Description

Early Fraud Warning (EFW) information originates from reports generated by issuing banks on the Visa, Mastercard, and JCB networks. These reports are used to flag payment services that the issuing bank suspects may be fraudulent, including Visa's TC40 reports and Mastercard's SAFE (System to Avoid Fraud Effectively) reports. These networks require issuers to report fraud, but this requirement does not affect the issuer's decision to initiate a dispute.

Despite the name "Early Fraud Warning," you may still receive an EFW even after you have received a fraudulent dispute for a payment. This typically occurs because the card network's EFW processing system operates independently from their dispute processing system, and the two are not necessarily synchronized.

You can proactively issue a refund to prevent the cardholder from filing a dispute, or you can choose to wait and see if a dispute occurs. If no action is taken, approximately 80% of Early Fraud Warnings will escalate into fraudulent disputes.

Upon receiving an Early Fraud Warning, merchants can take the following actions:

1. Review order details, customer information, and shipping address for potential signs of fraud.

2. Contact the customer using provided details to confirm the order; send a detailed receipt and transaction confirmation to ensure the customer recognizes your business name, helping to avoid "fraud" type disputes.

3. Delay shipping or providing services until further investigation is complete.

4. If your business already has a high dispute rate and you are concerned about the impact of disputes on your business or account, you may choose to proactively refund more aggressively.

Identifying Early Fraud Warnings

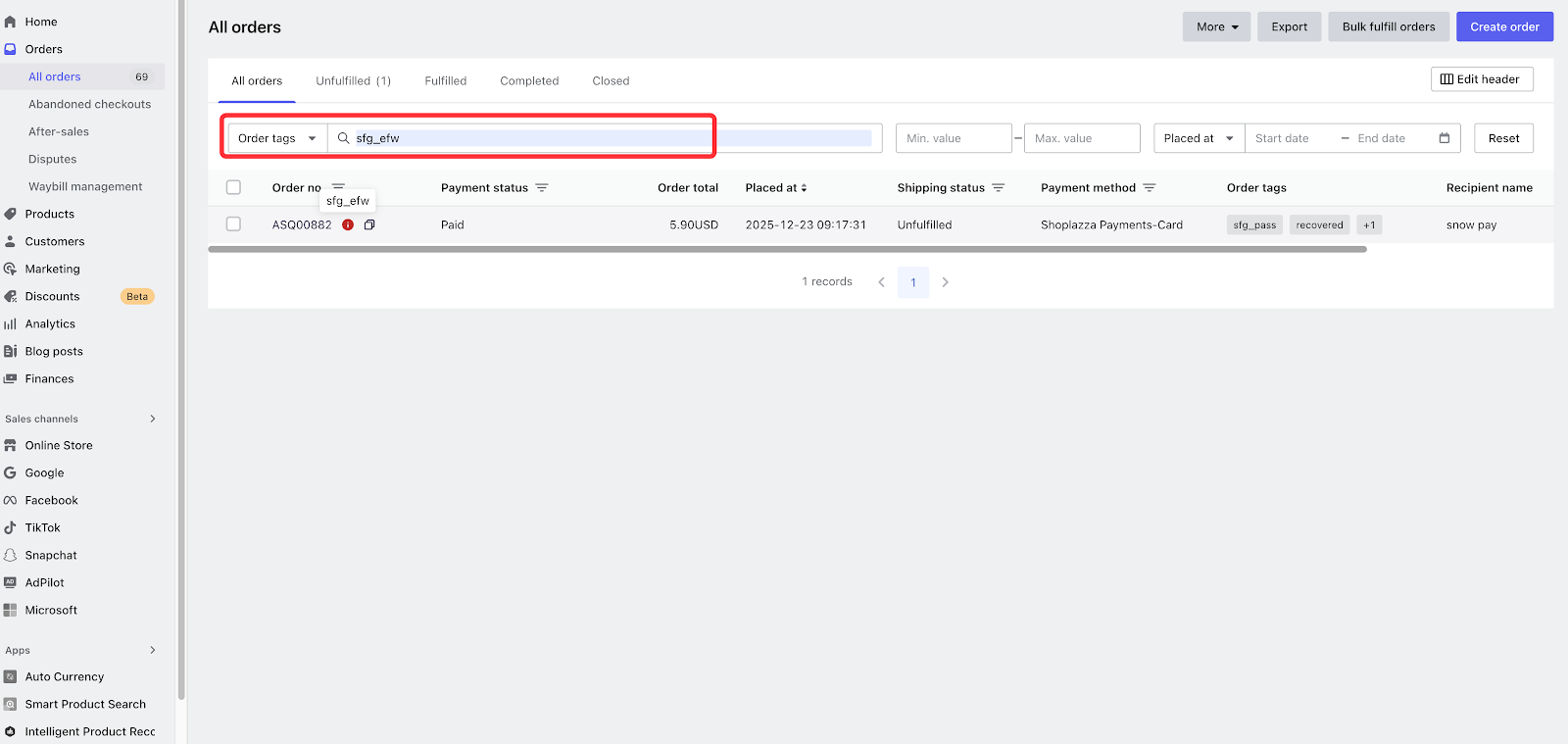

1. Orders

- Order tag filter: sfg_efw

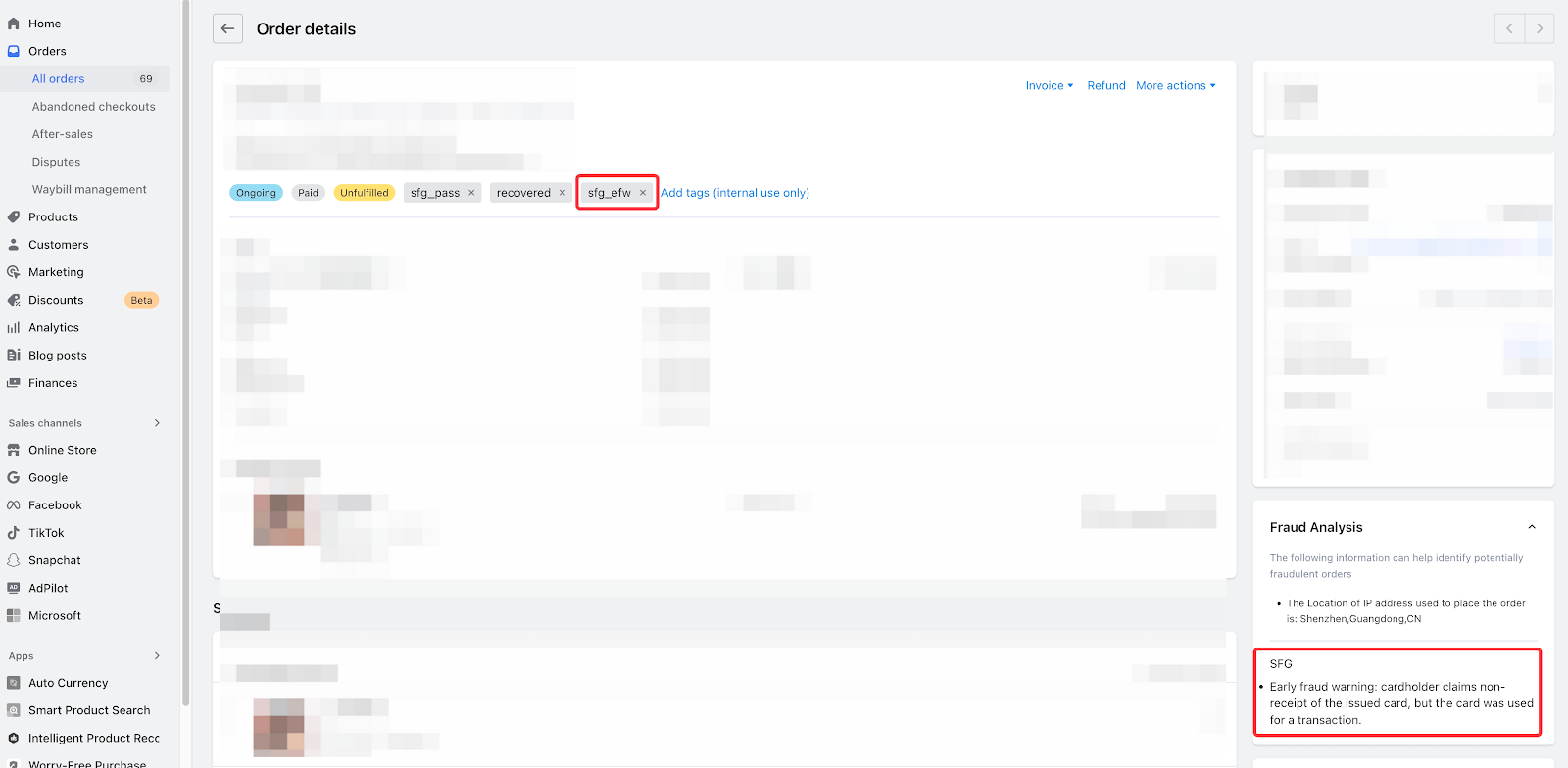

- Fraud Analysis, showing the specific Early Fraud Warning type within SFG.

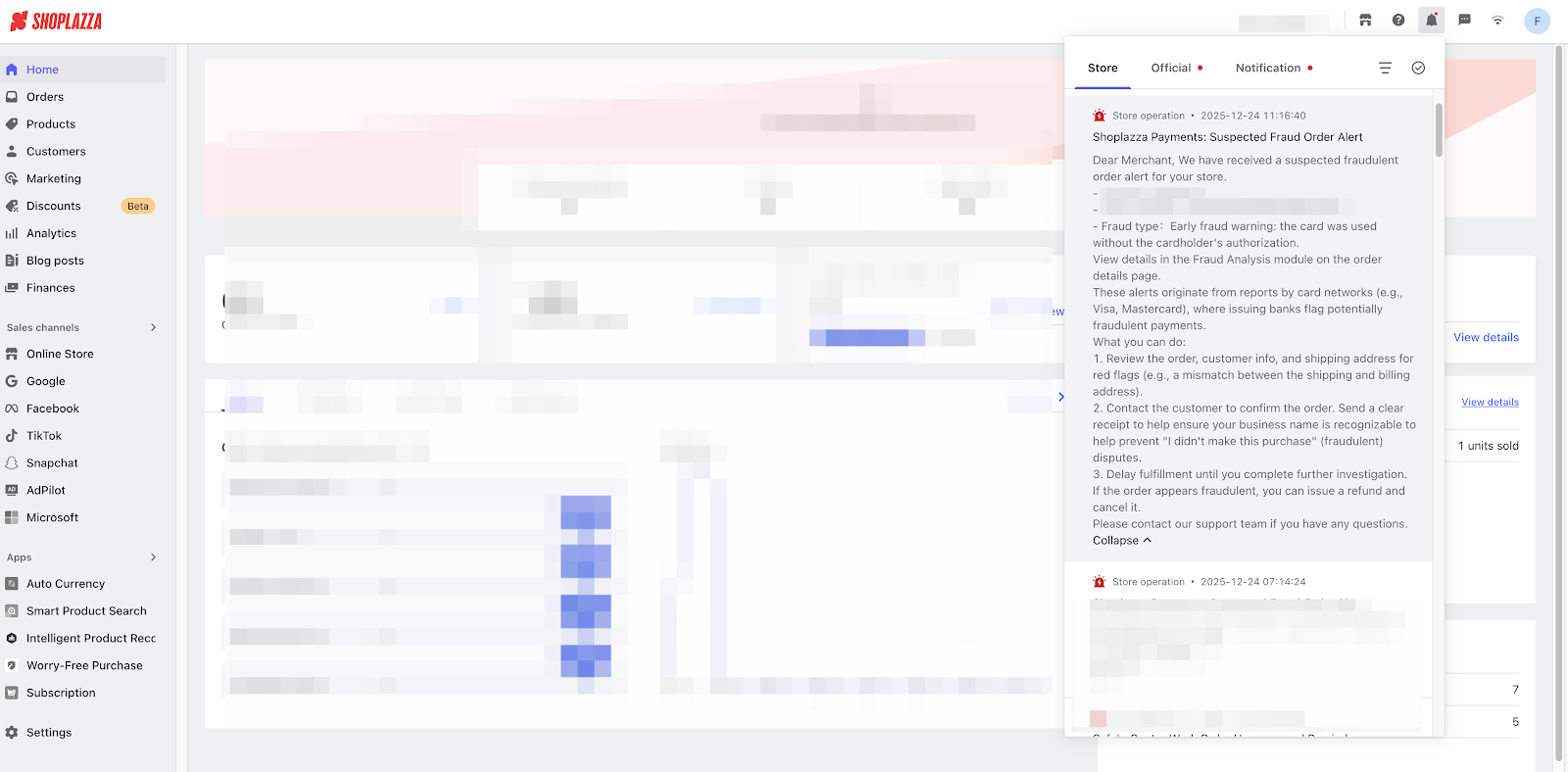

2. On-site Messages and Email Notifications

Comments

Please sign in to leave a comment.