Using Shoplazza Payments can sometimes lead to questions about setting it up, managing payouts, or troubleshooting issues. This guide offers clear and detailed answers to help you navigate these common topics and optimize your store’s payment operations.

Setting up Shoplazza payments

Q1: How can I enable Shoplazza payments for my store?

Currently, Shoplazza Payments is not available to all merchants. To apply, you’ll need to provide your store ID to our support team. They will then initiate the application process for you. Please note that only merchants based in Hong Kong, the U.S., Canada, the U.K., and France are eligible to apply at this time.

Q2: What is Shoplazza Fraud Guard, and how do I activate it?

Shoplazza Fraud Guard is a fraud prevention tool specifically designed for card payments and is available exclusively on the Shoplazza platform. To use Fraud Guard, you must first enable Shoplazza Payments. This tool uses adaptive machine learning to evaluate the risk level of each payment request in real time, helping you avoid fraudulent transactions and focus on growing your business.

Currently, Shoplazza Fraud Guard supports two features:

- Blacklist function: Automatically blocks transactions from blacklisted customers.

- Custom amount rules for 3DS verification: Allows you to set rules that trigger 3DS authentication for transactions above a certain amount, providing an additional layer of security.

To enable Shoplazza Fraud Guard:

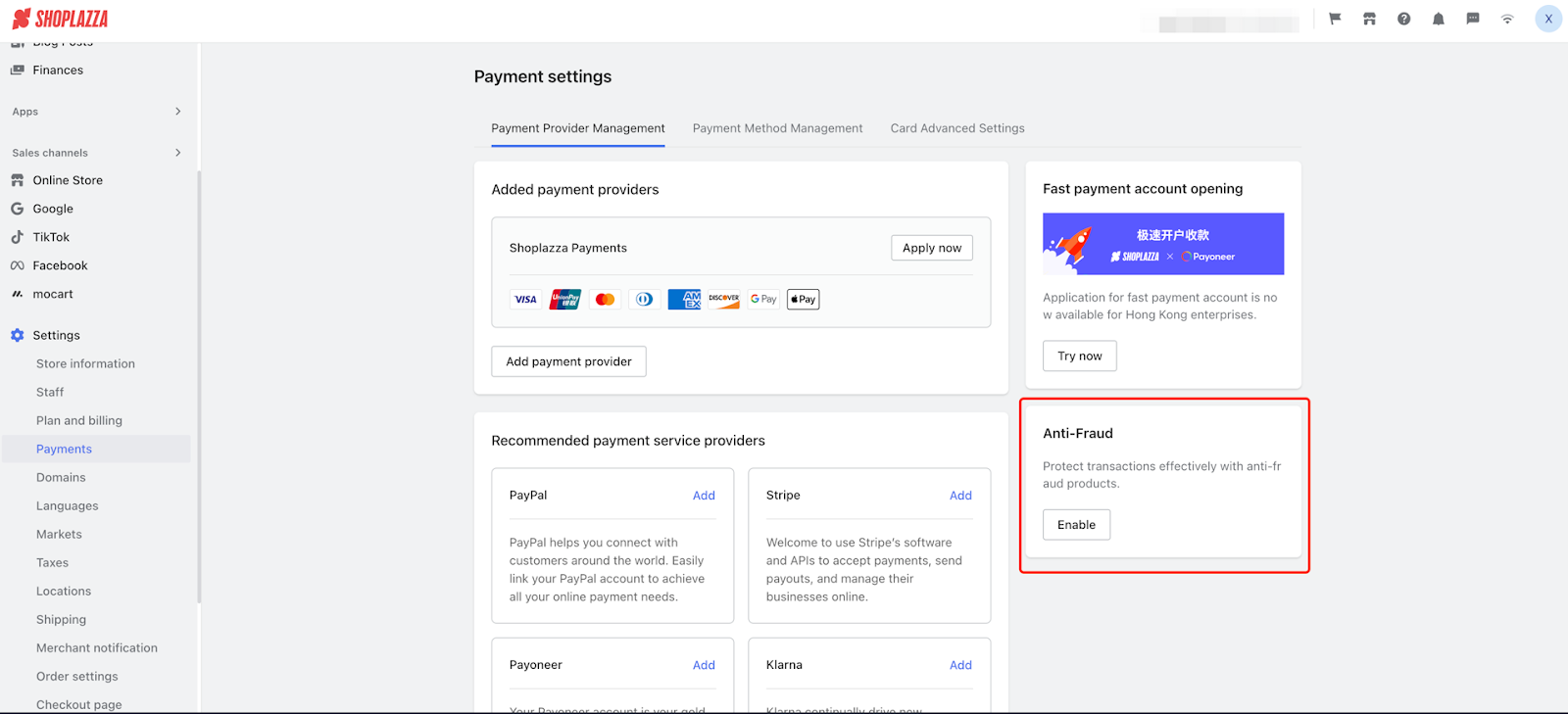

1. Access the settings: Go to Shoplazza admin > Settings > Payments, and look for the Anti-Fraud banner on the right. Click Enable.

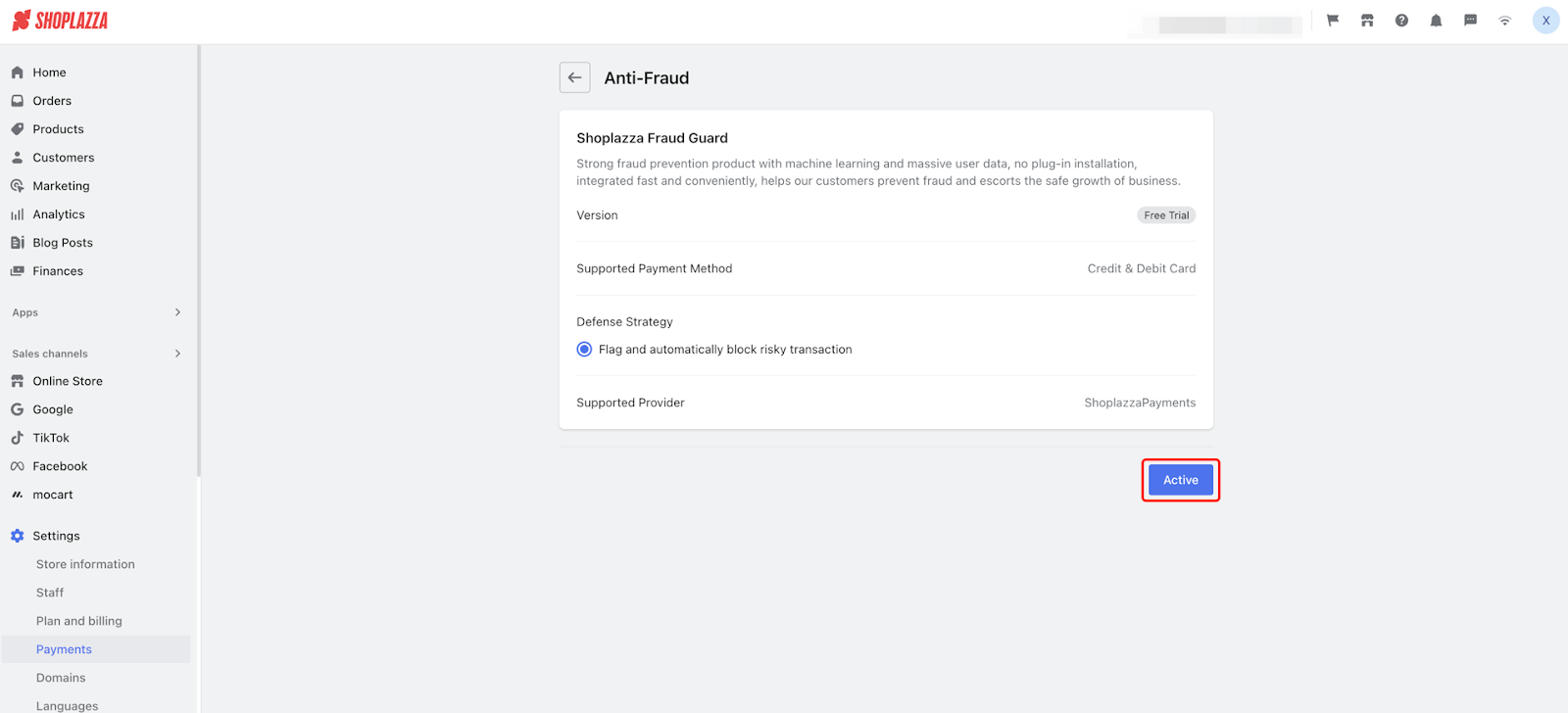

2. Set the defense strategy: Click on Flag and automatically block risky transaction under the Defense Strategy section, then click Activate. Shoplazza Fraud Guard will start protecting your transactions immediately.

Q3: What is 3D Secure (3DS), and how do I set it up?

3D Secure (3DS) adds an additional layer of authentication for credit card payments, helping to verify the cardholder’s identity and prevent fraud. If you want to enable 3DS for specific transaction amounts, you must first activate Shoplazza Fraud Guard.

Note

For stores with high-value items, enabling 3DS is recommended as it reduces the risk of fraud. However, for lower-value items, enabling 3DS might impact conversion rates, as it adds an extra step to the checkout process.

To enable 3DS:

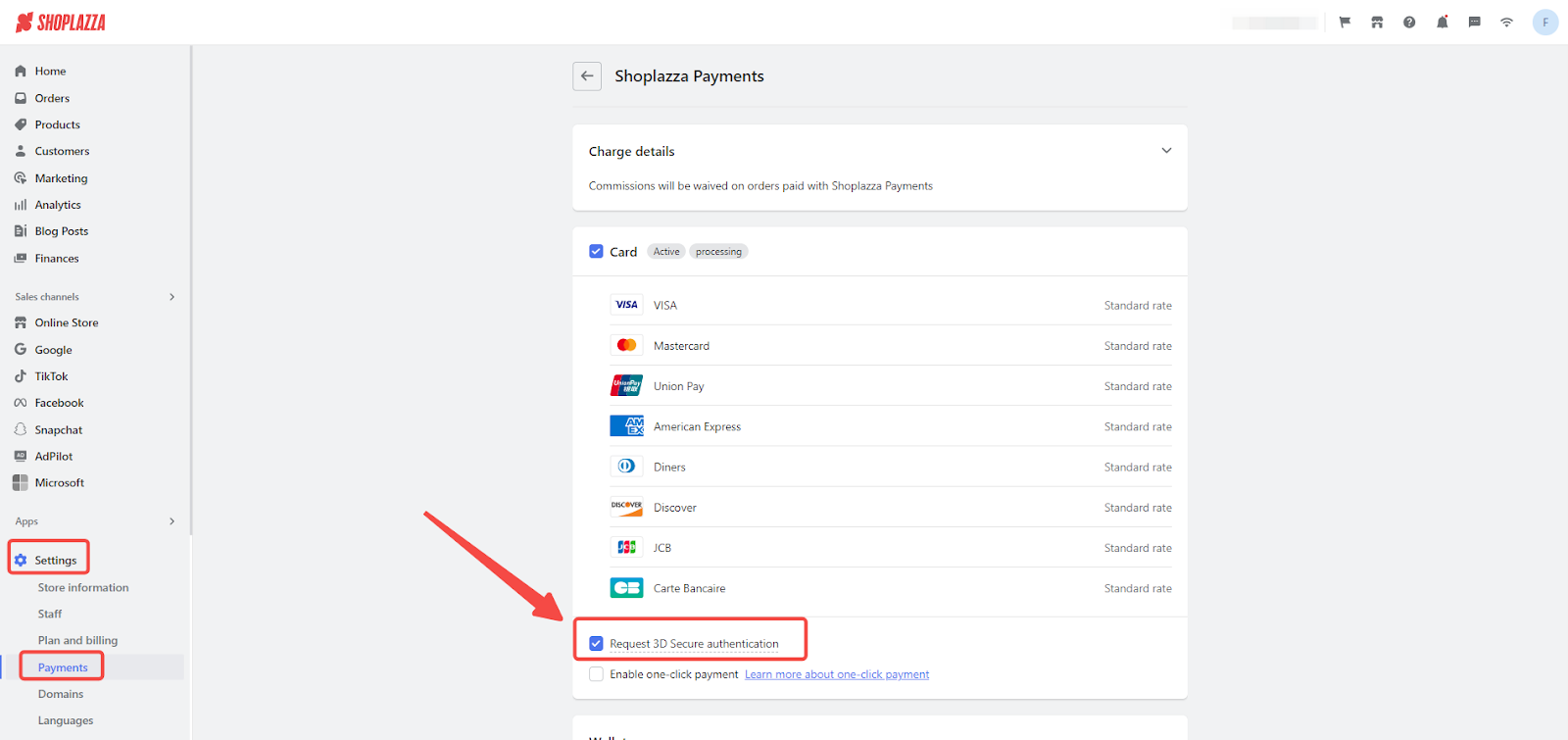

- Navigate to the configuration page: Go to the Shoplazza Payments configuration page, under the Card section. Check the box labeled Request 3D Secure authentication.

Q4: What are RDR & Ethoca, and how can I activate them?

- RDR (Rapid Dispute Resolution): This service, provided by Visa and Verifi, automatically handles disputes for eligible Visa transactions. When enabled, RDR intercepts disputes that meet your preset criteria, such as transaction amounts, and resolves them without affecting your dispute rate. For example, if you set a threshold of $100, disputes under this amount will be handled automatically by RDR, while disputes over $100 can still be managed manually. This feature is currently supported only for Shoplazza Payments and can be enabled through the Shoplazza admin.

- Ethoca: Ethoca provides early alerts for disputes initiated by cardholders, primarily for Mastercard and some other card brands. When Ethoca is enabled, you will receive immediate notifications if a customer contacts their bank to dispute a transaction. If the issuing bank is part of the Ethoca network, you can quickly resolve the dispute by refunding the transaction within 24 hours of receiving the alert. This prevents disputes from progressing further and helps you manage disputes more effectively. Ethoca is also available only for Shoplazza Payments and can be activated through the Shoplazza admin.

Payout issues

Q1: How long do I have to wait before I can request a payout if my account is restricted?

If your account has been restricted, Shoplazza will automatically release any remaining funds to your linked bank account 180 days after the restriction date. This payout will include your remaining balance, minus any dispute fees, if applicable.

Q2: How do I request a payout, and where will the funds be sent?

Shoplazza payments supports two types of payouts:

1. Manual payout: Request a payout manually through your Shoplazza admin.

2. Scheduled payout: Payouts can be set up based on a predetermined schedule (daily, weekly, or monthly), depending on your risk management profile.

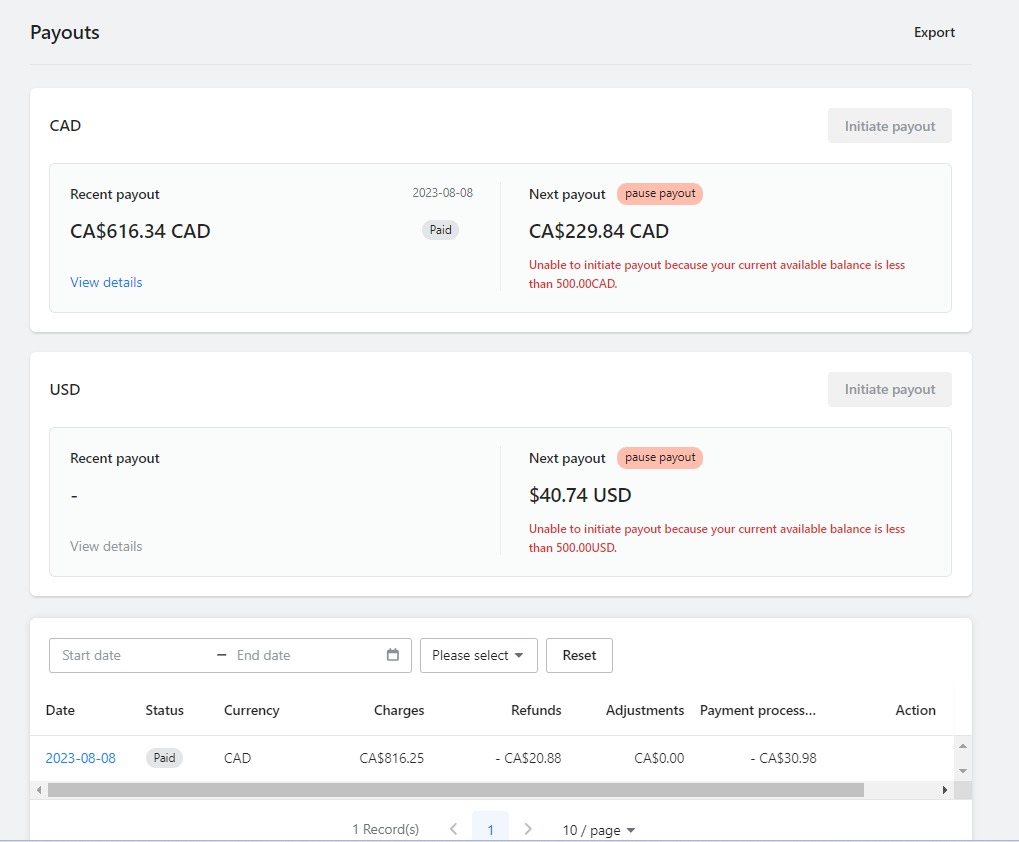

Funds are transferred to your linked bank account, and the minimum payout amount is $500 USD. Once the funds are sent, it may take 24 to 72 hours for them to appear in your bank account, depending on your bank’s processing time.

Q3: Why haven’t I received my payout on the expected date?

If your payout is delayed, there are typically two possible scenarios to consider:

1. Payout status shows as Failed

- Merchant account issue: Your account may be restricted, which pauses all payments and payouts. In this case, you need to contact support to verify your account status and resolve any restrictions.

- Receiving bank issue: There may be an issue with your bank account, such as incorrect bank details or specific bank restrictions. Contact your bank to resolve the issue and ensure that your account is able to receive funds.

2. Payout status shows as Successful

- If the status shows as successful but you still haven’t received the funds, it may take additional time for the bank to process the transfer. Typically, this can take an extra 1-2 business days for the funds to appear in your bank account, depending on your bank’s processing time.

Q: What is the withdrawal schedule and rules?

A: Withdrawals are typically processed on a T+3 basis (funds arrive within 3 business days after a successful transaction). There is a minimum withdrawal amount (e.g., USD 500). If your account balance is below this threshold, automatic withdrawals will not be processed, and a manual withdrawal request will be required.

Q: Are there any fees for manual withdrawals?

A: Yes. When the account balance is below USD 500, a small fee (e.g., USD 5) will be charged for manual withdrawals. The exact amount will depend on the actual transaction.

Q: My store has expired or is no longer in use. How can I withdraw the remaining balance?

A: You can request a withdrawal if the following conditions are met:

- The account is confirmed to be no longer in use;

- The last payment received was more than 180 days ago.

Once these conditions are satisfied, please contact the support team to request a manual withdrawal.

Q: What should I do if I see “Withdrawal failed due to risk control rules” when trying to withdraw?

A: This message indicates that your account is currently under risk control review. Please wait patiently for the review results, and keep an eye on the Security Center notifications in your store backend as well as your registered store email. The risk control team will notify you through these channels if any additional information is required or once the review is complete.

Order issues

Q1: How can I find the refund ARN (Acquirer Reference Number)?

Currently, Shoplazza does not support self-service ARN lookups. If you need to check a refund ARN, contact customer support or your Business Development (BD) manager. Our technical team is working on adding this feature to the Shoplazza admin for easier access in the future.

Q2: Why did my order fail to process?

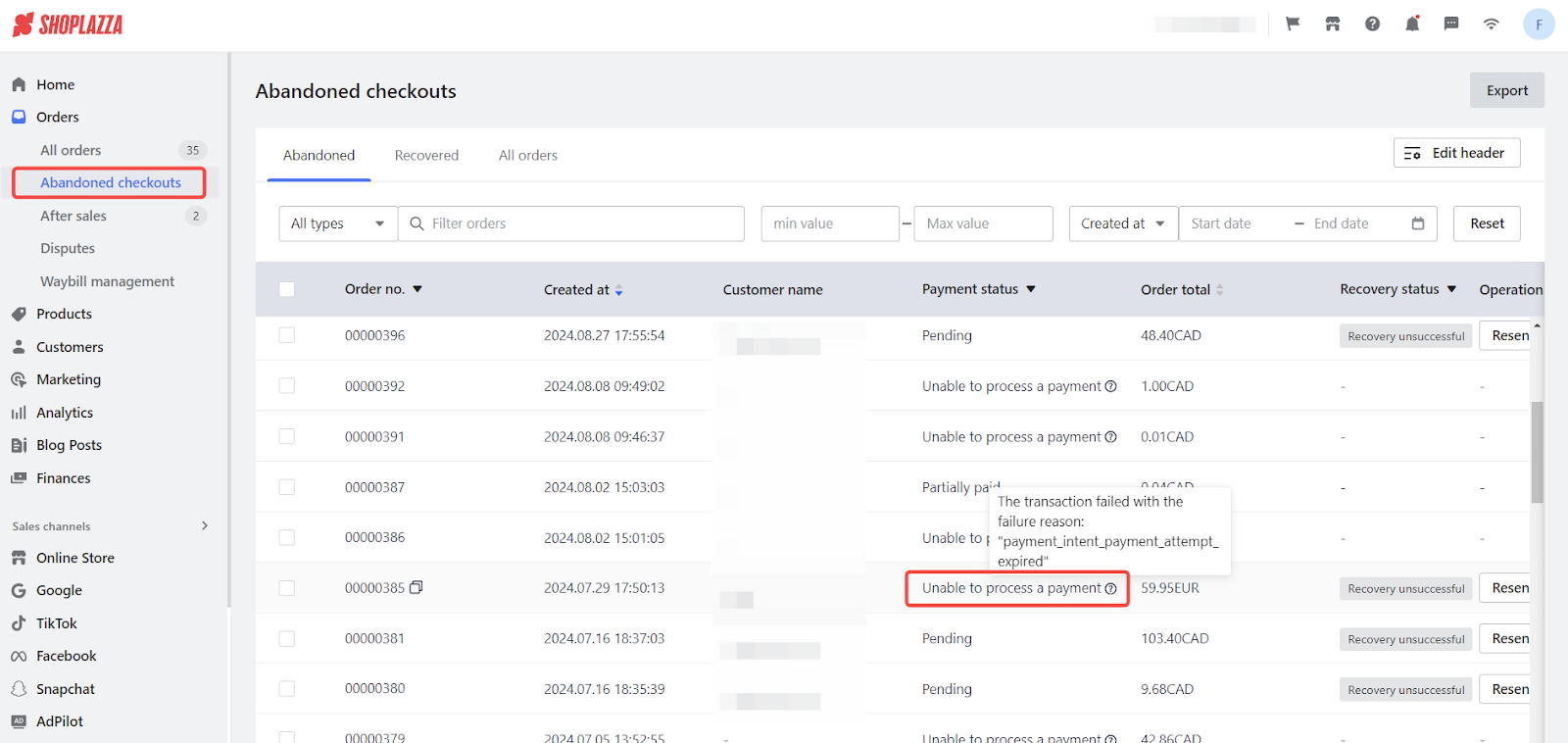

1. Check your order status: You can check the status of your order in Shoplazza admin > Orders > Abandoned checkouts. Orders are typically categorized as “Pending” or “Unable to process a payment”.

2. Use search filters: You can also use different search criteria in the admin panel to filter and find specific orders. After entering your search terms and clicking the search button, the page will display the corresponding orders. This will help you identify which orders have issues and take the necessary actions.

Here are some common reasons for payment failure:

| Error message (error_msg) | Description |

| authentication_required | Requires identity verification, such as confirming credit card information. |

| cancelled | The payment was canceled, either by the user or due to other reasons. |

| card_declined | The credit card was declined, possibly due to insufficient funds or bank rejection. |

| charge_closed | The payment request has been closed and can no longer be processed. |

| declined | The payment was declined due to issues with the bank or payment channel. |

| expired_card | The credit card has expired and cannot be used for transactions. |

| forter decline | The transaction was declined based on fraud risk assessment (e.g., by services like Forter). |

| incorrect_cvc | The provided CVC code is incorrect. |

| internal_server_err | Internal server error, making the payment service temporarily unavailable. |

| invalid_params | The provided payment parameters are invalid or incorrectly formatted. |

| pay_request_timeout | The payment request timed out and was not completed within the specified time. |

| payment_intent_authentication_failure | The authentication for the payment intent failed, possibly due to incomplete verification steps. |

| payment_internal_service_error | Internal service error within the payment platform, often related to backend issues. |

| payment_params_invalid | The payment parameters are invalid, possibly due to missing or incorrect fields. |

| processing_error | An error occurred during payment processing, usually due to system or channel issues. |

| refer_to_channel | Further action is required by the payment channel to resolve the issue. |

Payment method issues

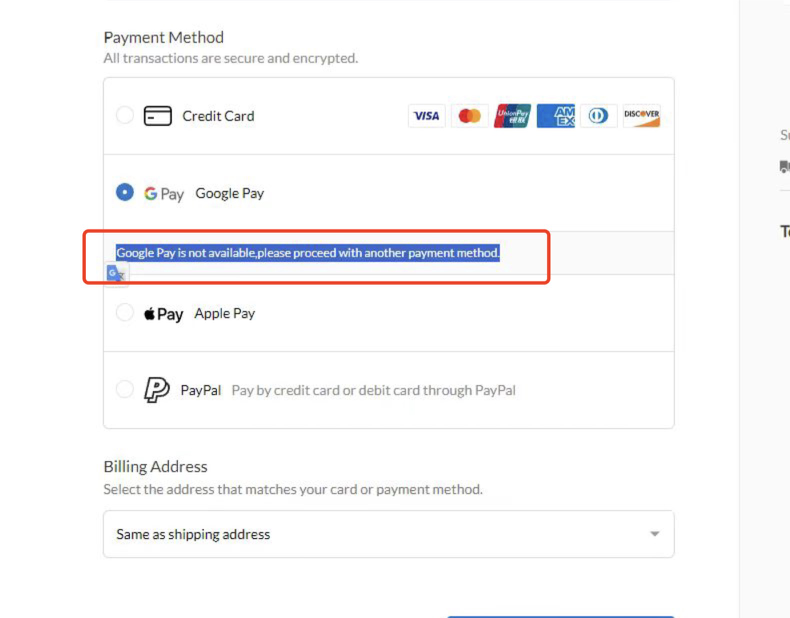

Q1: Why can’t I see Google Pay or Apple Pay as options?

Google Pay and Apple Pay will only appear during checkout if certain conditions are met, such as browser compatibility, availability of payment information, and whether the customer’s device supports these payment methods. If they’re visible but not available, it’s likely due to these conditions not being met.

Safety management issues

[Application Entry Issue]

Q: What should I do if I can’t find the application entry or the submission fails?

A: You can find the Shoplazza Payments application entry by going to Settings > Payments > Payment Provider Management in your Shoplazza account. Click Apply Now to start filling out the application form.

If you’re unable to access the application entry, it may be because a previous application was closed due to missing documents not being submitted in time. In this case, please contact our customer support team for further assistance.

Q: What should I enter for the Company Address? Can I use a shared address from a registration agency?

A: You must enter the official registered address as listed on your company registration certificate. Please note that public or shared addresses provided by company registration agents are not accepted.

Q: Is the SSN/ITIN (U.S. Tax ID) required?

A: Yes, if the applicant is a U.S.-based company, an SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number) is required.

If you are applying as a business entity, you may use your EIN (Employer Identification Number) in place of the ITIN.

Please ensure all tax information is accurate — incorrect or missing information may delay the review process.

Q: Are there any domain requirements for applying for Shoplazza Payments?

A: Yes. Your store must be connected to a primary domain that you purchased independently, and it must be set as the default domain.

For guidance on domain setup, please refer to the following links:

Q: Are there any website requirements for applying for Shoplazza Payments?

A: Please make sure your store is fully built and has products listed.

Your website must include the following policies: Refund Policy, Return/Cancellation Policy, Shipping Policy, Privacy Policy, and Terms of Service.

The company name, address, and other details shown in these policies must match exactly with the information used in your Shoplazza Payments application.

If you need assistance with website setup, please contact our customer support team.

Q: What are the company status requirements for application?

A: The applicant company must be in active operating status (e.g., “Active”).

Companies with statuses such as “Delinquent” or “Dissolved” are not eligible to apply.

Q: What situations may lead to application rejection?

A: Our risk control team evaluates the stability and compliance of each store.

Applications may be rejected if the store is involved in high-risk operations, prohibited product categories, or if the store has been recently established and cannot provide trading history from other platforms.

Q: Can I use a personal bank account for withdrawals?

A: Sole proprietorships and LLCs wholly owned by an individual may use personal bank accounts for withdrawals.

All other types of companies must provide a corporate bank account.

[Review Process and Timeline]

Q: How long does the review take after submitting my application?

A: The risk control team typically completes the review within 4 business days after receiving all required documents.

During peak periods or public holidays, the review time may be longer — thank you for your patience.

If additional or corrected documents are required, you will receive a notification via in-store message or email, with a link to resubmit materials through the “Supplement Documents” form.

Q: How can I check my application status? Why haven’t I received any updates?

A: The review results will be sent to you via email and your store admin panel.

If you haven’t received any notifications, possible reasons include:

1. The application was not successfully submitted;

2. The system marked the notification email as spam (please check your spam/junk folder);

The application is still under review.

3. If you’re unsure about your application status, please contact our customer support team for assistance.

Q: What if I entered incorrect information or need to change the application entity?

A: If the review has not yet started, you may contact customer support to reopen (“return”) the application form for editing.

Once reopened, you can correct the information and resubmit it.

Please note that no changes can be made once the application enters the review process.

Q: What should I do if I haven’t received the review result or explanation?

A: All review outcomes and explanations are sent to the email address registered as the store owner’s contact.

Please ensure that your registered email is correct and check both your inbox and spam folders.

If you still haven’t received any communication, contact our support team for further assistance.

[Account Function Restrictions & Reinstatement]

Q: Why has my Shoplazza Payments receiving or withdrawal function been disabled?

A: Please note that the risk control team periodically reviews Shoplazza Payments accounts. Common reasons for account restrictions include:

- Abnormal store status: Store expired or not renewed;

- Poor operational performance: Low order fulfillment or delivery success rates;

- High transaction risk: Excessive disputes or frequent refunds;

- Documentation issues: Expired company documents or personal information, or failure to submit required materials;

- Channel-level risk control: The underlying payment channel may have disabled the account for compliance or risk reasons.

Q: How can I appeal or reinstate my account if the withdrawal function is disabled?

A: First, check your in-store message center and the store owner’s registered email for the specific restriction notice.

Then, submit the required appeal materials through the Security Center based on the reasons provided. To speed up the process, prepare clear and targeted supporting documents.

Q: I received a Shoplazza Payments alert ticket in the Security Center. How should I respond?

A: Please review the alert carefully and identify the specific issue (e.g., high dispute rate, delayed shipments).

Prepare a targeted response with supporting documentation and submit it via the Security Center. The risk control team will follow up within 2–3 business days after receiving your submission.

Q: If my store requires corrections, how long after completing them will normal payments resume?

A: Once you complete the required corrections as outlined in the notification email, the risk control team will review the changes within 2–3 business days and notify you of the results.

Q: Why does Shoplazza require me to correct my store when other SaaS platforms allow selling similar products?

A: Each SaaS platform has different policies and risk tolerance. Receiving a correction notice may indicate a violation of the Shoplazza Payments user agreement.

Please review the relevant terms for your region to ensure smooth operations:

- Shoplazza Payments (CA) Terms and Conditions

- Shoplazza Payments (HK) Terms and Conditions

- Shoplazza Payments (USA) Terms and Conditions

Q: Why is my account still restricted even after completing the corrections?

A: After store corrections, the risk control team must perform a final review to ensure all content complies with standards.

During this period, your account functions will remain temporarily limited. Reviews are usually completed within 2–3 business days.

If you have further questions, you may reply directly to the original email — the Shoplazza risk control team will assist you promptly.

Comments

Please sign in to leave a comment.