Choco Up is transforming the landscape of startup and digital business funding in Asia. As a prominent e-commerce financing and growth platform, Choco Up specializes in Revenue-Based Financing (RBF), offering a distinct and adaptable funding solution. This article provides an in-depth look at Choco Up's services, including its application process, unique features, and the integration procedure with Shoplazza stores.

Choco up: A Closer Look

- Extensive Financing Range: Choco Up provides funding from $100,000 to $10 million, catering to the diverse needs of startups and digital merchants.

- Tailored for E-Commerce: Specifically designed for e-commerce businesses, the platform aligns funding with revenue, enabling more adaptable repayment options.

Who Can Apply?

- Online Merchants: Online merchants engaged in product sales.

- Sales Criteria: A minimum of USD 50,000 in monthly sales.

- Operational History: The online store should be operational for at least 6 months.

Flexible funding for your growth

- Use of Capital: Provides greater freedom than traditional financing, allowing funds to be used without limitations.

- Tailored Funding Plans: Each funding plan is customized to meet specific business needs.

- Flexible Repayment: Repayments terms are based on sales performance, easing the pressure on cash flow.

Integrating Choco Up with Your Shoplazza Store

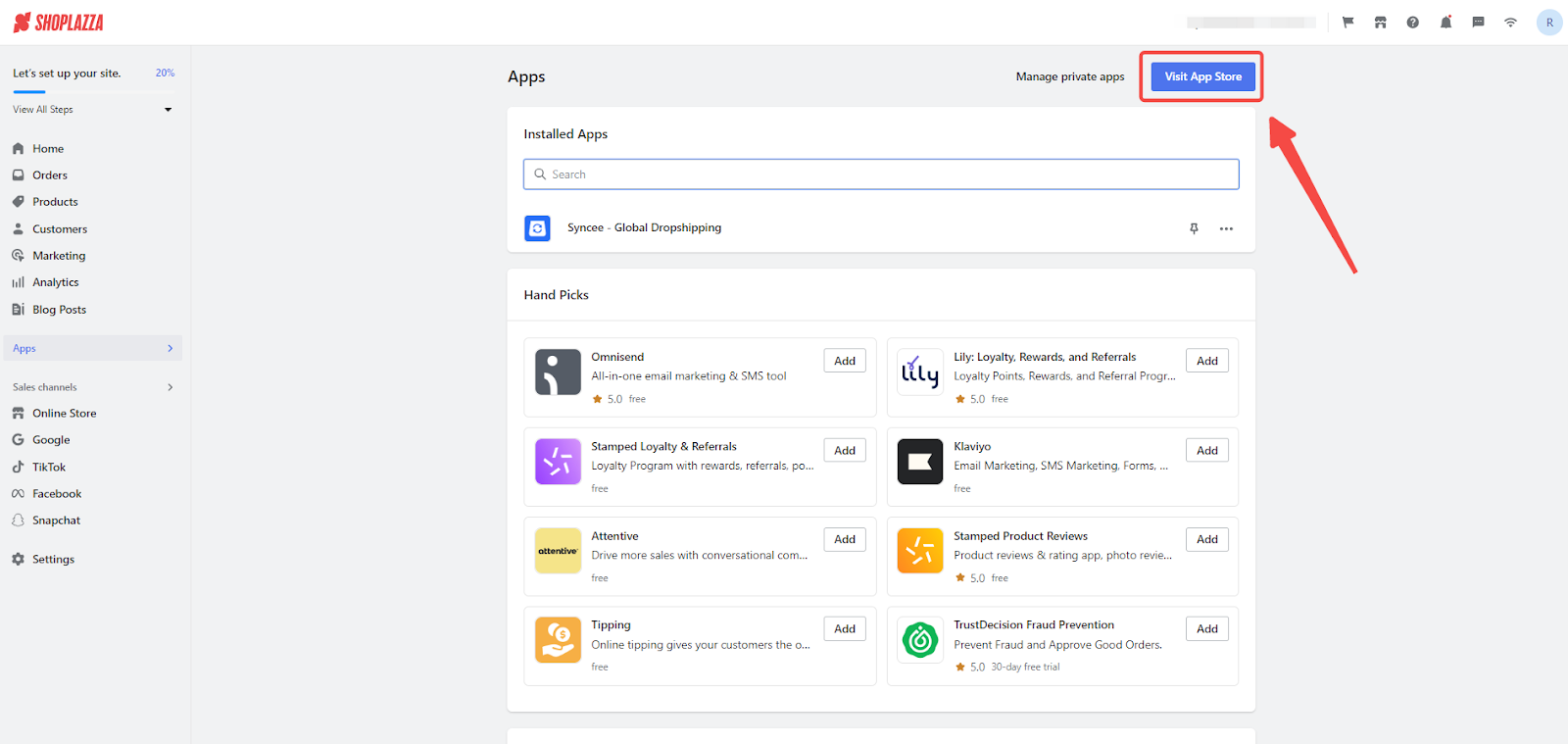

1. From your Shoplazza Admin > Apps, click Visit App Store.

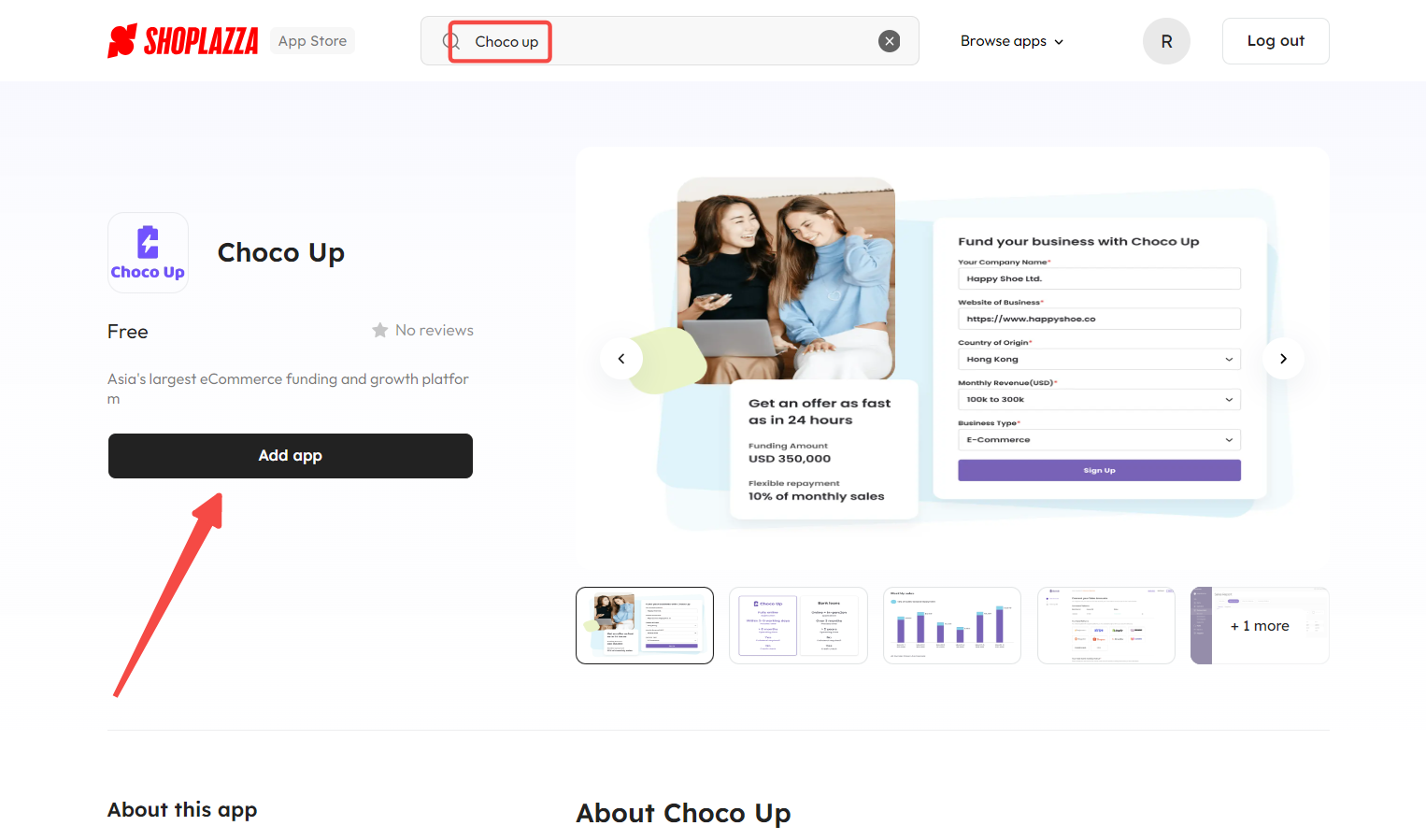

2. Search for Choco Up in the search box and click Add app to add it to your store.

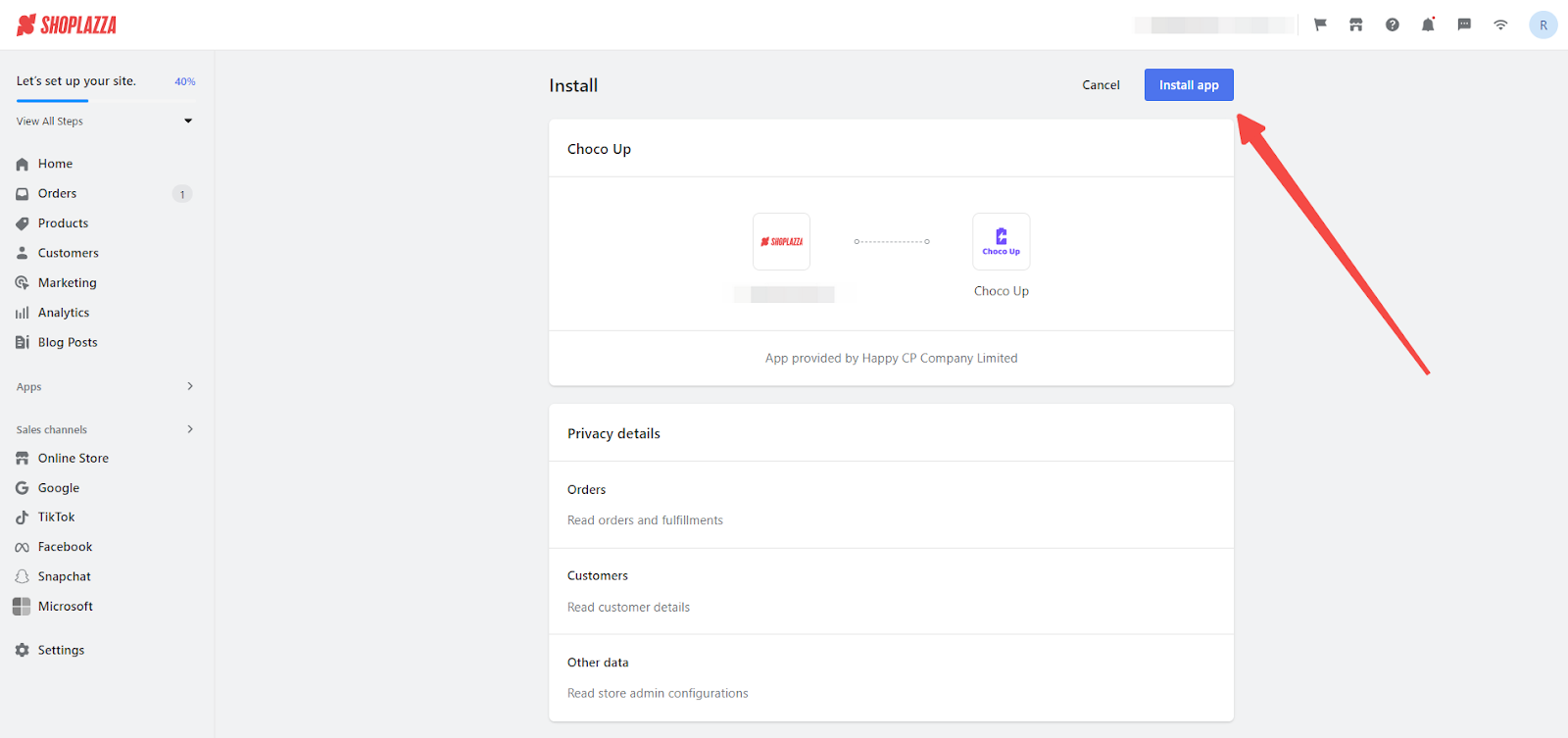

3. Click Install app to complete the app installation.

Funding Process

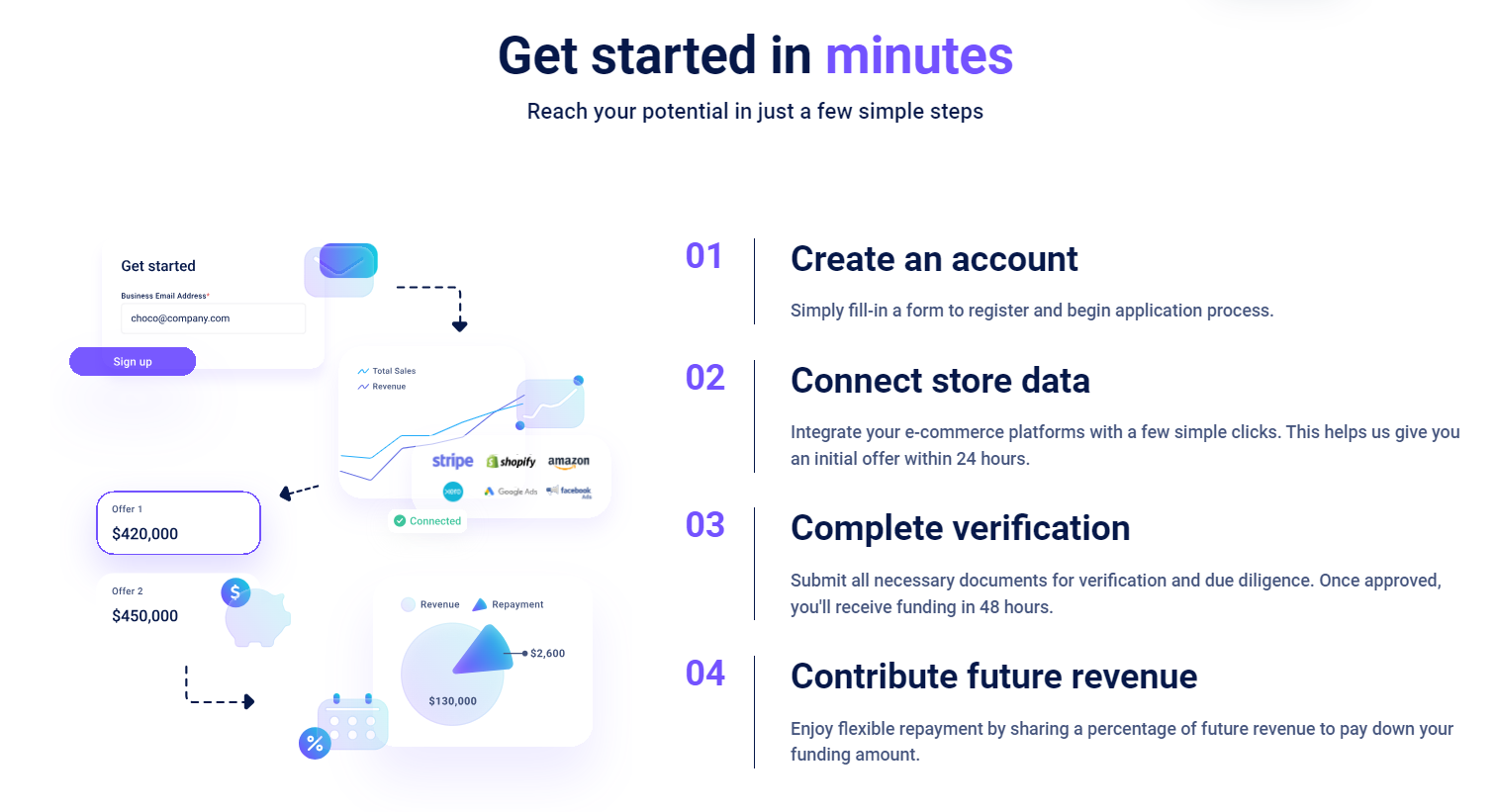

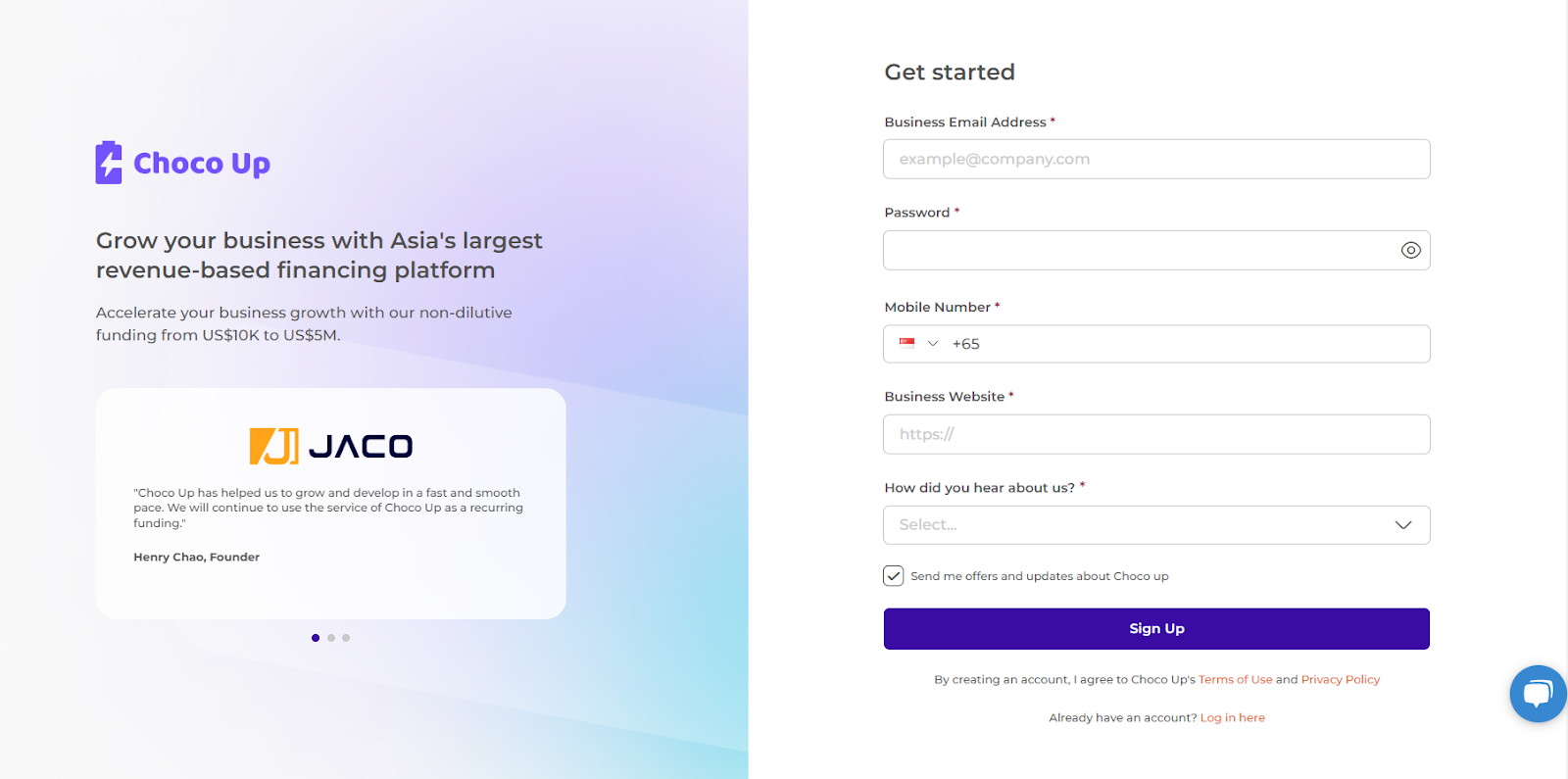

Create an account

After installing the Choco Up app, begin by installing the Choco Up app and registering through a simple form to initiate the application process.

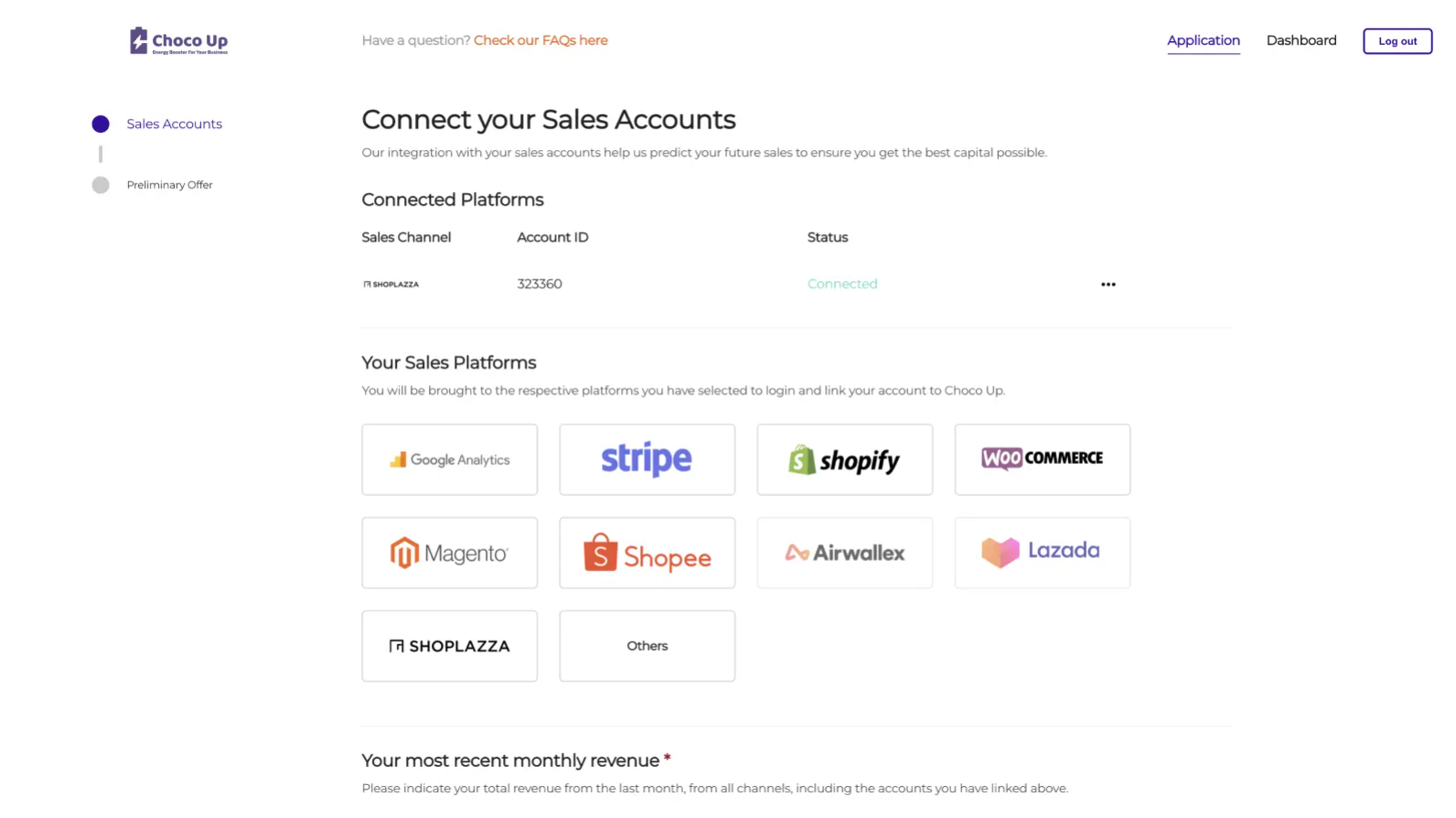

Connect store data

With just a few clicks, you can integrate your e-commerce platforms. This step allows Choco Up to assess your business quickly and provide an initial funding offer within 24 hours.

Complete Verification

To ensure a thorough and efficient verification process, Choco Up has established a step-by-step approach for applicants. This involves:

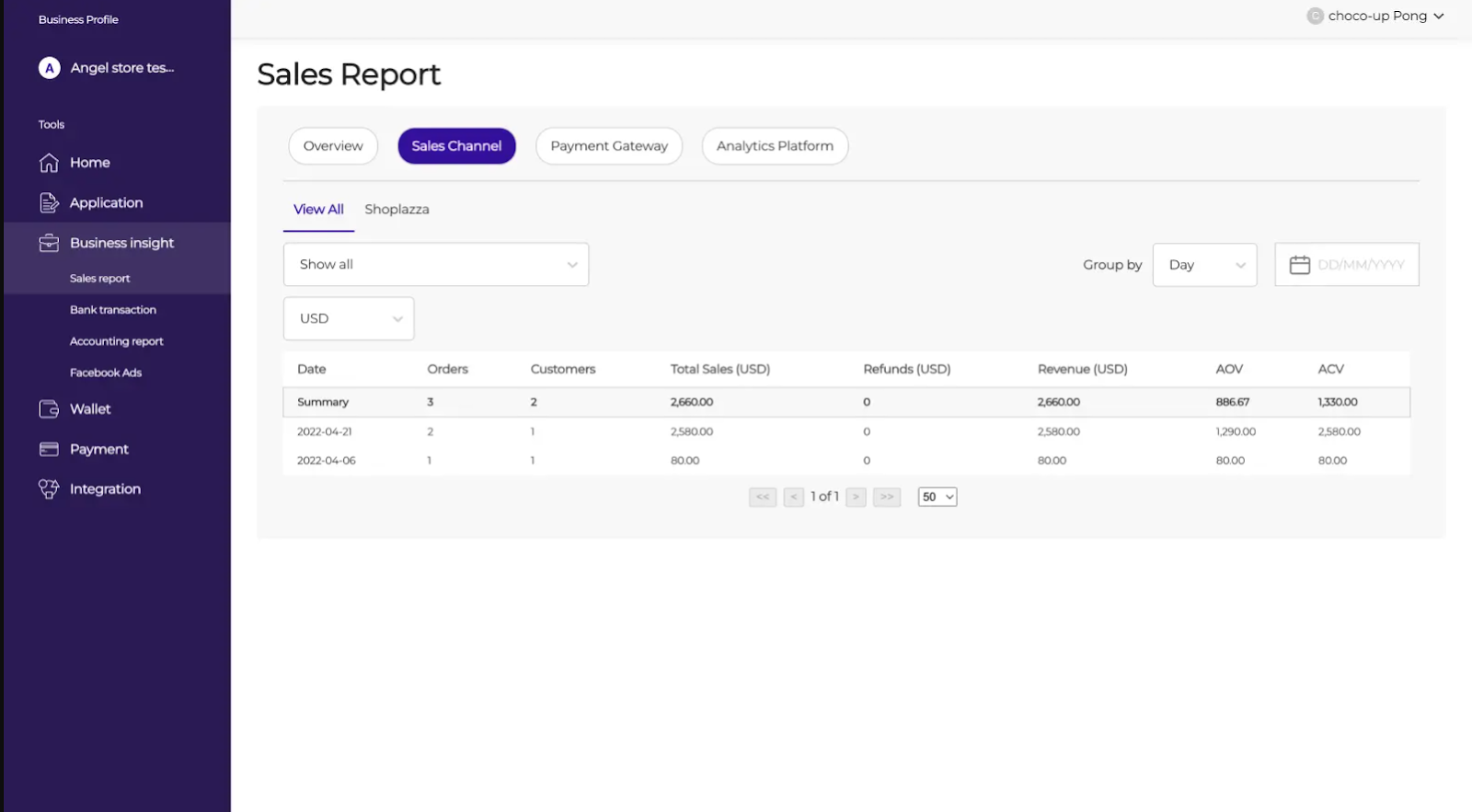

1. Submission of Business Details: Provide detailed information about your business, including sales data, to quickly receive an initial offer, typically within 5 minutes.

2. Linking Marketing Accounts: Connect your marketing accounts to Choco Up for sales data analysis.

3. Providing Financial Information: Add your bank accounts and financial statements, which is essential for maximizing the potential funding you can receive.

4. Accounting Information Submission: The submission of your financial details is a significant aspect of the verification process. This information is key in evaluating your eligibility for funding.

5. Approval and Funding: After Choco Up reviews your submitted information and approves your details, a contract will be drafted. Upon signing this contract, you can expect to receive funding within 48 hours.

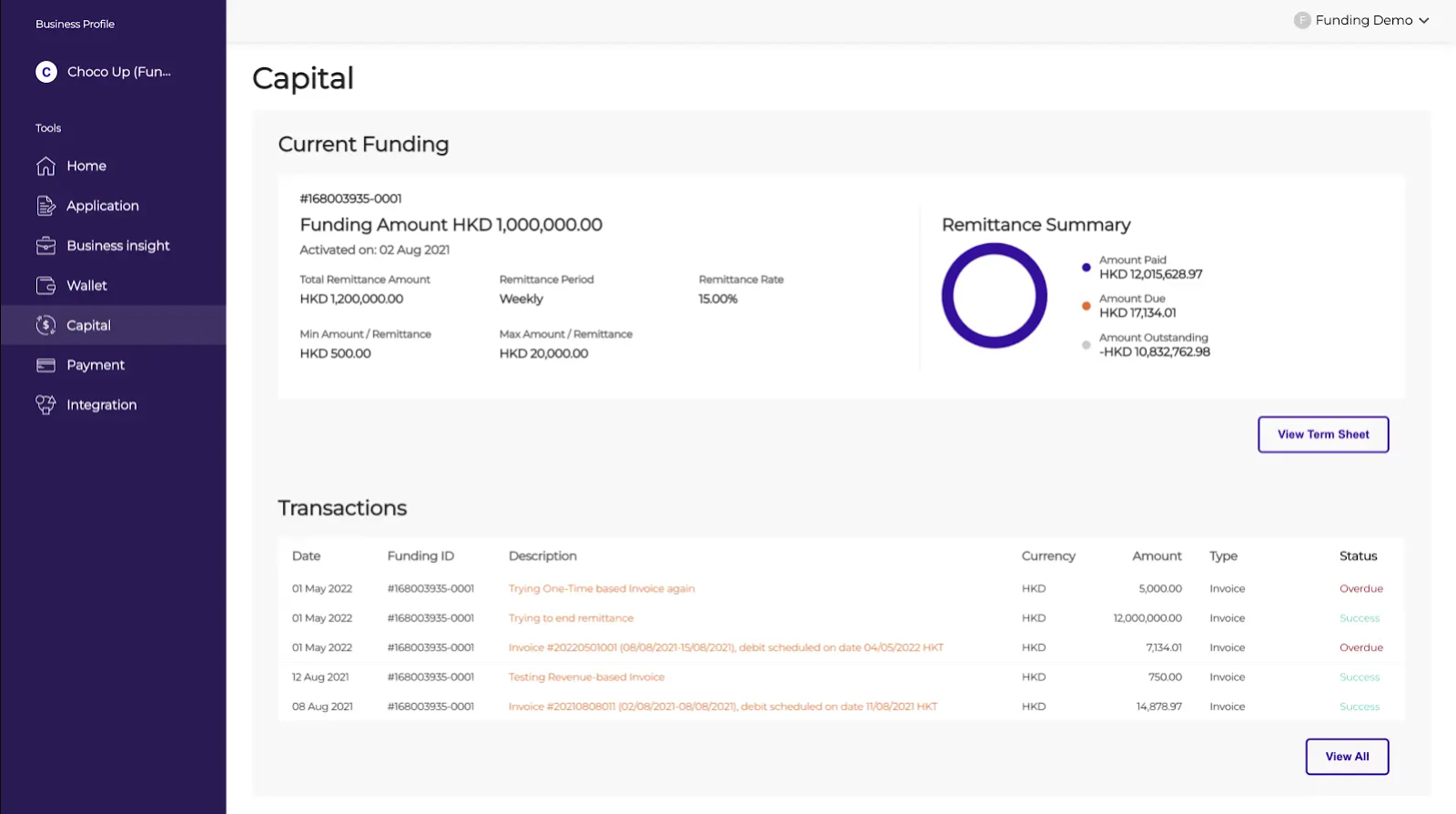

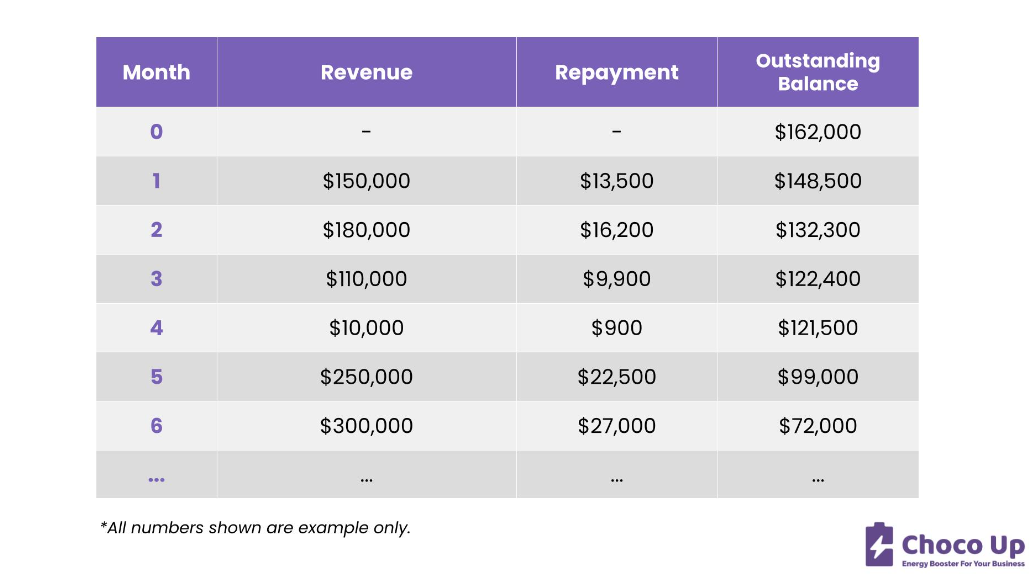

Contribute Future Revenue

Choco Up offers a flexible repayment method that aligns with your business's financial flow, allowing you to repay the funding using a portion of your future revenue. This approach eases the financial pressure on your business, ensuring that repayment terms adapt to your revenue patterns and growth trajectory.

Choco up is more than just a funding platform; it's a growth accelerator for e-commerce and digital businesses in Asia. Its user-friendly integration with Shoplazza, coupled with a straightforward application process, makes it an ideal choice for businesses seeking flexible funding solutions. By following these steps, you can efficiently leverage Choco up's innovative Revenue-Based Financing model to fuel their growth and achieve new milestones in the competitive digital marketplace.

Comments

Please sign in to leave a comment.