In order for customers to know the exact price they need to pay for an item, you may need to submit information about the taxes charged. In the United States, tax rates vary depending on where the buyer or seller is located, such as state, county, and city. Each state or local tax authority has its own rules, which affects the amount of tax you should charge, depending on where your business needs to collect sales tax. The easiest way to set up taxes is to use the tax settings in Merchant Center, which allow you to set tax rates for individual states.

Steps

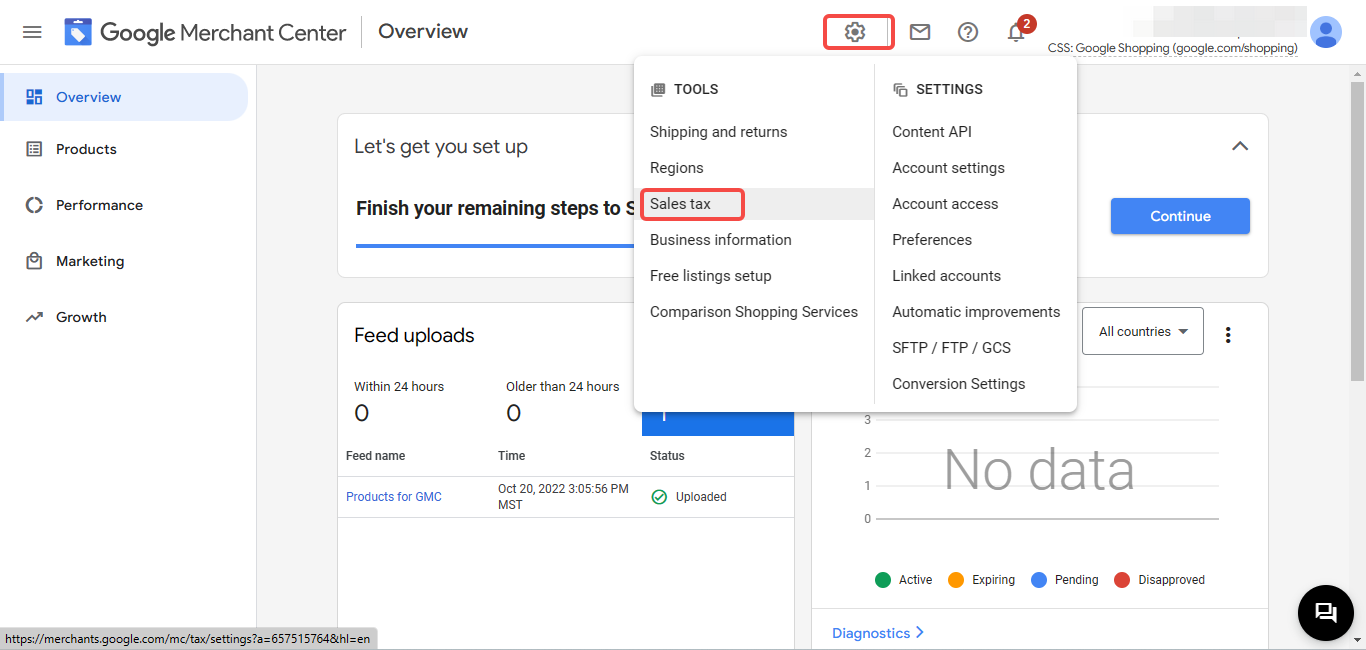

1. Login to your GMC account , Click the Tools & Settings menu and select Sales tax.

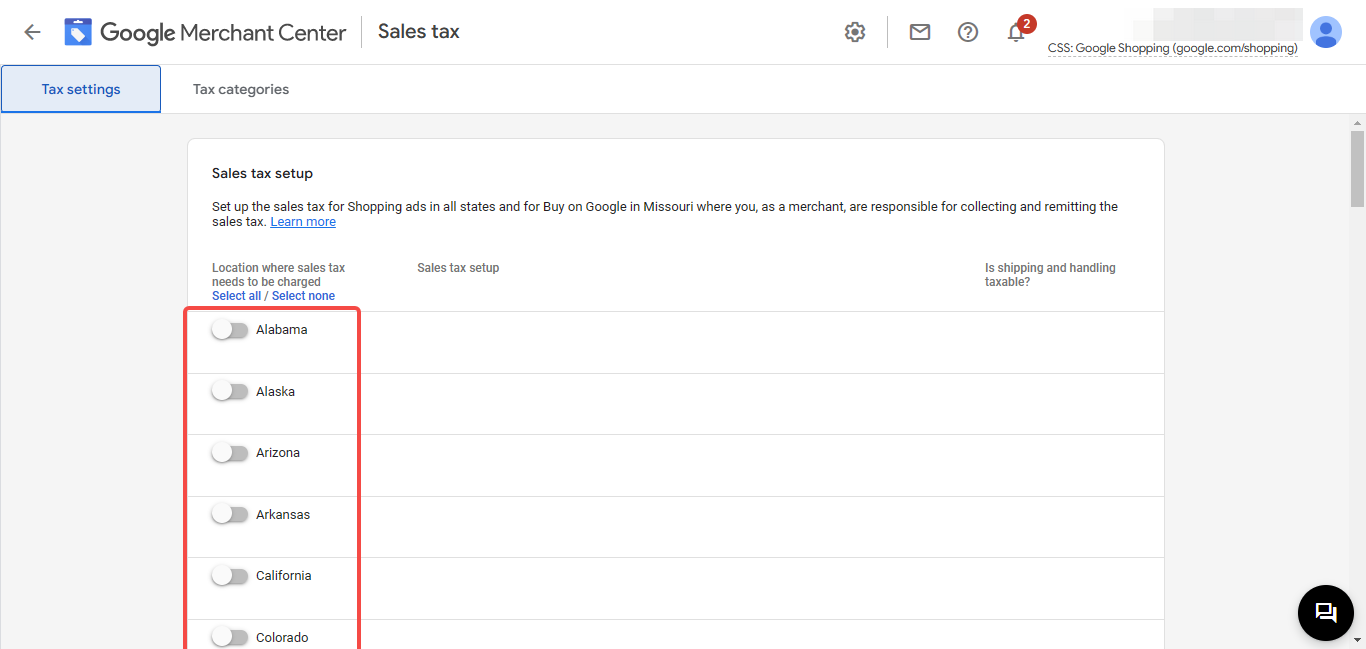

2. In the Tax settings tab, if the system detects that there is no business address in the United States, the system will propose the corresponding tax setup.

3. If the system detects a US IP address, it will automatically show you the option to set up sales tax for each state.

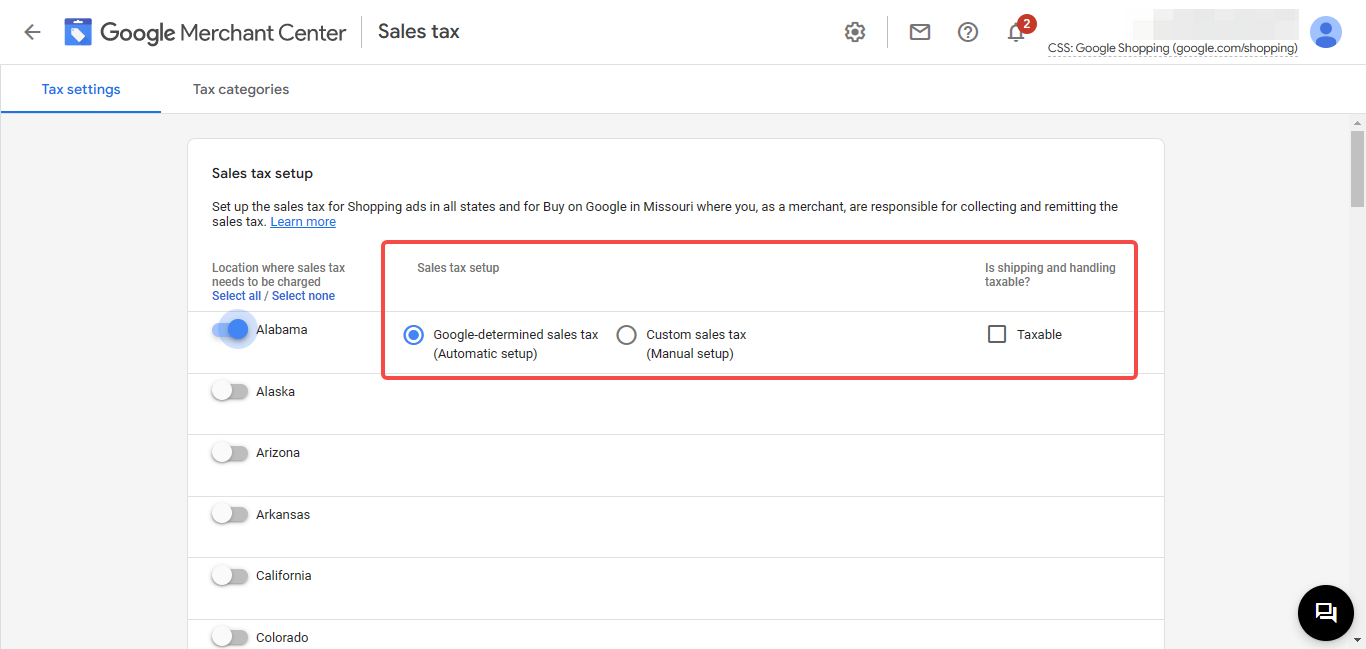

4. Here you will select the setting for each state where you want to collect sales tax.

- For Tax rate, select one of the following options:

-

- Google-determined sales tax (automatic): Let Google estimate the tax rate based on where the customer is located.

- Custom sales tax (manual setting): Enter a specific tax rate to charge for the entire state.

-

- If you charge shipping tax, select Shipping tax.

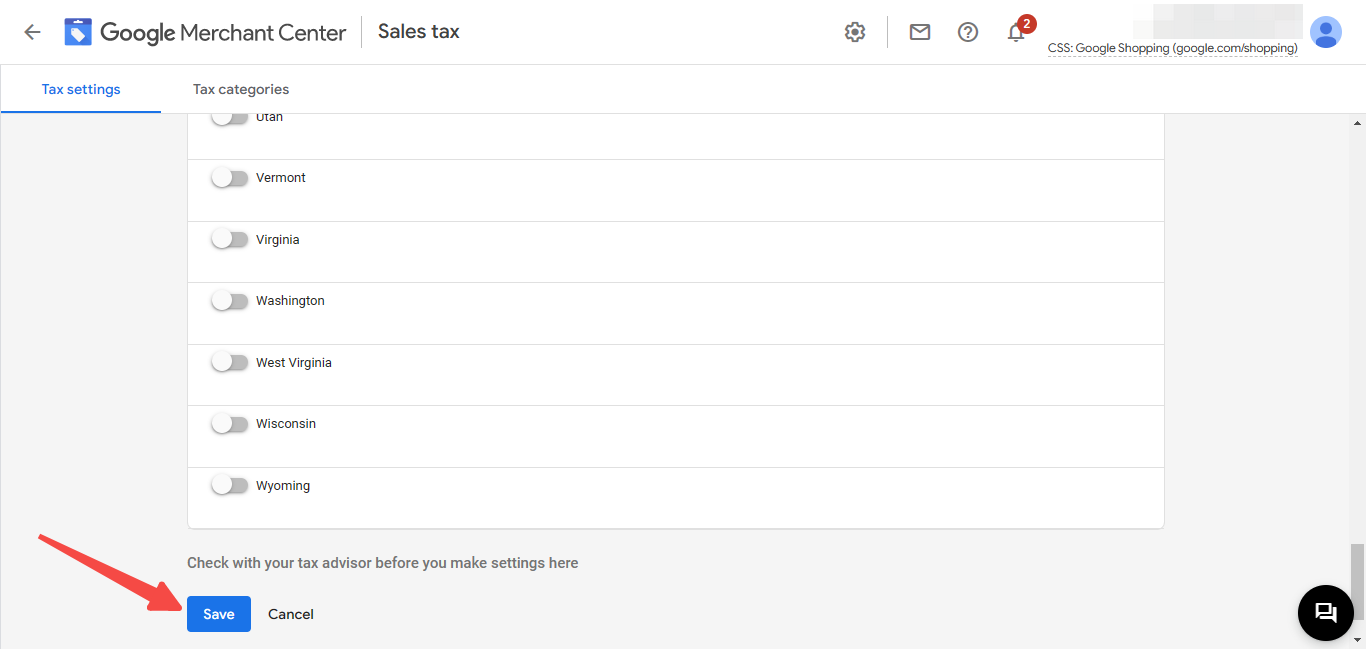

5. Click Save to complete settings.

After setting up sales tax, your customers will know the exact price they need to pay for an item.

Note

- In states that have Marketplace facilitator tax in place, products will be taxed under the laws. For orders from those states, Google remits taxes directly to the tax authorities. Merchants cannot refund or change taxes on orders in these states.

- In states that do not have the Marketplace facilitator tax in place, Google will refund all taxes collected to merchants for remitting. Merchants can also get a tax refund or change taxes when shipping the order.

Comments

Please sign in to leave a comment.