Smart Dispute Resolution (SDR) is a tool designed to help you manage payment disputes effectively. High dispute rates can lead to revenue loss and potential issues such as warnings or penalties from payment channels or card issuers. SDR integrates Verifi Rapid Dispute Resolution (RDR) and Ethoca Alerts to assist you in controlling dispute rates, maintaining stable acquiring channels, keeping customers satisfied, and protecting your brand reputation. Verifi RDR handles Visa disputes, while Ethoca Alerts addresses disputes involving Mastercard and other major card networks. These tools help you streamline dispute management, saving time and resources while improving customer experience.

Note

Currently, this feature supports only Shoplazza Payments. Integration with other third-party payment channels is underway. Stay tuned!

Controlling dispute rates

Effectively managing your dispute rates is essential to avoiding potential penalties and maintaining smooth operations. Here are some key actions you can take using the SDR feature.

1. Manage dispute rates and reduce penalty risks: Enabling the SDR feature helps you effectively control dispute rates, avoiding potential fines from card issuers.

2. Automate processing to save time and resources: After setting the rules, disputes or alerts can be handled automatically. This reduces resource waste in collecting disputes and communicating defenses, allowing you to focus on more valuable business modules.

3. Improve customer experience: Typically, resolving disputes takes at least a month, often leading to significant customer dissatisfaction. SDR can resolve disputes within a week, improving customer experience and helping you maintain better customer relationships.

4. Activate with one-click without integration: The product is already integrated with Shoplazza Payments. You can activate and configure rules with one click in the backend without needing to allocate resources for installation and integration.

Verifi RDR

Overview of Verifi RDR

Verifi Rapid Dispute Resolution (RDR) is a Visa-endorsed solution designed to streamline the handling of disputes. This tool allows you to automate the dispute resolution process by setting custom rules that automatically trigger actions like refunds when disputes arise. Verifi RDR helps you efficiently manage disputes without the need for manual intervention, saving time and resources while enhancing customer satisfaction.

How Verifi RDR Works

Verifi RDR operates by following predefined rules that you set up based on your business’s needs. Here’s how it works:

1. Automatic dispute handling: When a customer disputes a transaction, Verifi RDR checks the dispute against the rules you’ve established. For example, if the disputed amount is below a certain threshold, the system can automatically issue a refund without requiring any manual review.

2. Efficient resolution process: By automating the handling of common disputes, Verifi RDR ensures that these issues are resolved quickly and efficiently. This reduces the time and effort you need to dedicate to managing disputes and helps maintain a lower dispute rate.

3. Proactive dispute management: Verifi RDR helps you manage disputes effectively after they occur. When disputes match the rules you've set up in RDR, they are processed accordingly and automatically resolved. Importantly, disputes handled by Verifi RDR are excluded from programs like the Visa Dispute Monitoring Program (VDMP), which monitors merchants' dispute rates. This helps prevent these disputes from negatively impacting your standing with payment processors.

These capabilities allow Verifi RDR to act as a powerful tool in your dispute management strategy, helping to maintain positive relationships with both your customers and payment processors.

Ethoca Alerts

Overview of Ethoca Alerts

Ethoca alerts are provided by Ethoca, a company owned by Mastercard, that gives you the ability to resolve potential disputes before they escalate into chargebacks. This tool is especially useful in preventing disputes involving Mastercard and other major card networks by notifying you as soon as a customer contacts their bank about a transaction. Ethoca allows you to take proactive steps to address the customer’s concerns, often resolving the issue before it officially becomes a dispute. It’s important to note that, in general, you typically have 72 hours to take action before it officially becomes a dispute.

How Ethoca Alerts work

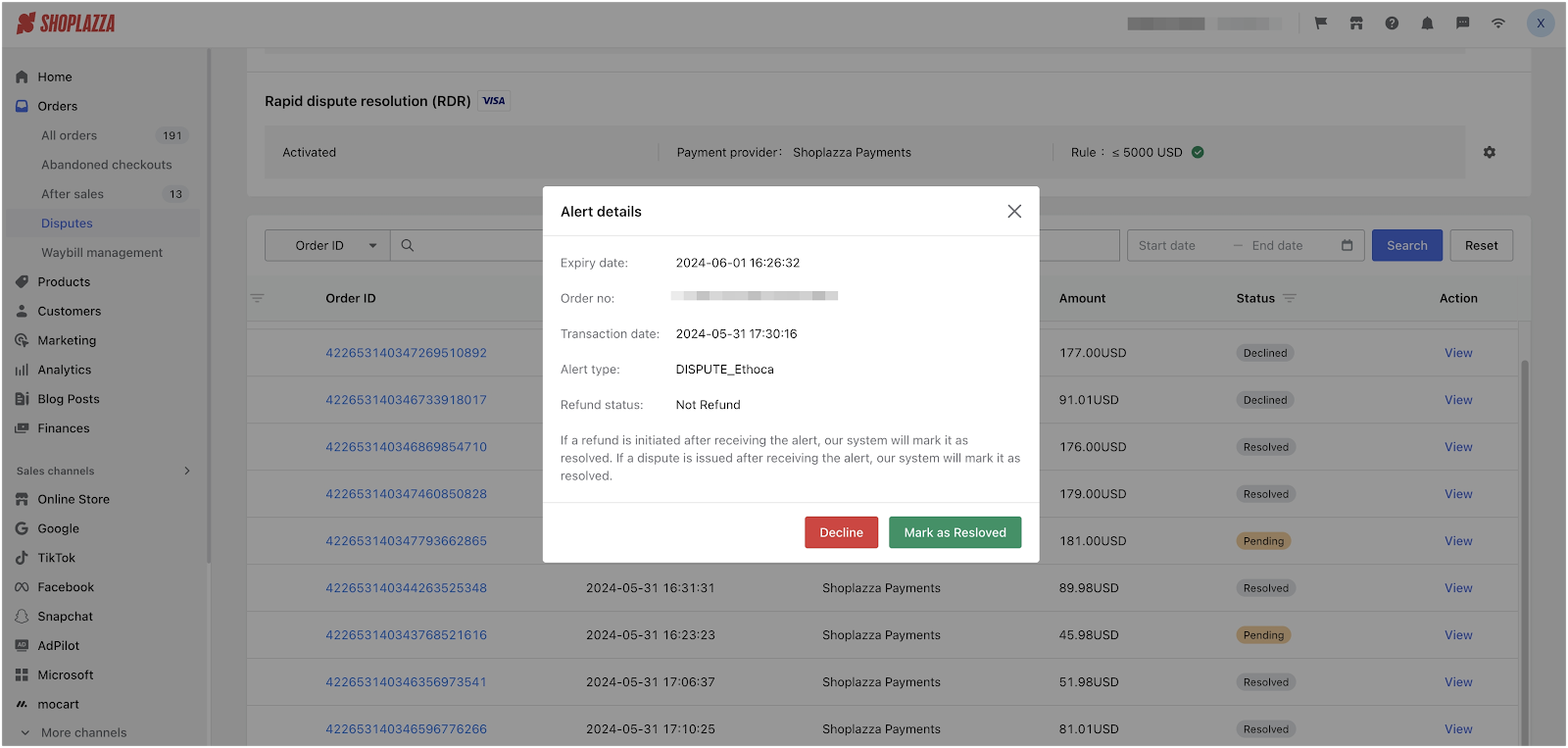

Ethoca Alerts operate by providing early notifications about potential disputes, allowing you to act quickly. Here’s how it works:

1. Pre-Dispute Notifications: When a customer contacts their bank to dispute a charge on their Mastercard (or another supported card), Ethoca sends you an alert before the dispute is officially filed. This early warning system gives you the opportunity to resolve the issue directly with the customer.

2. Proactive Resolution: Upon receiving an Ethoca alert, you can reach out to the customer to address the issue. This might involve clarifying the details of the transaction, providing additional information, or offering a refund. By resolving the issue quickly, you prevent it from escalating into a formal chargeback. Please note that issuing a direct refund to the customer, whether or not the goods are returned, is usually a more effective and recommended way to avoid disputes after receiving the alerts.

3. Enhanced Communication with Customers: Ethoca facilitates direct communication with customers at a critical point, allowing you to resolve their concerns promptly. This not only helps in preventing disputes but also strengthens customer relationships by demonstrating your commitment to resolving issues.

4. Cost Savings and Efficiency: By resolving disputes before they escalate into chargebacks, Ethoca helps you avoid the fees and resources typically associated with processing chargebacks. This proactive approach can save your business money and reduce the operational burden of managing disputes.

Ethoca Alerts serve as a valuable tool in your dispute management arsenal, helping to minimize the impact of disputes on your business while improving customer satisfaction.

Setting up RDR and Ethoca

Setting up RDR and Ethoca in your Shoplazza Admin is straightforward. Follow these steps to get started:

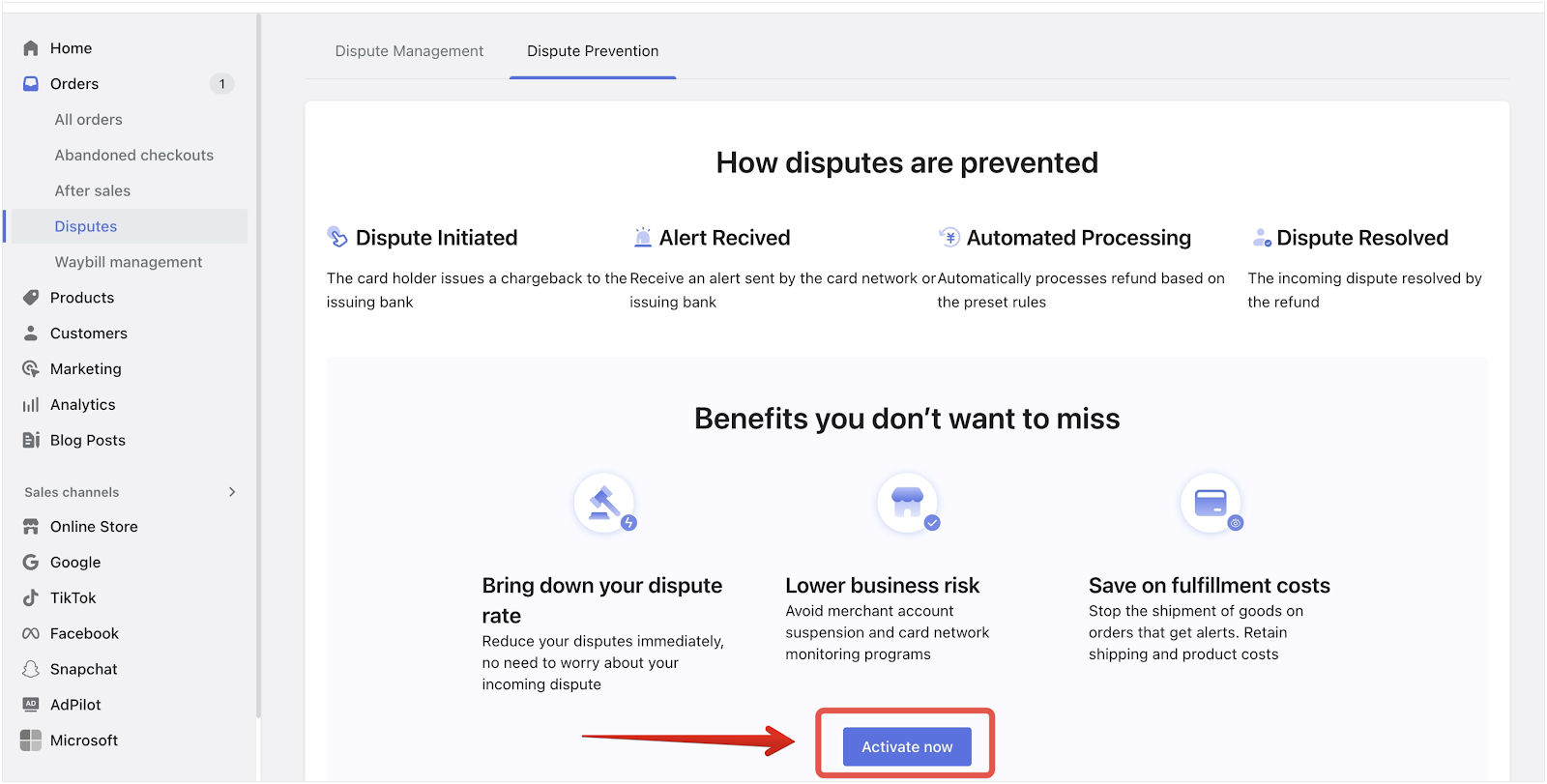

1. Log into your Shoplazza Admin: Login to your Shoplazza Admin and navigate to Orders > Disputes > Dispute Prevention and select Activate now.

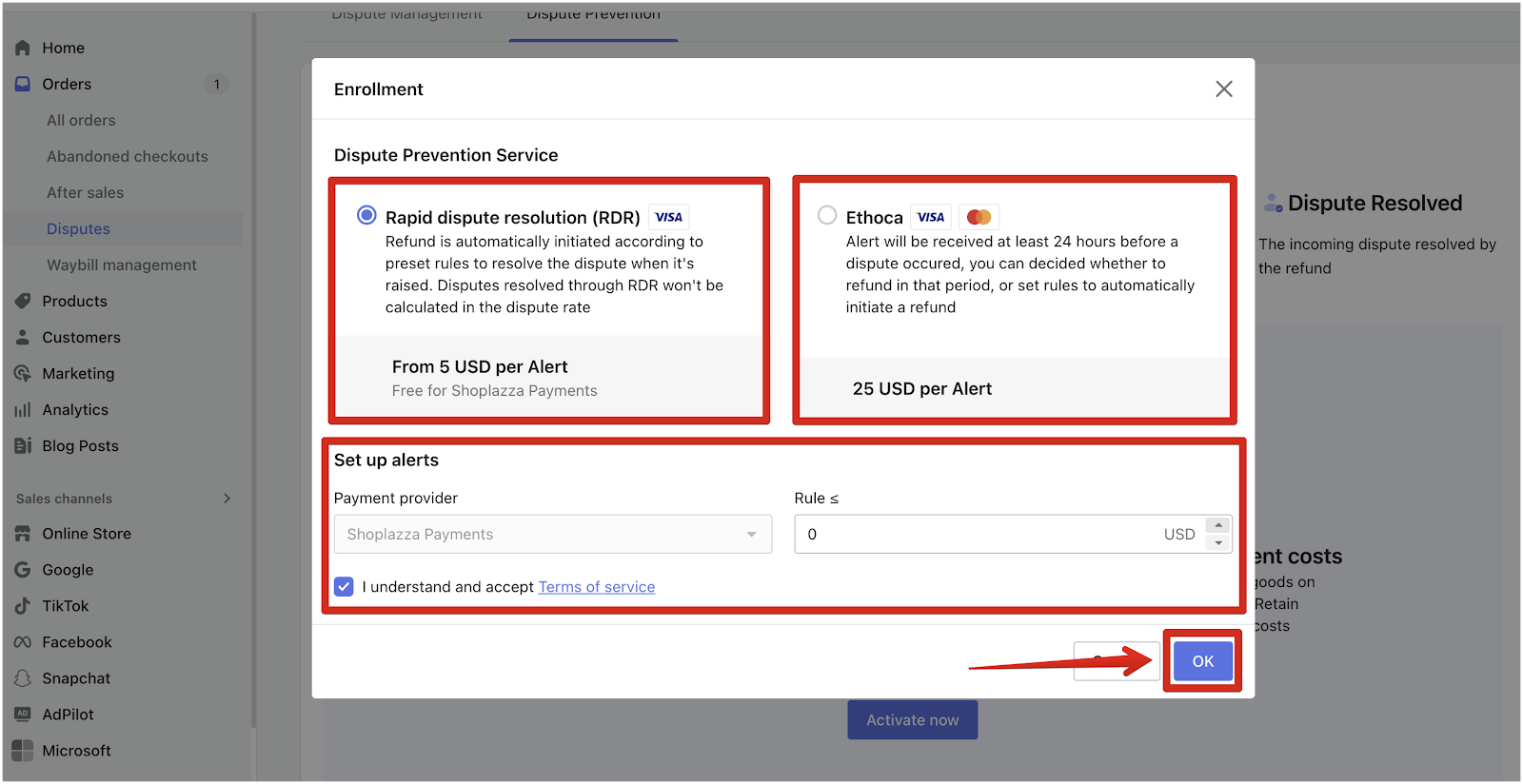

2. Select the service and set rules: In the popup window, select the service and set processing rules. Click OK to complete activation.

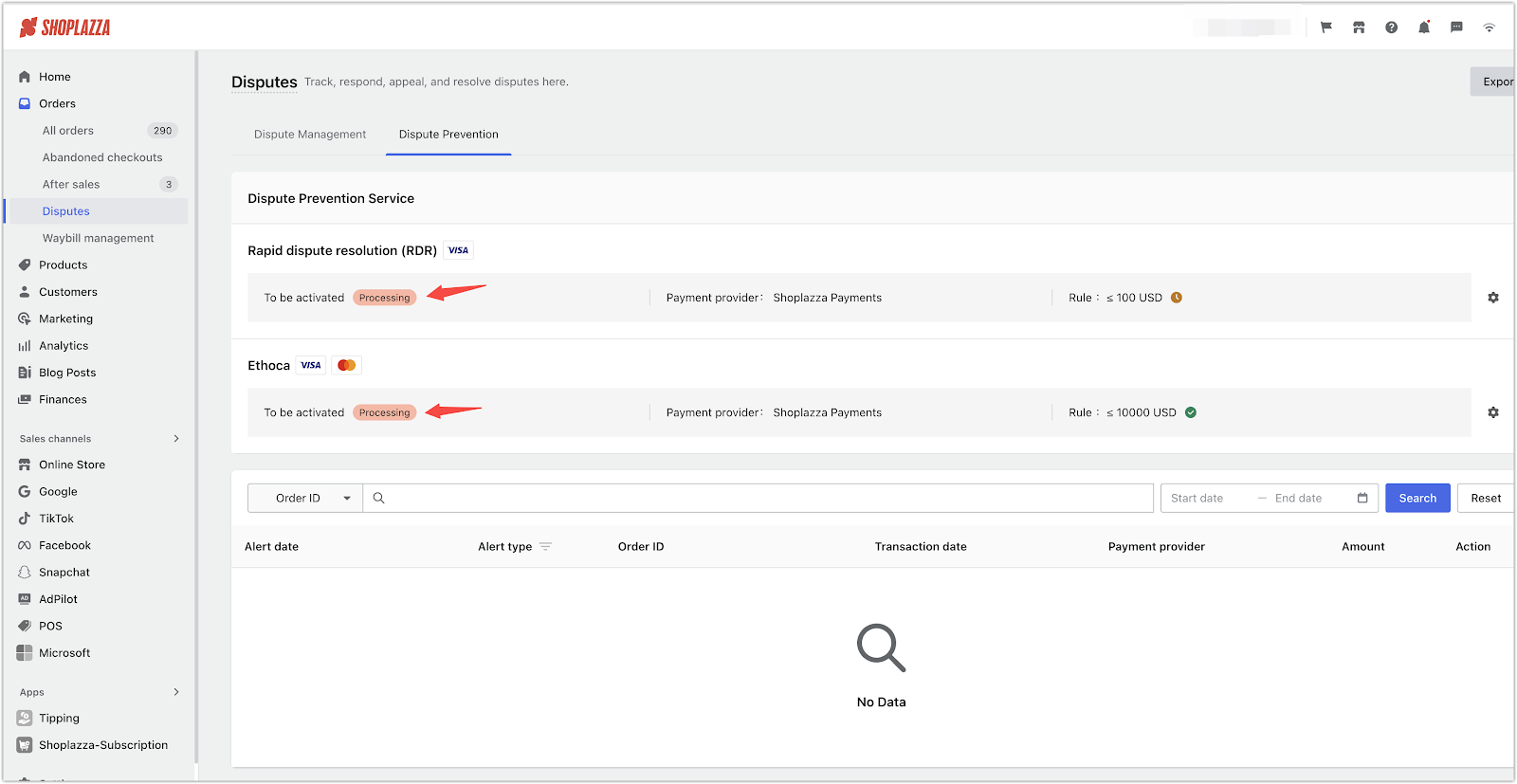

3. Status: The service status will show as pending activation. Typically, RDR service activation takes 3-4 weeks, while Ethoca takes 2 business days.

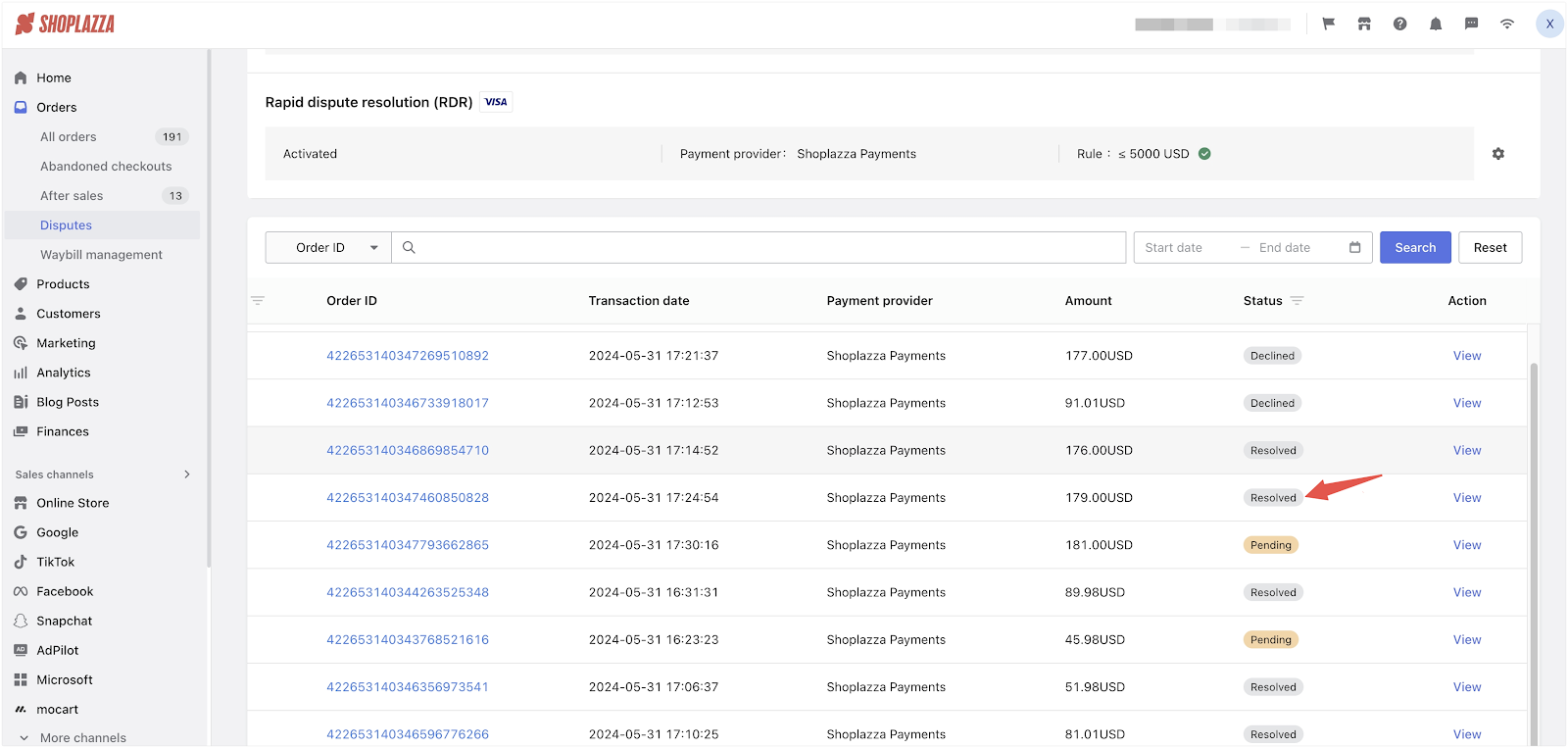

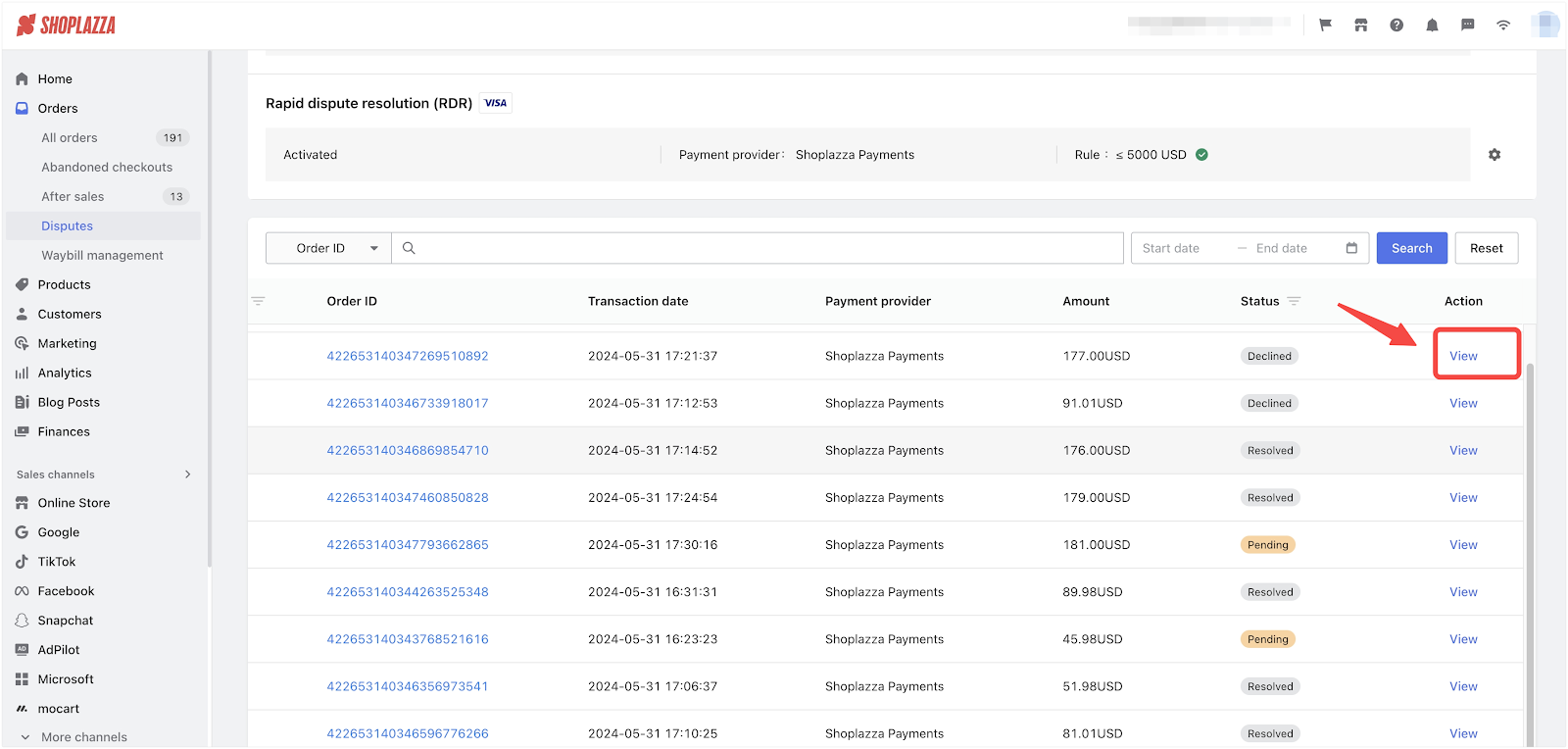

Understanding dispute notification statuses

Managing your dispute notifications is key to staying on top of potential issues. Here’s how you can keep track:

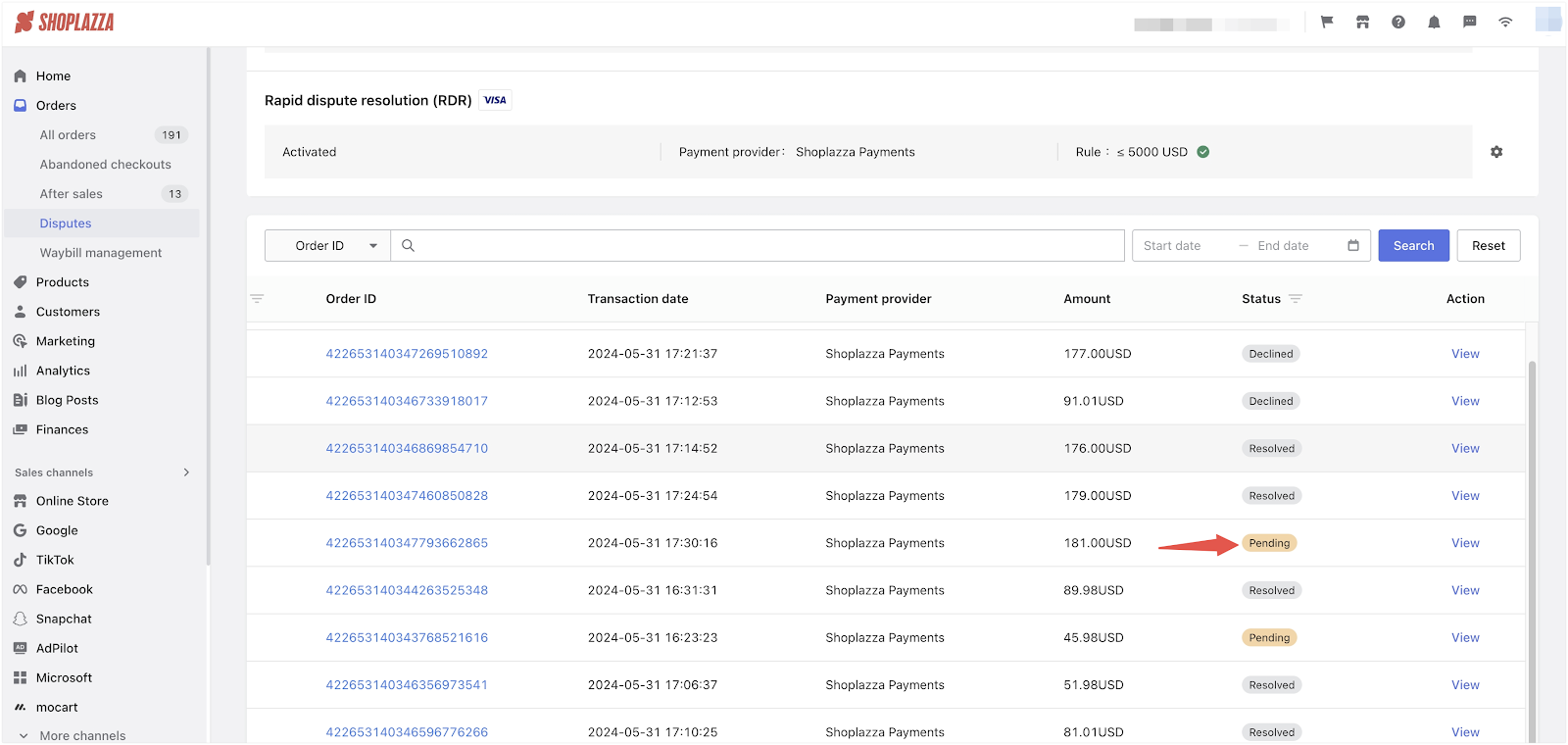

1. Pending status for new notifications: All new notifications are in pending status.

2. Resolution for auto-refund orders: Orders with auto-refund rules are marked as resolved.

3. View notification details: Click the action button to view notification details. Unresolved orders can be manually refunded to change the status to resolved.

Examples of Using SDR

Consider an online store that sells electronic gadgets. Over the past few months, there has been an increase in payment disputes from customers who either didn’t recognize the charge or had issues with their purchases. These disputes not only take up a significant amount of time to resolve but also strain customer service resources and potentially affect the relationship with payment processors.

Enabling the SDR feature automates and streamlines the dispute resolution process. Here’s how:

1. Verifi Rapid Dispute Resolution (RDR): A customer disputes a charge on their Visa card, claiming they did not make the purchase. With RDR, the dispute is automatically flagged, and if it meets predefined criteria (such as transactions under $100), the system can automatically issue a refund, resolving the dispute quickly. This reduces the time spent manually handling the dispute and improves the customer’s experience as they receive a quick resolution.

2. Ethoca Alerts: A customer with a Mastercard contacts their bank to dispute a charge, saying they never received the item. Before the dispute formally escalates, Ethoca alerts the merchant to the issue. The merchant can immediately reach out to the customer to clarify the situation or issue a refund if necessary, preventing the dispute from escalating and potentially avoiding additional fees or penalties.

Leveraging SDR significantly reduces the manual effort involved in dispute management, ensuring disputes are handled swiftly and efficiently. This proactive approach saves time and resources, enhances customer satisfaction, and helps maintain a positive relationship with payment processors.

Reviewing case studies

Real-world examples can help illustrate the benefits of SDR. Here are two case studies:

1. Case study of Merchant A: Merchant A had a 2.5% Visa dispute rate before enabling RDR, with over 100 disputes included in VDMP (Visa Dispute Monitoring Program). After enabling RDR, the dispute rate dropped to 1%, reducing the number of disputes to below 100 and meeting VDMP standards, avoiding penalties.

2. Case study of Merchant B: Merchant B had a 7.5% dispute rate before enabling Ethoca. After enabling it, the dispute rate was controlled at 4.5%.

Contacting support

For any questions regarding this feature, please email dispute_resolution_support@shoplazza.com.

Smart Dispute Resolution (SDR) tools enhance your ability to manage payment disputes efficiently. Leveraging Verifi RDR and Ethoca automates dispute processing, reduces resource waste, and improves customer satisfaction. Staying proactive in handling disputes protects your revenue and maintains your brand’s reputation and customer trust. Activate these features today to experience streamlined dispute management and a better overall business operation.

Comments

Please sign in to leave a comment.