCB/Diners/Discover)

- Alternative payment

The way of accessing Shoplazza with Open API and the specializations in the transaction process

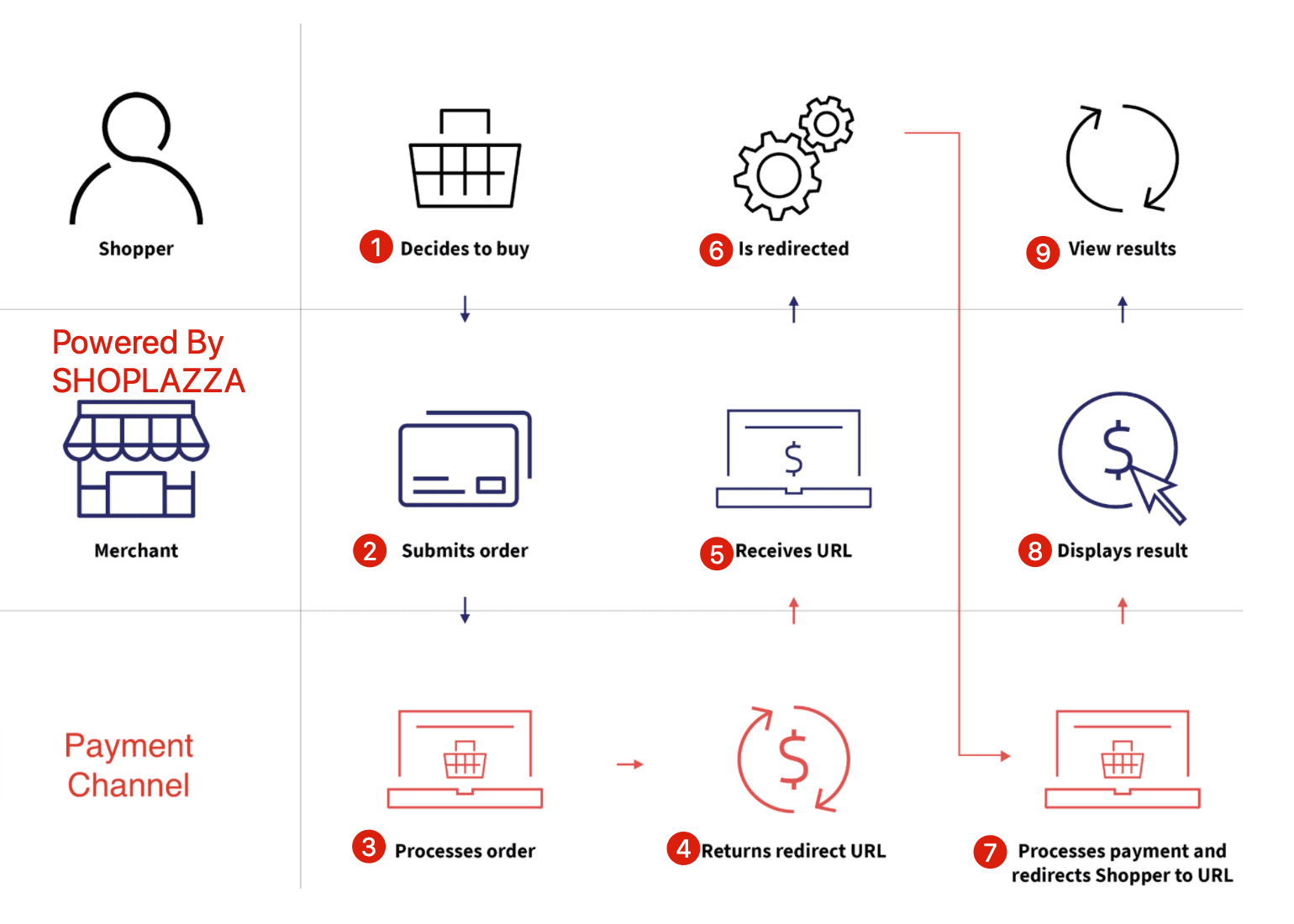

This type of access, called third-party checkout, is one of the most common ways to accept online payments. The following table details the part that Shoplazza and the payment company are responsible for in the payment process.

|

What Shoplazza does |

What Payment Channel Does |

|

-Collect details of the items your shopper wants to buy -Send the order details to Payment Channe -Redirect the shopper to Payment Channel to make a payment -Inform the shopper of the payment result |

-Collect the shopper's payment details -Process your shopper's payment-Carry out changes/modifications to the payment -Notify you of payment status changes -Respond to your queries about the status of an order |

Payment process after access

Payment channel display details after access

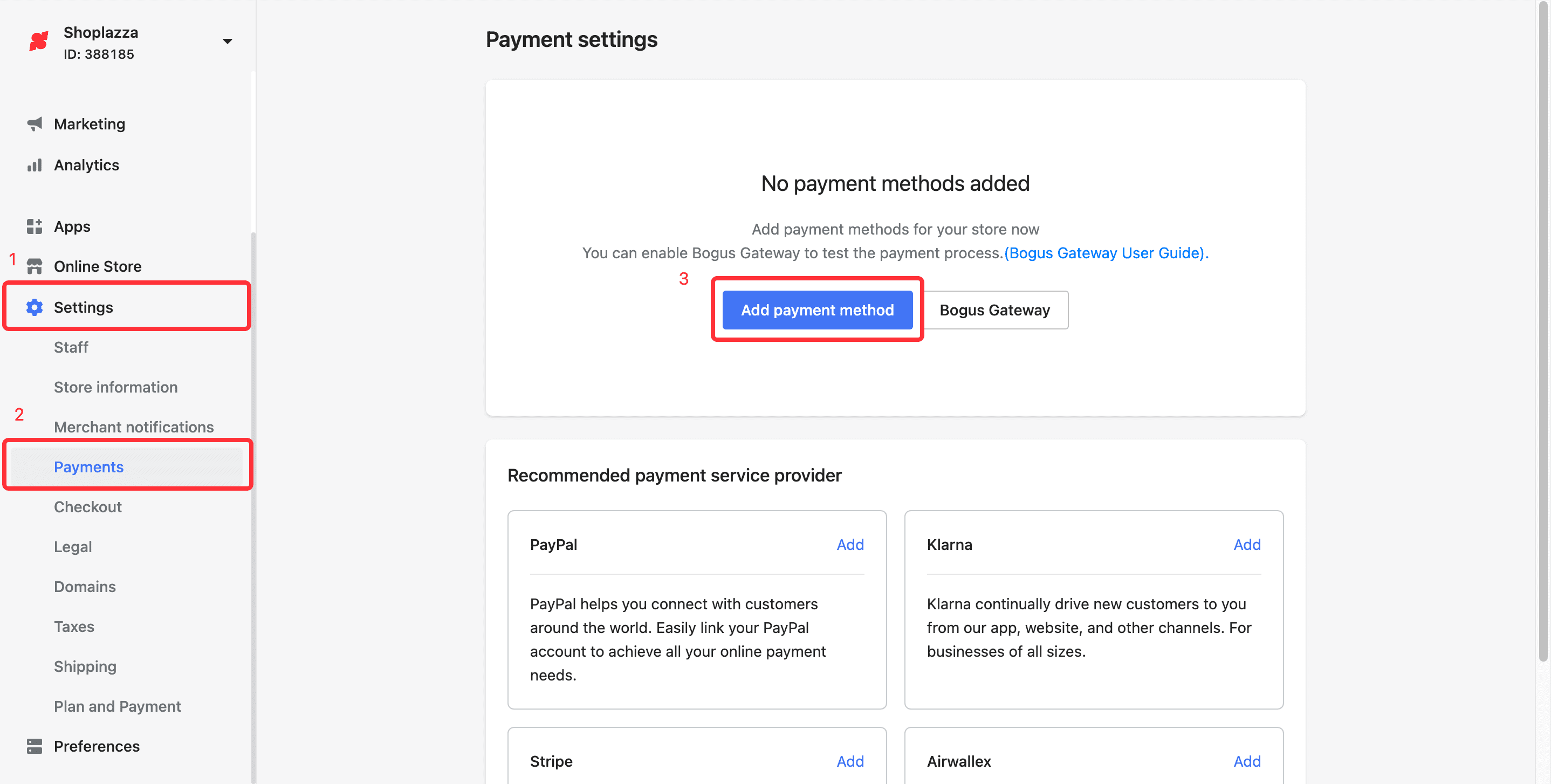

After accessing the Payment App through Open API, the path in the Shoplazza store management platform is Settings > Payments > Add payment method

Overview of the steps to apply for access

To access Shoplazza through Open API to become a payment channel that provides payment services for merchants, you need to complete the following steps.

Step 1: Complete the payment company qualification review.

Step 2: Register as an external developer and create a Payment APP.

Step 3: Configuration of Payment APP.

Step 4: Develop and manage the Payment APP.

Step 5: Apply for and complete the Shoplazza payment test acceptance.

Step 6: Prepare payment channel linking guidelines for merchants.

Step 7: Apply for APP listing.

The details of the above steps will be explained and guided in detail in the following chapters.

Steps to apply to become a Payment APP developer

Step 1: Complete the payment company qualification review.

In order to ensure that the connected payment company is a compliant payment company that meets the basic requirements of card organization and acquirers, and also to protect the information security of merchants and customers, we require that developers who apply to become Payment APP must meet the basic compliance of payment companies.

version of the following qualifications to Partnership_FS@shoplazza.com of the Shoplazza payment group

- Company business profile

- Introduction to the company's payment process and settlement process

- business license

- PCI certificate

- PCI ASV Report

- Any payment license (if any)

Email subject format: Apply to be a Payment APP + payment company name

Note

- The company subject of the business license/PCI certificate/payment license must be the same.

- All qualifications are valid.

- Payment and settlement processes can clearly show the flow of business and funds.

- If there is a clearing and settlement business, a payment license must be held.

Shoplazza will reply within 3 working days after receiving the materials.

Step 2: Register as an External Developer

After you get the email of Confirmation of Completion of Payment Company Qualification KYB Review, you need to apply for a developer account by yourself. The detailed steps are as follows.

1. Go to the Shoplazza Partner Center and register as an external developer. For detailed registration steps, please refer to the How to join our Partner Center

2. Create a Payment APP. For the steps, please refer to the guide on Building public APP;

Step 3: Application for configuration development of Payment APP

After you have successfully created the Payment APP, the Shoplazza developer center and the Payment team need to activate and configure the permissions for your account so that you can carry out subsequent development.

You need to fill in the Payment App Configuration Information Form (the form template will be provided by email after approval), and then email it back to pym@shoplazza.com

Shoplazza will notify the result by email after completing the Payment APP configuration. The general configuration time is 5-7 working days. Please wait patiently and pay attention to the feedback of pym@shoplazza.com

Step 4: Develop and manage the Payment APP

his step is mainly for you to lead and complete the development, and SHOPLAZZA will assist you to complete the development by specialized technical engineers. Here is some information that may be helpful for your development.

1. Develop application

- After the developer creates or accesses the application, you can continue to develop your application, and you can prepare the development environment by applying for a developer store.

- Refer to Creating development store to learn how to create and apply for your developer store.

- Refer to the Developer Overview to learn about the Open APIs that can be used.

2. Manage applications

- After the developer creates or accesses the application, you can continue to manage your application in the Partner Center, including the basic configuration of the application and the listing information of the application.

3. Migrating to standard OAuth

- If the developer has created an application before, but does not use the standard OAuth, the developer needs to complete the standard OAuth migration before 2022-07-01, otherwise the application will be removed.

- Refer to documentation Migrating to the Standard OAuth Flow to learn how to migrate and the timing of the migration.

Step 5: Apply and complete SHOPLAZZA payment test acceptance

After you complete the development of the Payment APP, you need to test yourself first, please refer to the Payment APP test case suggested by Shhoplazza

After passing the self-test, you can apply to Shoplazza for payment of test acceptance. After we receive your application, we will generally complete the test and give feedback within 7 working days. Feedback information will be sent via pym@shoplazza.com, please pay close attention to the email after submitting the acceptance application.

Step 6: Prepare payment channel linking guidelines for merchants

After you complete the above steps, you also need to prepare detailed instructions and guides for your users. This step will help your users and potential future users understand "Who are you?" "What can your APP do?" "How to enable your app?"

Please include the following items in the help document.

- Your company profile

- Payment methods supported by your Payment APP

- How to link your Payment APP

- User landing page screenshots and guidelines for your own platform

The linking guide should preferably be in Chinese and English. Please send the guide to pym@shoplazza.com.

Note

The linking guide will not affect your application for APP listing, but it will affect your exposure in the Shoplazza admin and Help Center.

Step 7: Apply for listing Payment APP

After you pass the Shoplazza payment test and acceptance, you can apply for listing the APP. You can submit an app listing application in the Partner center, and the approved APP will be put on the Shoplazza App store.

You can refer to Building Public App - Submita Public App for Review to learn how to apply your APP for review.

After submitting the application, Shoplazza will feedback the review results within 3 working days. The review results will be sent through the email address of pym@shoplazza.com. Please pay close attention to the email after submitting the application.

Unpublish APP

The Shoplazza open platform can unpublish applications that do not meet the application review standards. After being unpublished, developers can rectify and submit for review again.

Refer to Building Public APP - Unpublish Public App to learn about the methods and rules of unpublish applications.

Comments

Please sign in to leave a comment.