Managing duties and taxes correctly ensures compliance with import regulations and provides transparency to customers. With Shoplazza, you can configure duty collection at checkout to prevent unexpected costs and maintain accurate tax calculations.

Benefits of enabling duty collection

Enabling duty collection at checkout improves both your operations and the shopping experience. This setup ensures your customers always know the true cost of their purchase before payment. Activating duty collection at checkout provides several advantages for your business and customers:

1. Accurate tax calculations: Automatically calculates duties based on each market’s specific rate to prevent pricing errors.

2. Transparent customer experience: Displays duties during checkout, helping buyers understand any additional charges before payment.

3. Reduced unexpected fees: Minimizes surprises from post-purchase customs charges, improving customer satisfaction.

Enabling duty collection

Shoplazza gives you a simple way to activate duty collection directly from your admin. Once enabled, the system will calculate and display applicable duties during checkout. This helps ensure your store complies with international shipping requirements and clearly communicates pricing to buyers. To start collecting duties at checkout, follow these steps in your Shoplazza admin:

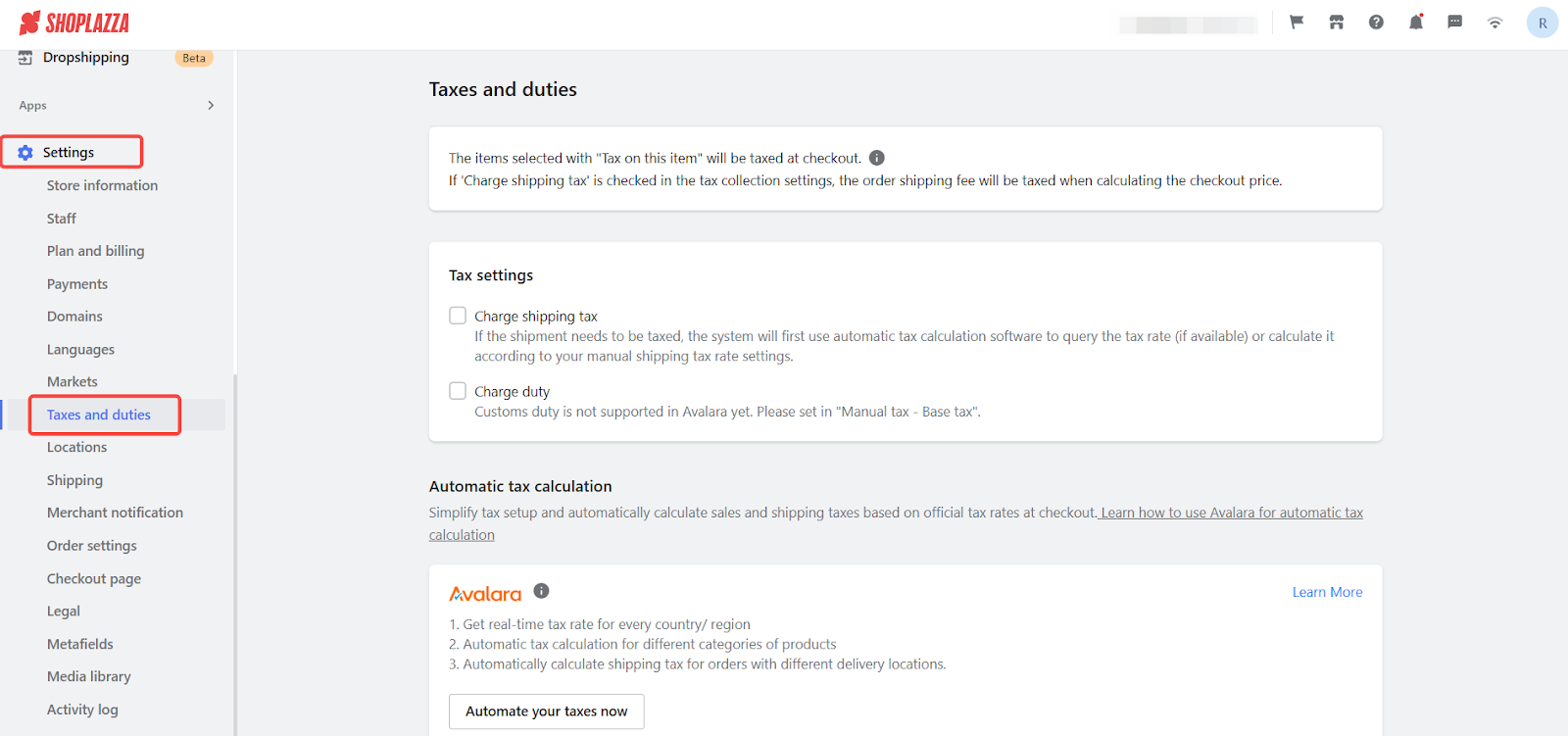

1. Access tax settings: Log in to your Shoplazza admin, go to Settings > Taxes and duties.

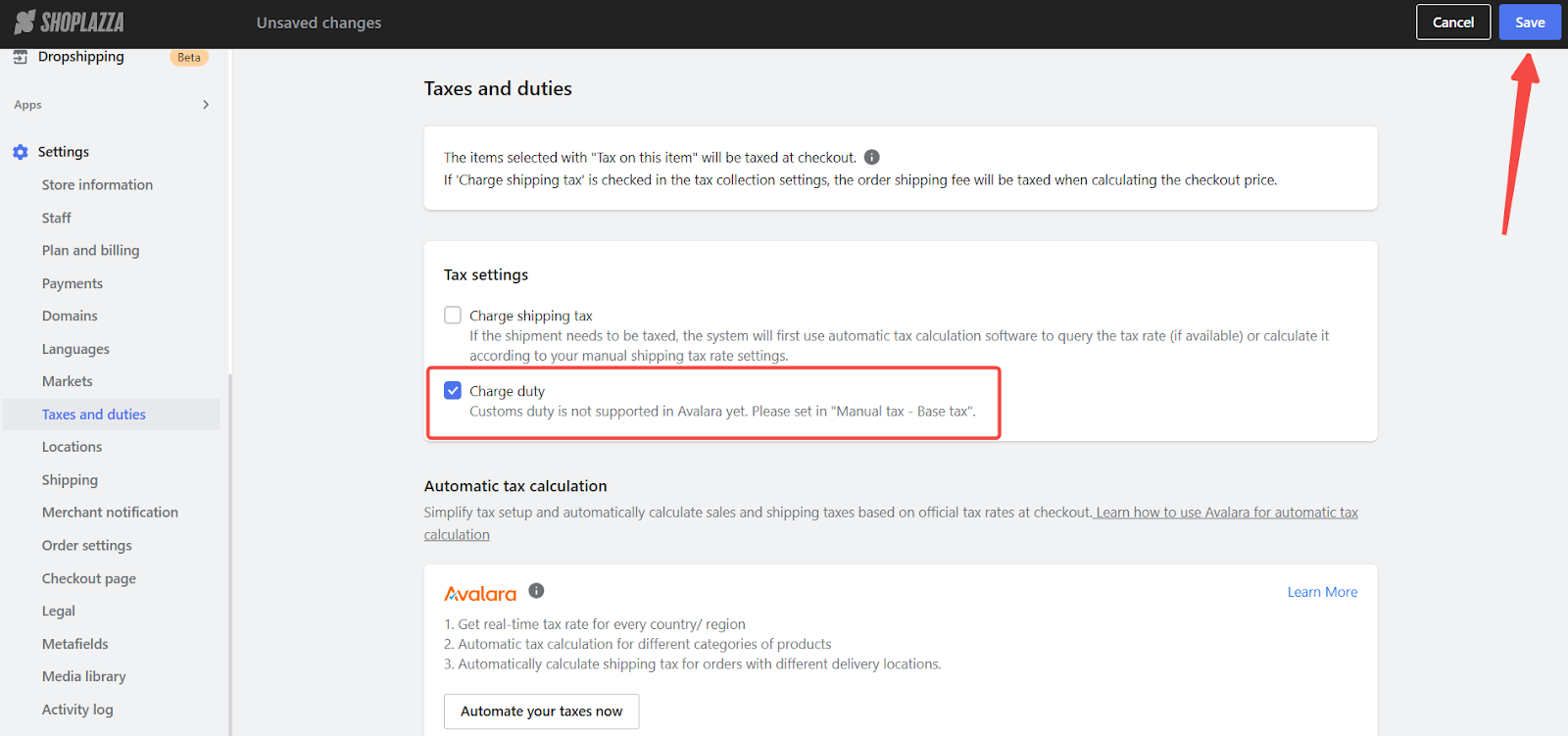

2. Enable duty collection: Under Tax settings, check the box for Charge duty. Click Save in the upper-right corner.

Configuring manual tax rates

Manual duty rates allow you to control how much duty is charged per country. This is useful if you operate in markets with unique tax rules or if you want to customize duty amounts for better pricing strategy. You can also display a short description to help customers understand these charges at checkout.

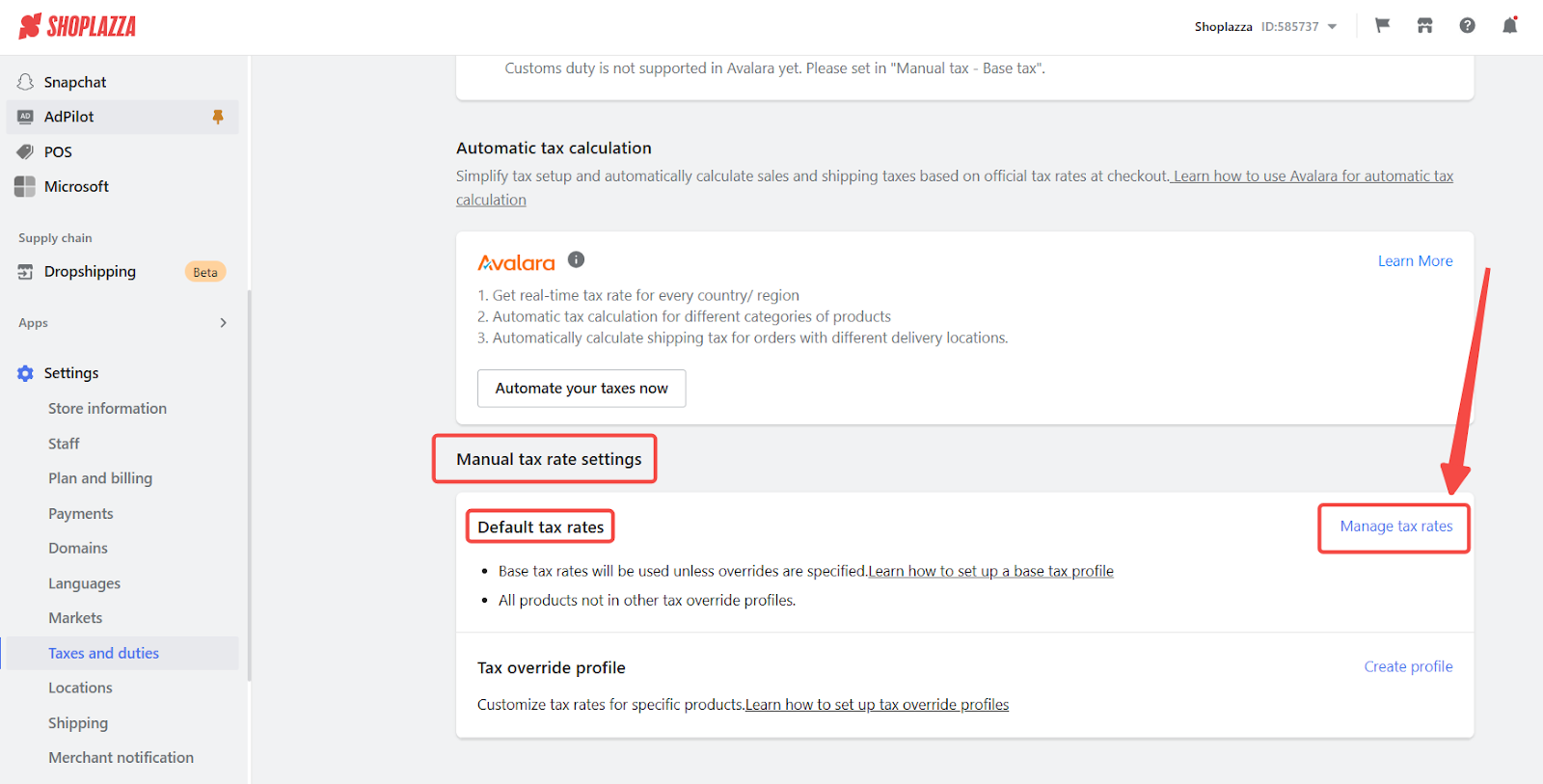

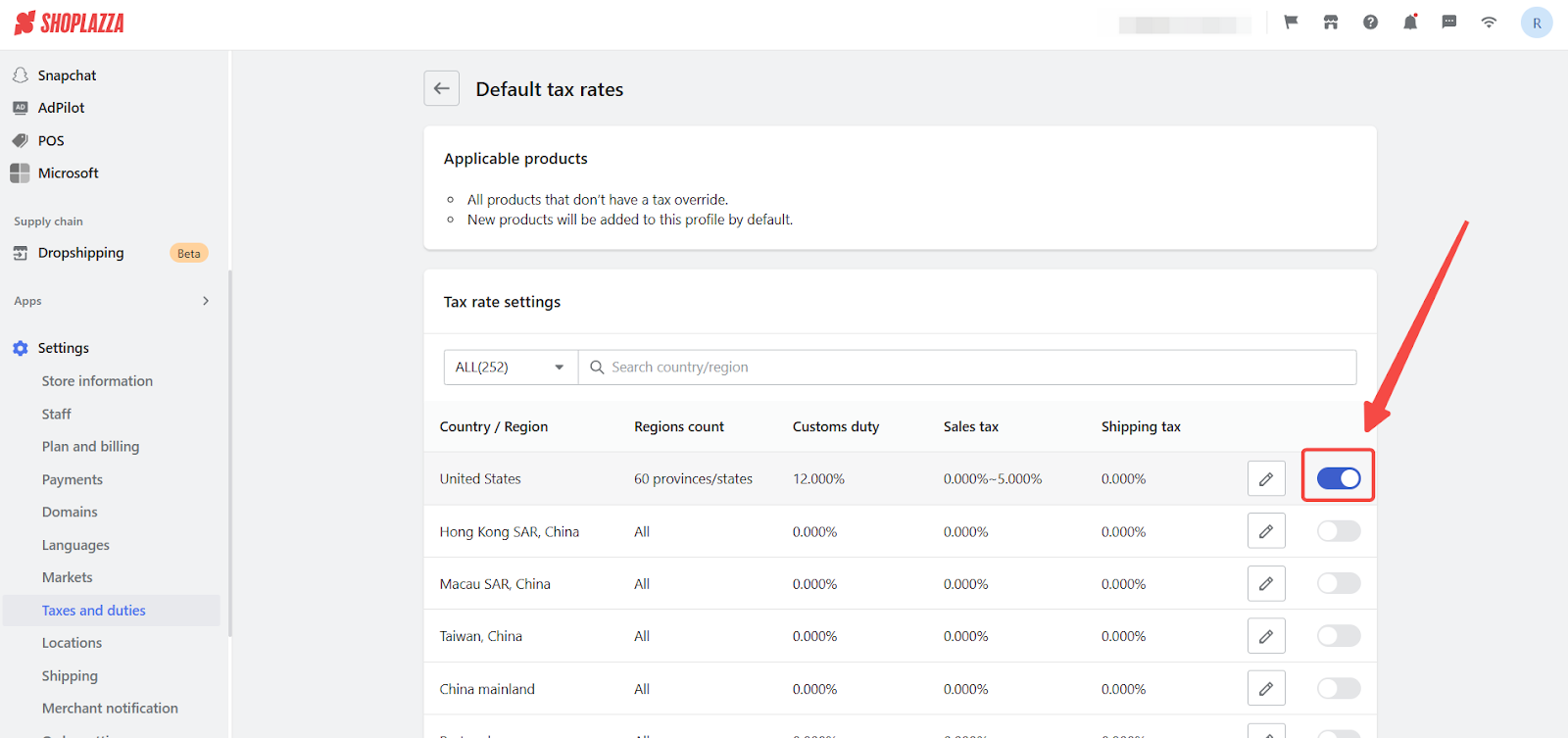

1. Manage tax rates: Under Manual tax rate settings, click Manage tax rates under Default tax rates.

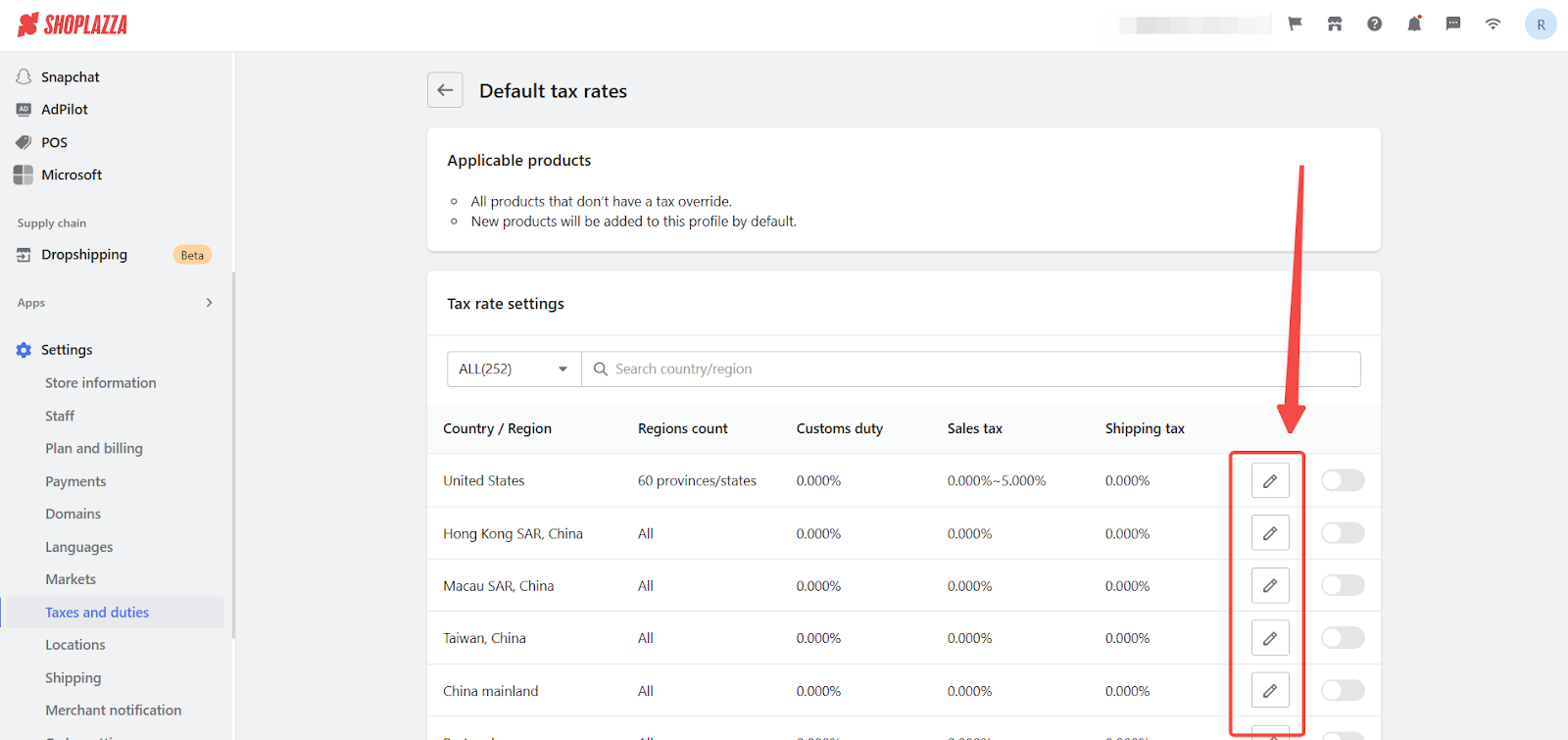

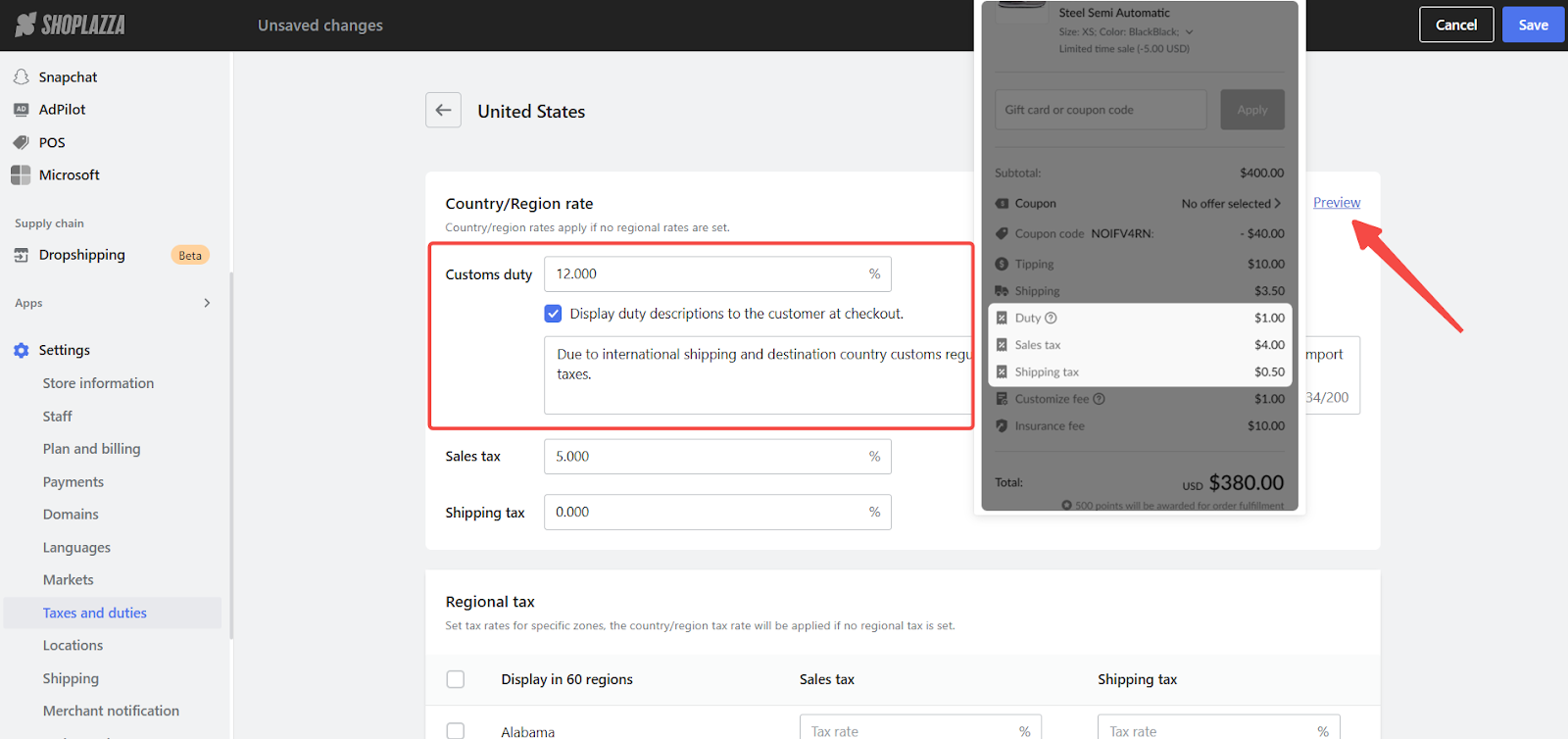

2. Update country-specific duty rates: Find the country where you want to adjust duty rates. Click the Edit icon to access the tax settings.

3. Set the duty rate: On the Tax editing page, set the overall duty rate for the selected country or region.

- Enter the duty rate for the selected country.

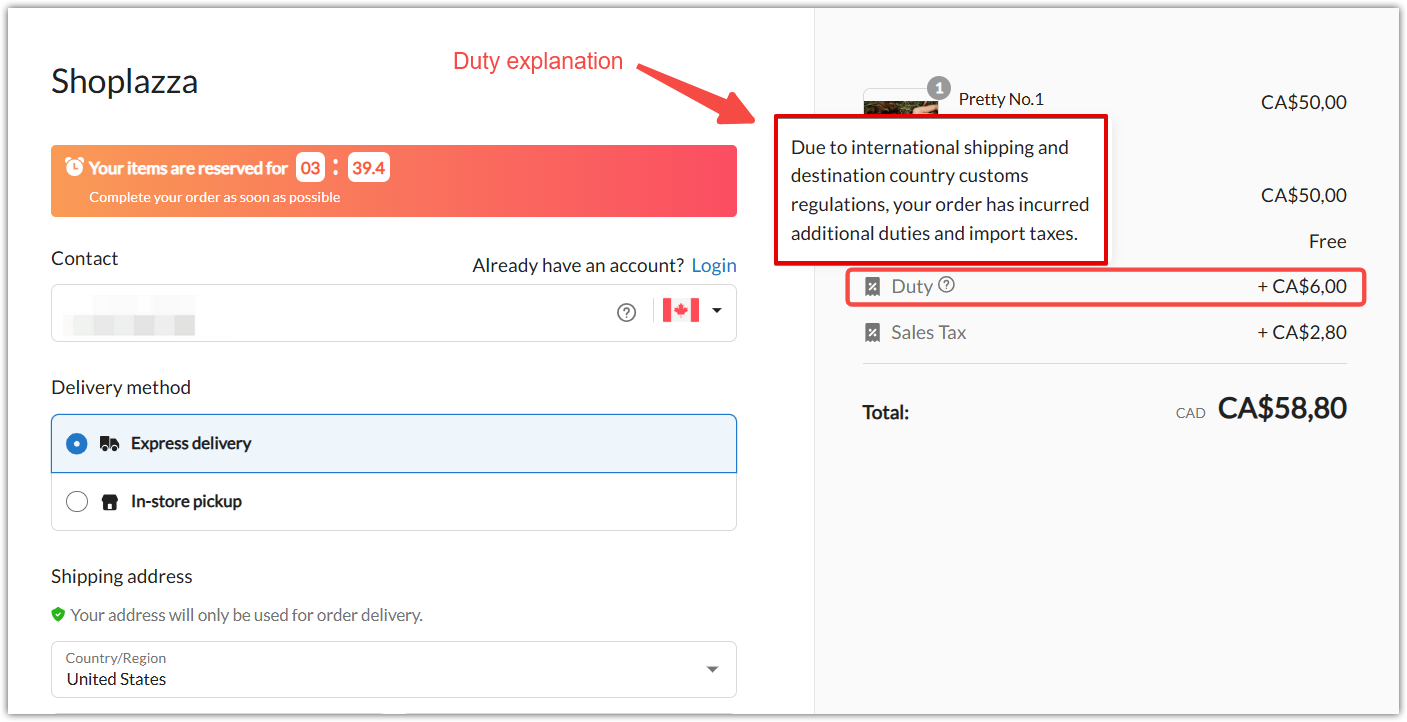

- To show customers a duty explanation at checkout, enable Display duty descriptions to the customer at checkout and add relevant details.

- Preview the description before saving.

4. Apply and activate changes: Return to the previous page and enable the tax rate for that country.

Duty display at checkout

When duty collection is enabled, customers will see a separate line item for duties during checkout. This helps prevent confusion, encourages informed purchasing decisions, and reduces the chances of cart abandonment. Clear visibility of all charges builds trust and supports international sales.

Key considerations for duty calculation

Understanding how duties are calculated helps you price your products correctly and avoid billing errors. The calculation varies depending on whether your pricing is tax-inclusive or tax-exclusive. Shoplazza uses different formulas for each pricing method, which also affects how sales tax is calculated when duties are applied.

1. Price calculation: Tax-Inclusive vs. Tax-Exclusive pricing: Whether your store uses tax-inclusive or tax-exclusive pricing affects how duties are calculated. If your product prices already include tax, the system will apply a different formula compared to when taxes are added at checkout. You can configure your pricing method in Settings > Markets. For additional guidance, refer to Setting a tax-inclusive price for a product.

2. Duty calculation formulas:

- If tax-inclusive pricing is enabled: Duty Fee = (Discounted Product Price × Duty Rate) / (1 + Sales Tax Rate)

- If tax-inclusive pricing is NOT enabled: Duty Fee = Duty Rate × Discounted Product Price

-

Example: If a discounted product price is $100, the duty rate is 10%, and the sales tax rate is 5%:

- Tax-inclusive pricing: Duty Fee = (100 × 10%) / (1 + 5%) = $9.52

- Tax-exclusive pricing: Duty Fee = 100 × 10% = $10

3. Sales tax calculation impact: Enabling duties also affects how sales tax is calculated. The formulas vary depending on whether tax-inclusive pricing is enabled:

- If tax-inclusive pricing is enabled: Sales Tax = (Discounted Product Price × Sales Tax Rate) / (1 + Sales Tax Rate)

- If tax-inclusive pricing is NOT enabled: Sales Tax = Sales Tax Rate × (Discounted Product Price + Duty Fee)

-

Example: If a product price is $100, the duty fee is $10, and the sales tax rate is 5%:

- Tax-inclusive pricing: Sales Tax = (100 × 5%) / (1 + 5%) = $4.76

- Tax-exclusive pricing: Sales Tax = 5% × (100 + 10) = $5.50

4. Duties applied at the country level: Duty rates are set per country, not per region or province. If you sell in multiple markets, ensure duty settings are reviewed and adjusted for each country individually.

5. Displaying duty information to customers: When you enable the Display duty descriptions setting, you can add a short note to explain the duty charge. This improves communication and helps customers feel more confident about placing their order.

Advantages of collecting duties at checkout

Collecting duties at checkout creates a smoother shopping experience and helps you avoid delivery issues caused by unpaid customs fees. It also supports a more consistent international pricing strategy, making it easier to scale your business globally while minimizing surprises for your buyers.

Comments

Please sign in to leave a comment.