When selling products around the world, figuring out the tax rules in different countries can be challenging. Here we provide you with easy access to manage the tax profiles in advance. The steps below will guide you in creating a Base tax profile, which can be used across most countries or regions. This profile will automatically apply to new products as well.

Note

Base tax profile is applicable to all products except for the product specially set in Tax override profile.

Steps

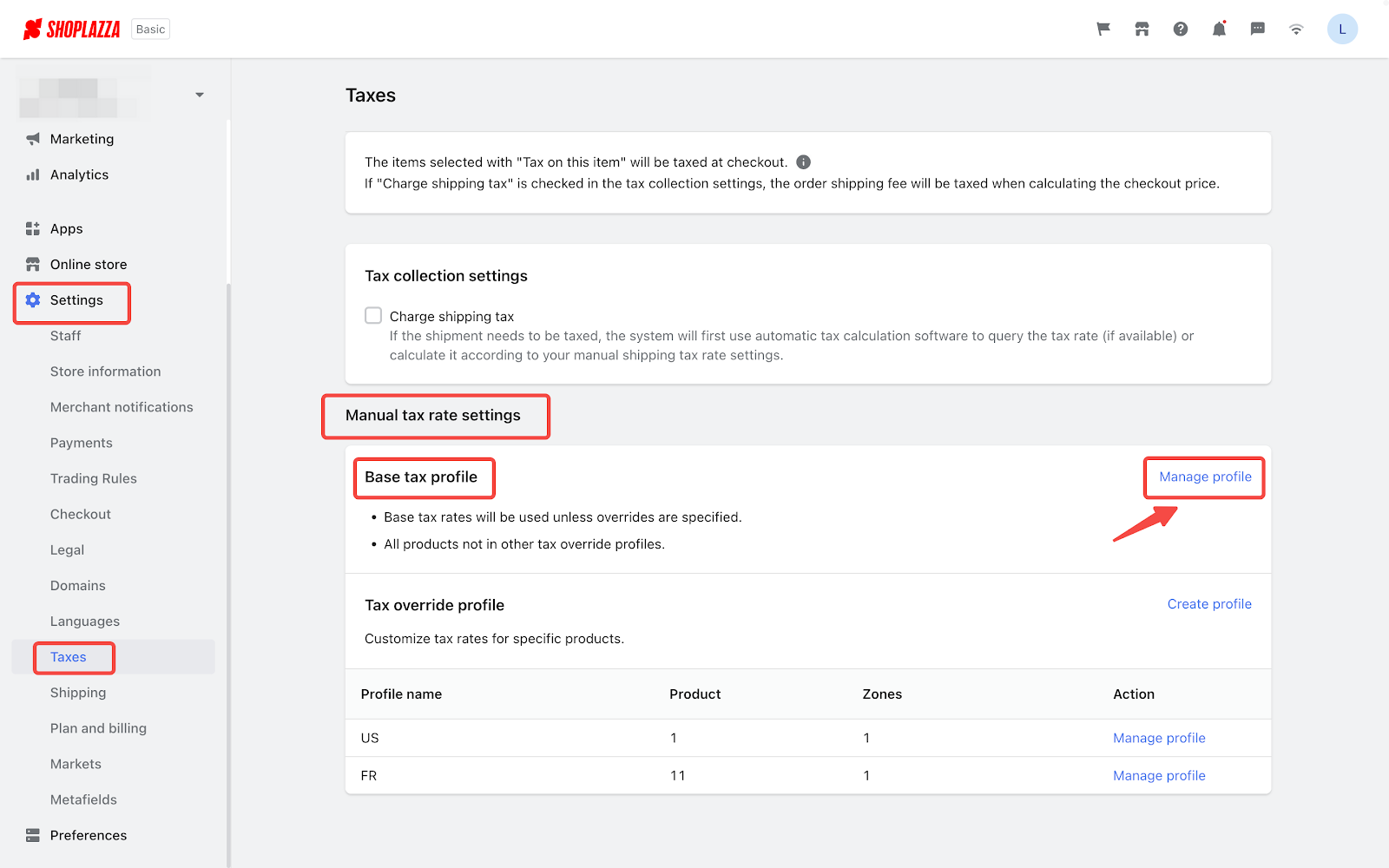

1. From your Shoplazza Admin, go to Settings > Taxes, look under the Manual tax rate settings, find the Base tax profile, and click on Manage profile.

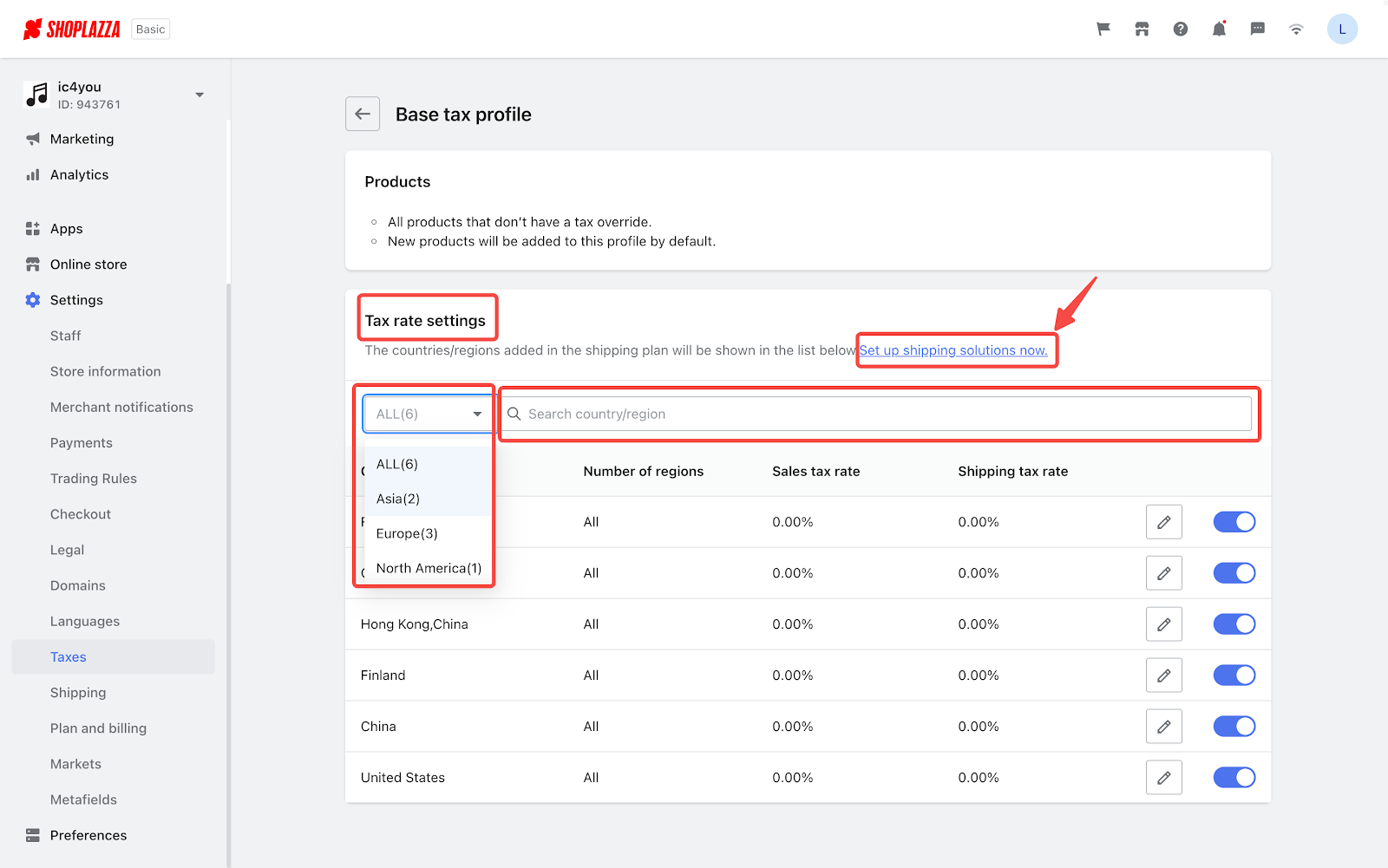

2. You can search for the target country or region in the search box on the right, and you can narrow the search by selecting the continent in the optional bar on the left. If you cannot find the target country or region in the Tax rate settings list below, just click Set up shipping solutions now to create a new shipping plan for the country or region under Shipping.

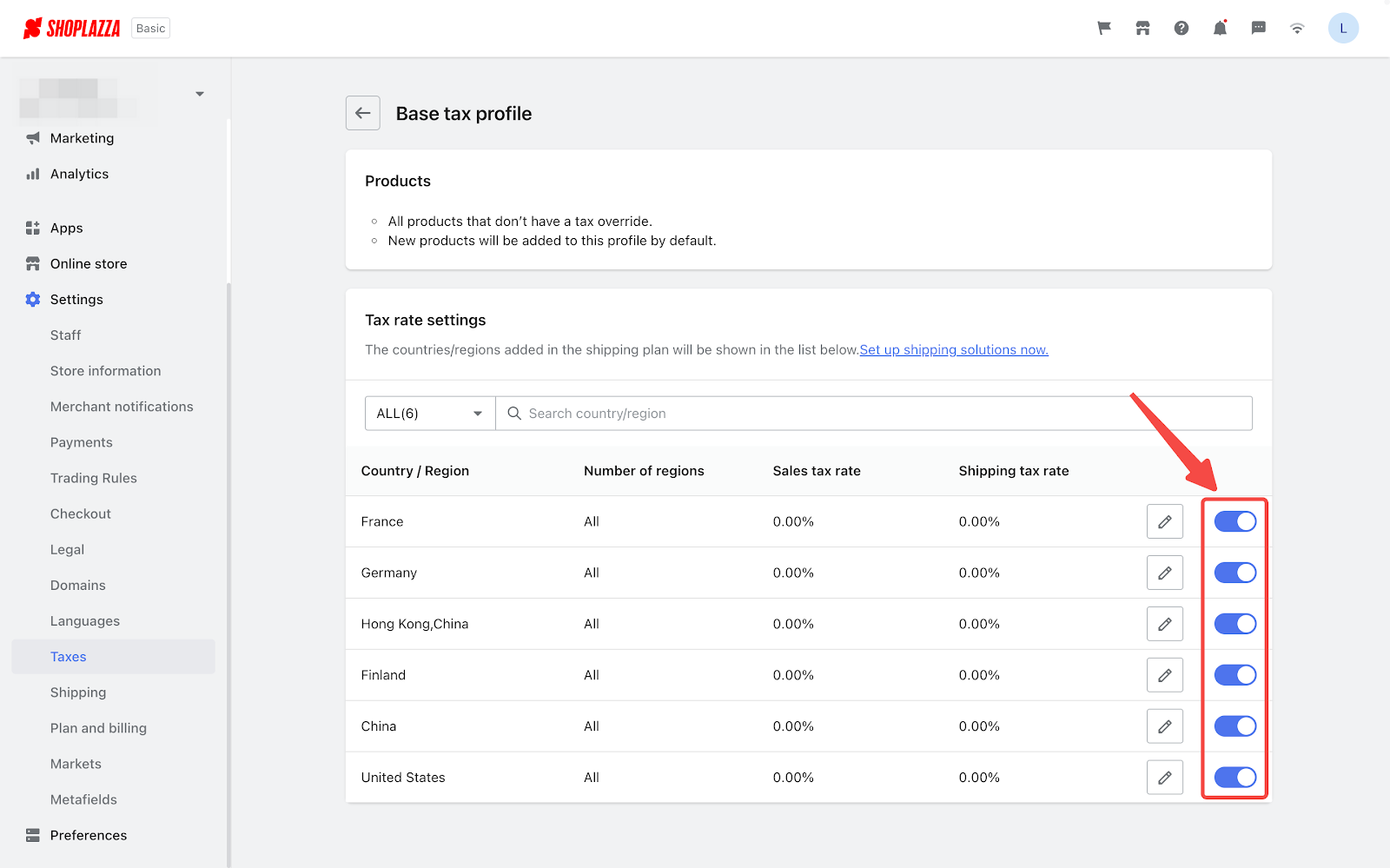

3. You can click the button here to enable or disable the Sales tax rate and Shipping tax rate of the certain country or region.

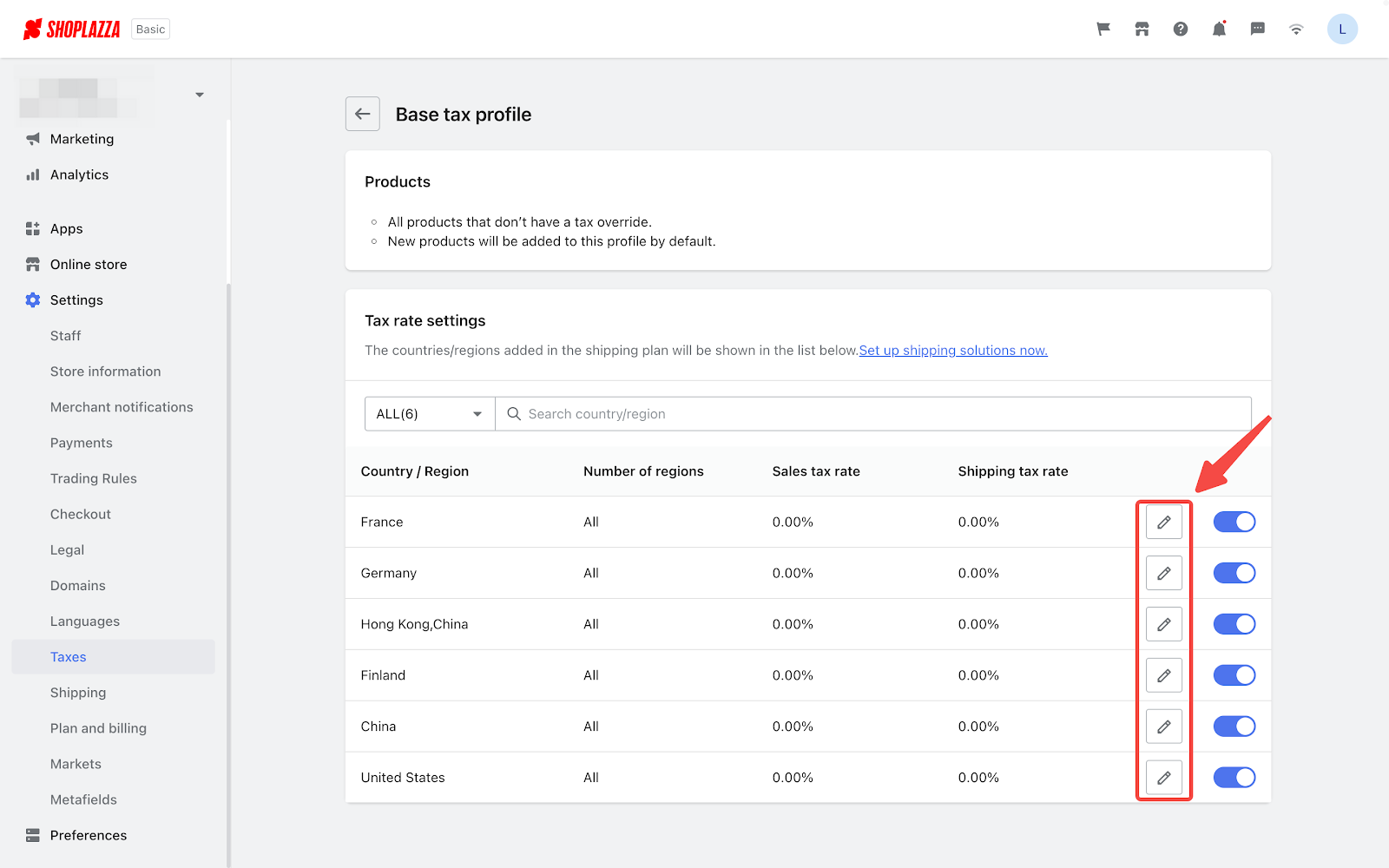

4. You can click the edit button here to set up tax rates for a certain country or region.

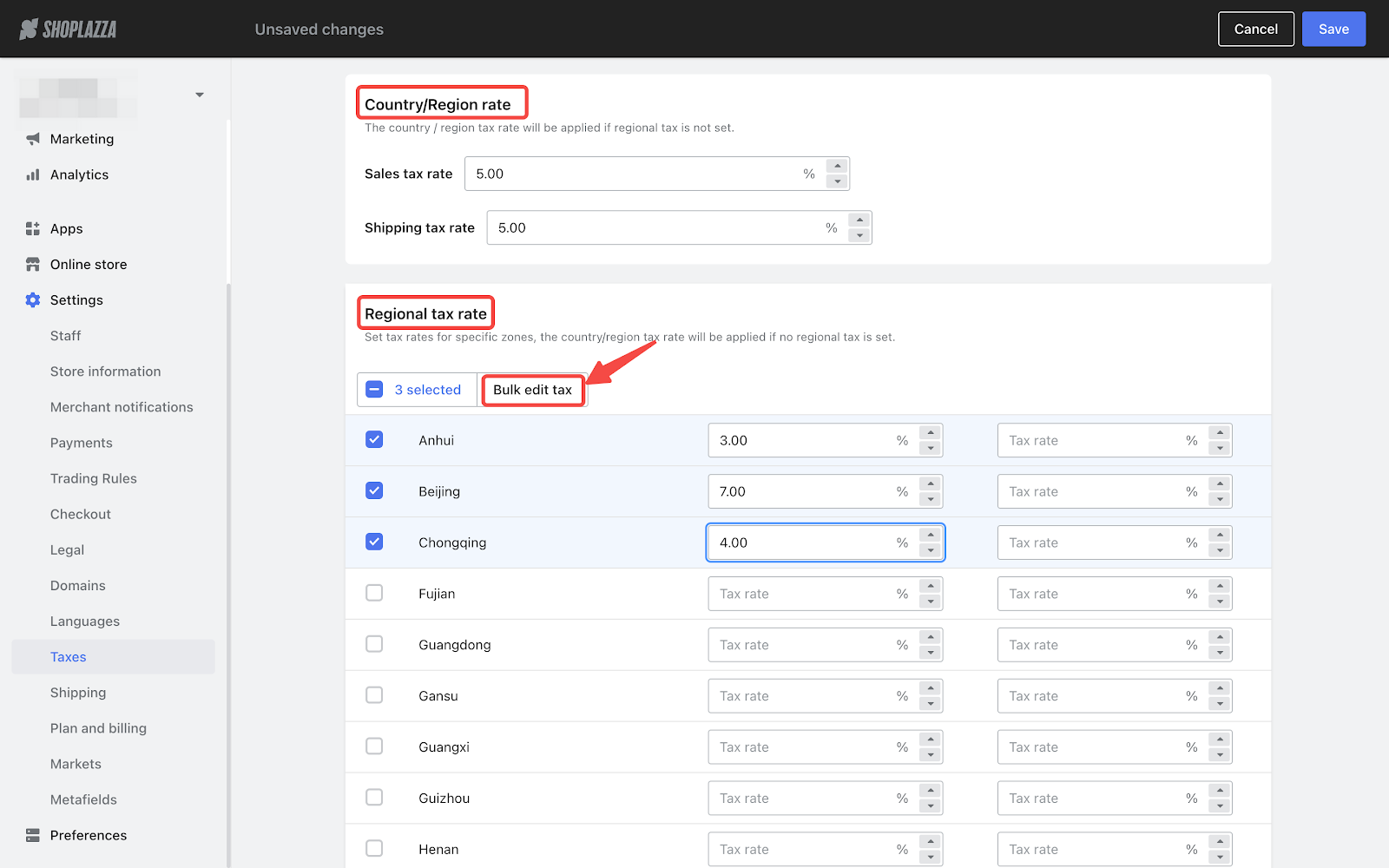

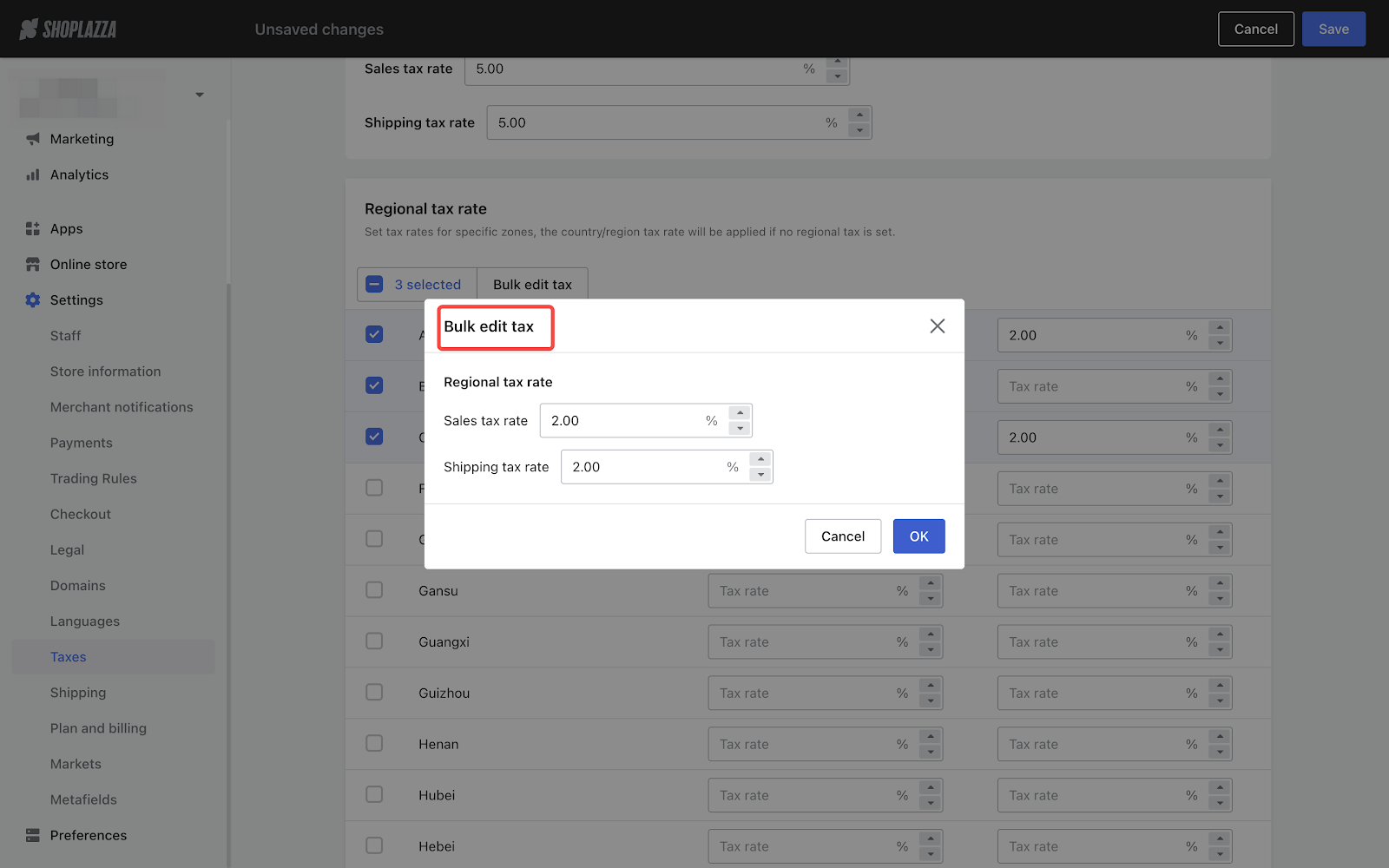

5. In this section, you can set the Country/Region rate as a whole or the Regional tax rate seperately. You can also set the regional tax rate of several regions by clicking Bulk edit tax.

Note

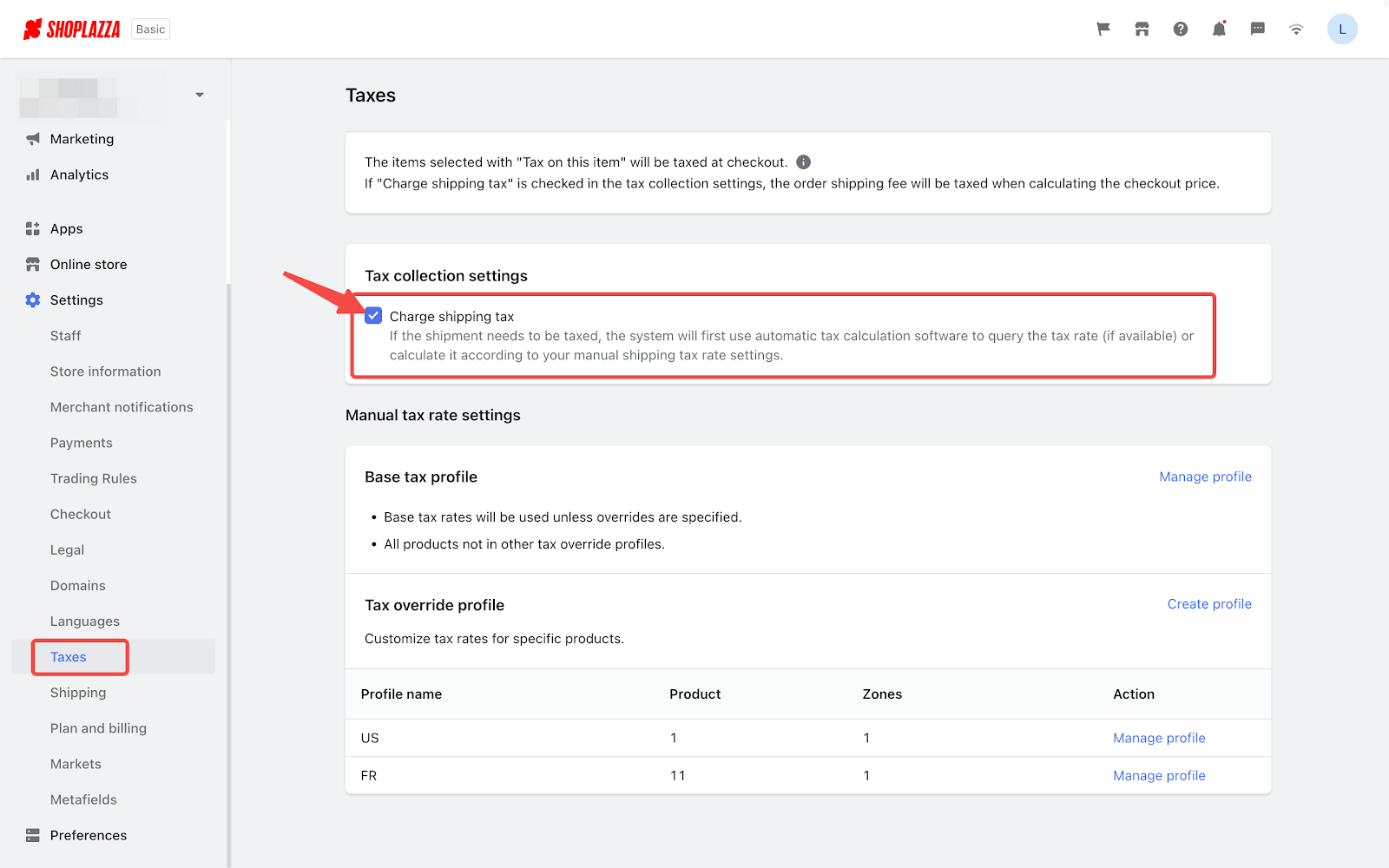

If you want to charge the customers shipping tax, please first go to Settings > Taxes > Tax collection settings and allow "Charge shipping tax".

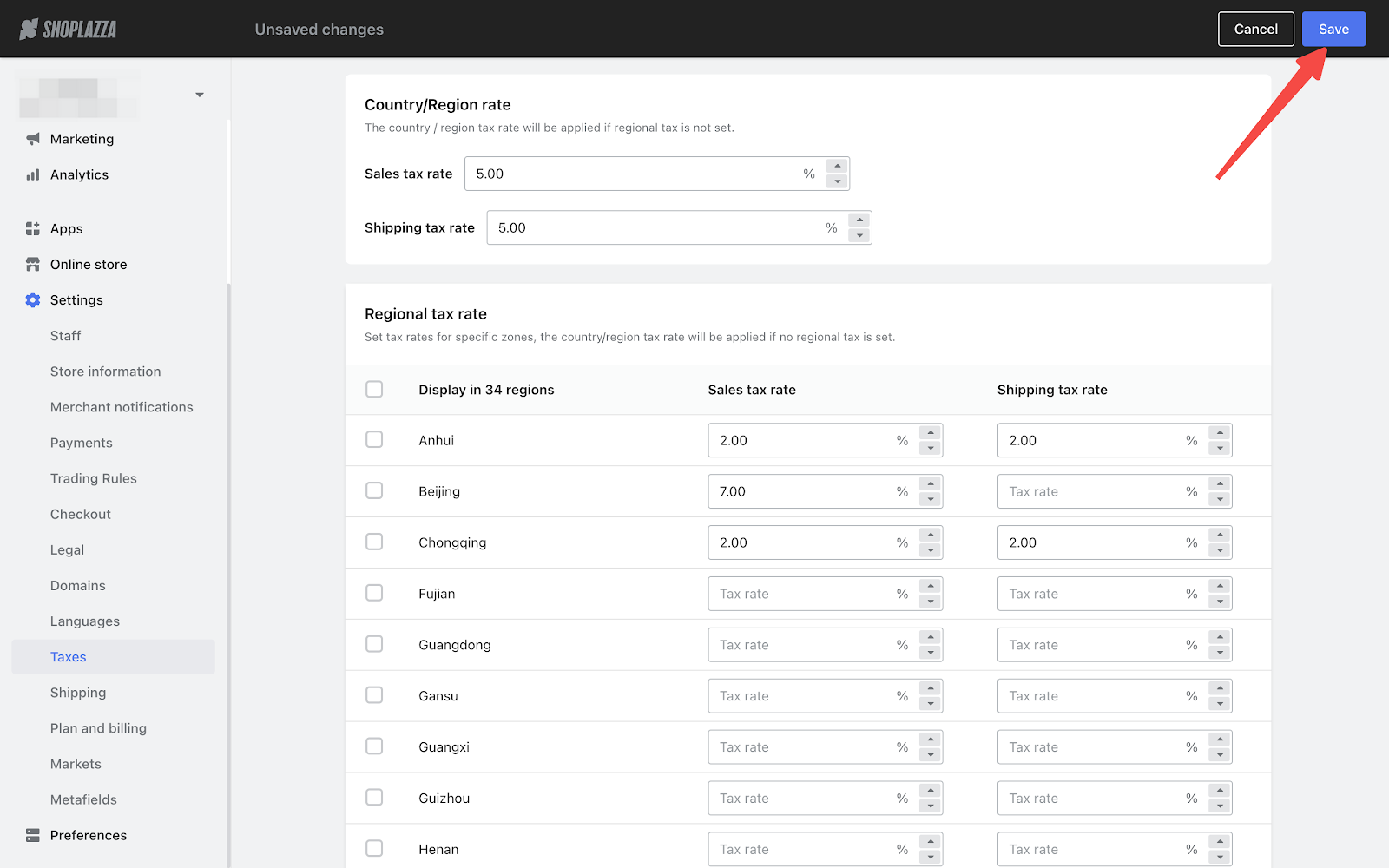

6. After completing the whole process, you can click Save to save your settings.

Comments

Please sign in to leave a comment.