On This Page

1. 【Update】Taxation on Canadian pricing plans

2. 【Update】Store Migration: Supports migration from Shopline and product SEO migration

3. 【Update】TikTok Shop added to TikTok sales channel

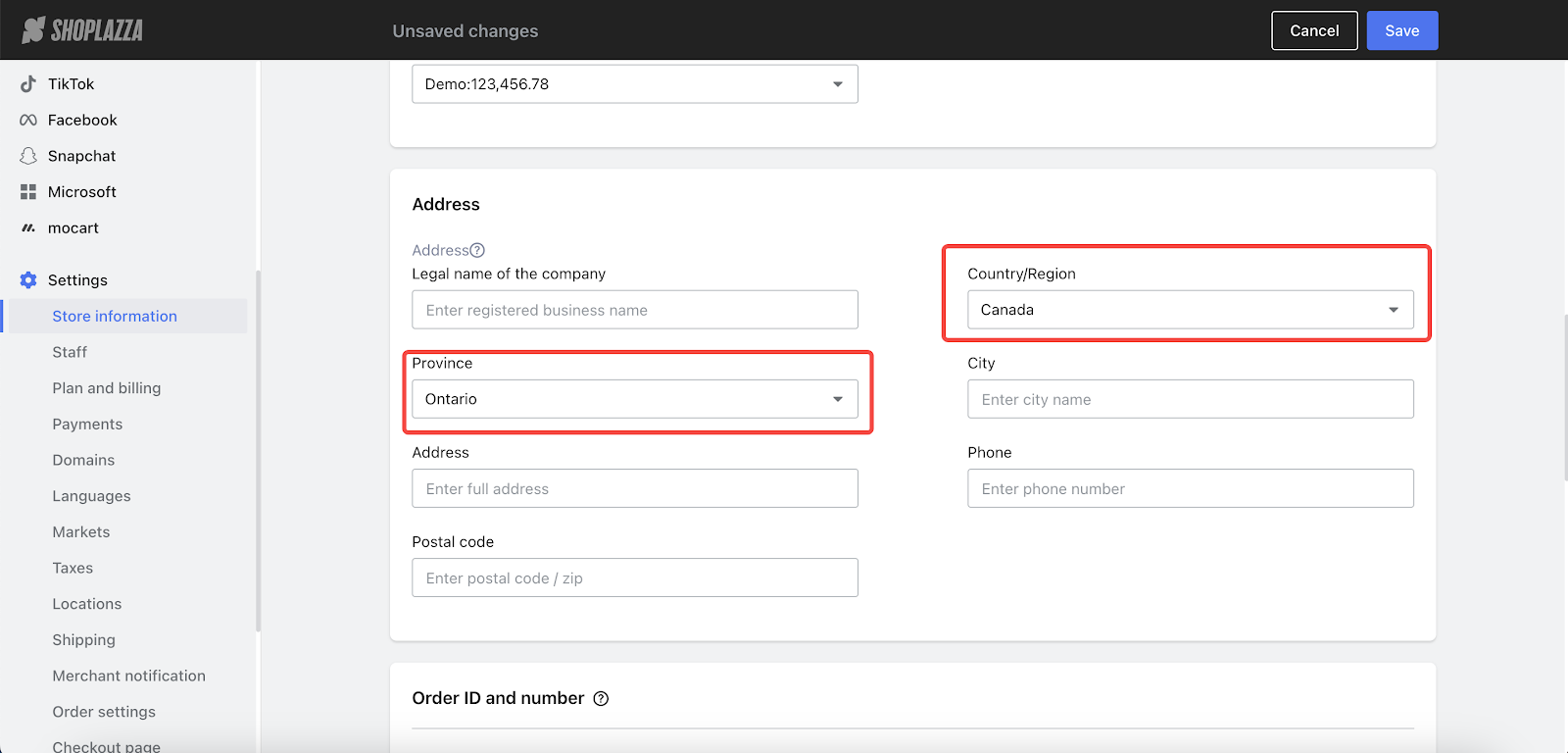

1. 【Update】Taxation on Canadian pricing plans

Usage scenario

- According to Canadian law, merchants selling products within Canada have the responsibility to ensure that their stores have correctly declared and paid taxes.

Usage path

- Log in to your Shoplazza admin backend, go to Settings -> Store information, and complete the information about the country/region and province/state where the store is located.

Overview of tax rules

- For merchants using our Canadian pricing plans, taxes will be calculated based on the province indicated in your store info during both the plan purchase and commission deductions:

- Plan tax = (Plan price - Discount) * Tax rate

- Commission tax = Total commission * Tax rate

- Starting April 30, all tax charges associated with your store will be strictly based on the information you've provided in your settings. If you haven't specified a province/state, we'll default to the tax rate of Ontario. Detailed tax information will be included in your billing statement.

Interface screenshot or GIF

- Screenshots

- Tax Rules by Province in Canada

| Province | GST | RATE | HST | RATE | Tax ID |

| Alberta | GST-CANADA | 5% | HST-Alberta | 0% | #703020404 RT0001 |

| British Columbia | GST-CANADA | 5% | HST-British Columbia | 7% | #703020404 RT0001 |

| Manitoba | GST-CANADA | 5% | HST-Manitoba | 7% | #703020404 RT0001 |

| New Brunswick | GST-CANADA | 5% | HST-New Brunswick | 10% | #703020404 RT0001 |

| Newfoundland and Labrador | GST-CANADA | 5% | HST-Newfoundland and Labrador | 10% | #703020404 RT0001 |

| Northwest Territories | GST-CANADA | 5% | HST-Northwest Territories | 0% | #703020404 RT0001 |

| Nova Scotia | GST-CANADA | 5% | HST-Nova Scotia | 10% | #703020404 RT0001 |

| Nunavut | GST-CANADA | 5% | HST-Nunavut | 0% | #703020404 RT0001 |

| Ontario | GST-CANADA | 5% | HST-Ontario | 8% | #703020404 RT0001 |

| Quebec | GST-CANADA | 5% | HST-Quebec | 9.98% | #703020404 RT0001 |

| Prince Edward Island | GST-CANADA | 5% | HST-Prince Edward Island | 10% | #703020404 RT0001 |

| Saskatchewan | GST-CANADA | 5% | HST-Saskatchewan | 6% | #703020404 RT0001 |

| Yukon | GST-CANADA | 5% | HST-Yukon | 0% | #703020404 RT0001 |

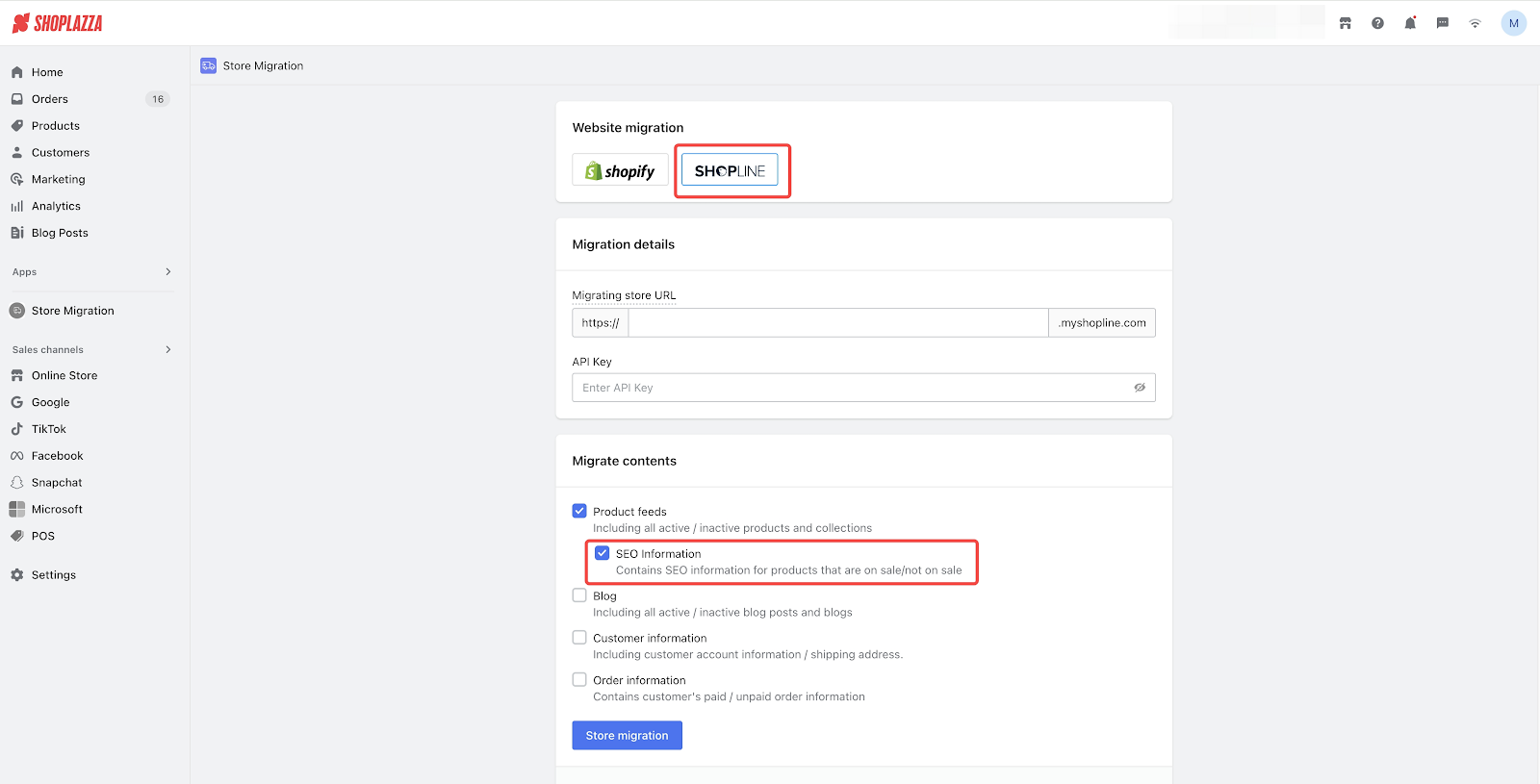

2. 【Update】Store Migration: Supports migration from Shopline and product SEO migration

Background info

- Some merchants have expressed a need for migration from Shopline and for product SEO migration.

Optimization objective

- To fulfill the requirements for Shopline migration and product SEO migration.

Usage path

- Log in to your Shoplazza admin backend, go to Apps -> Store Migration

Interface screenshot or GIF

- Screenshots

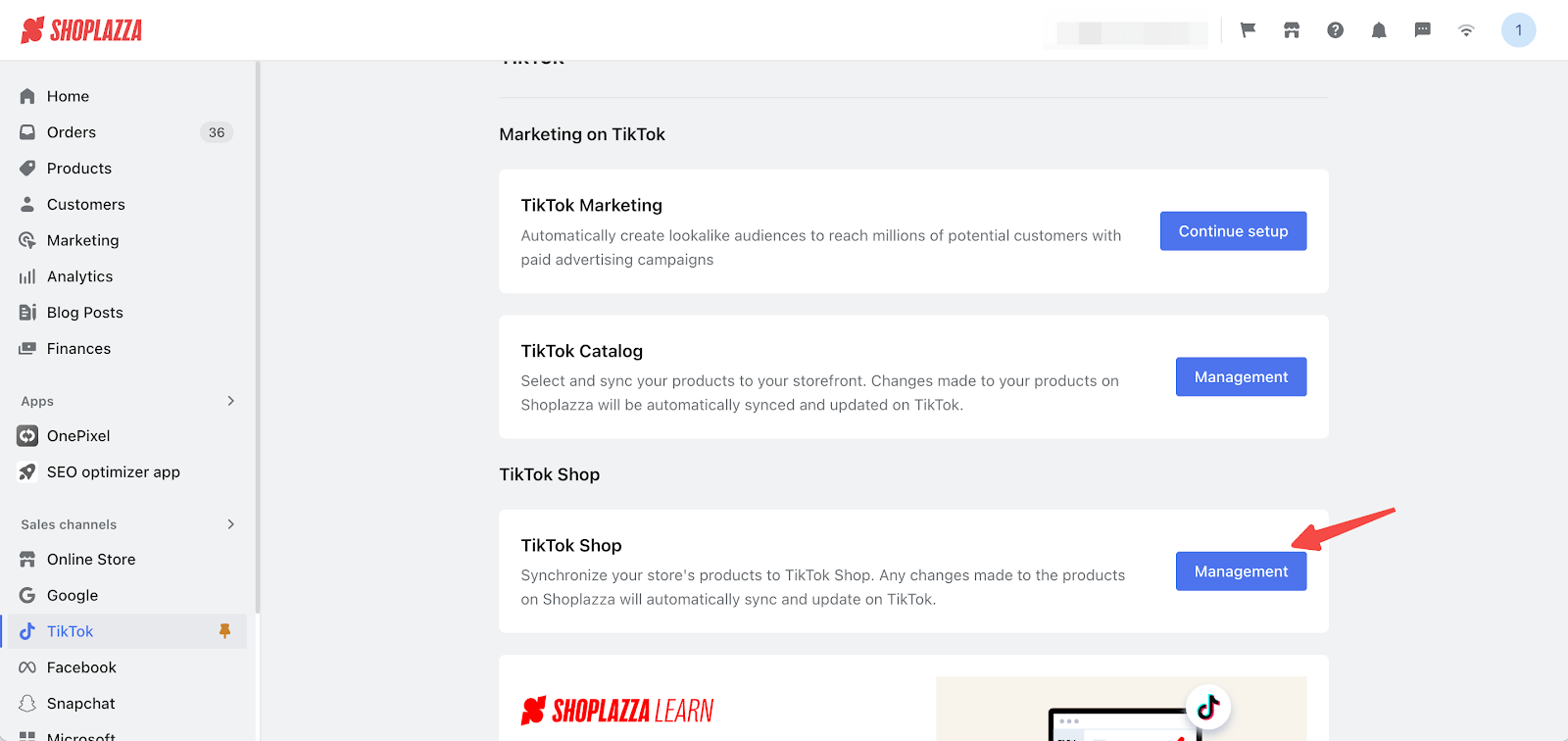

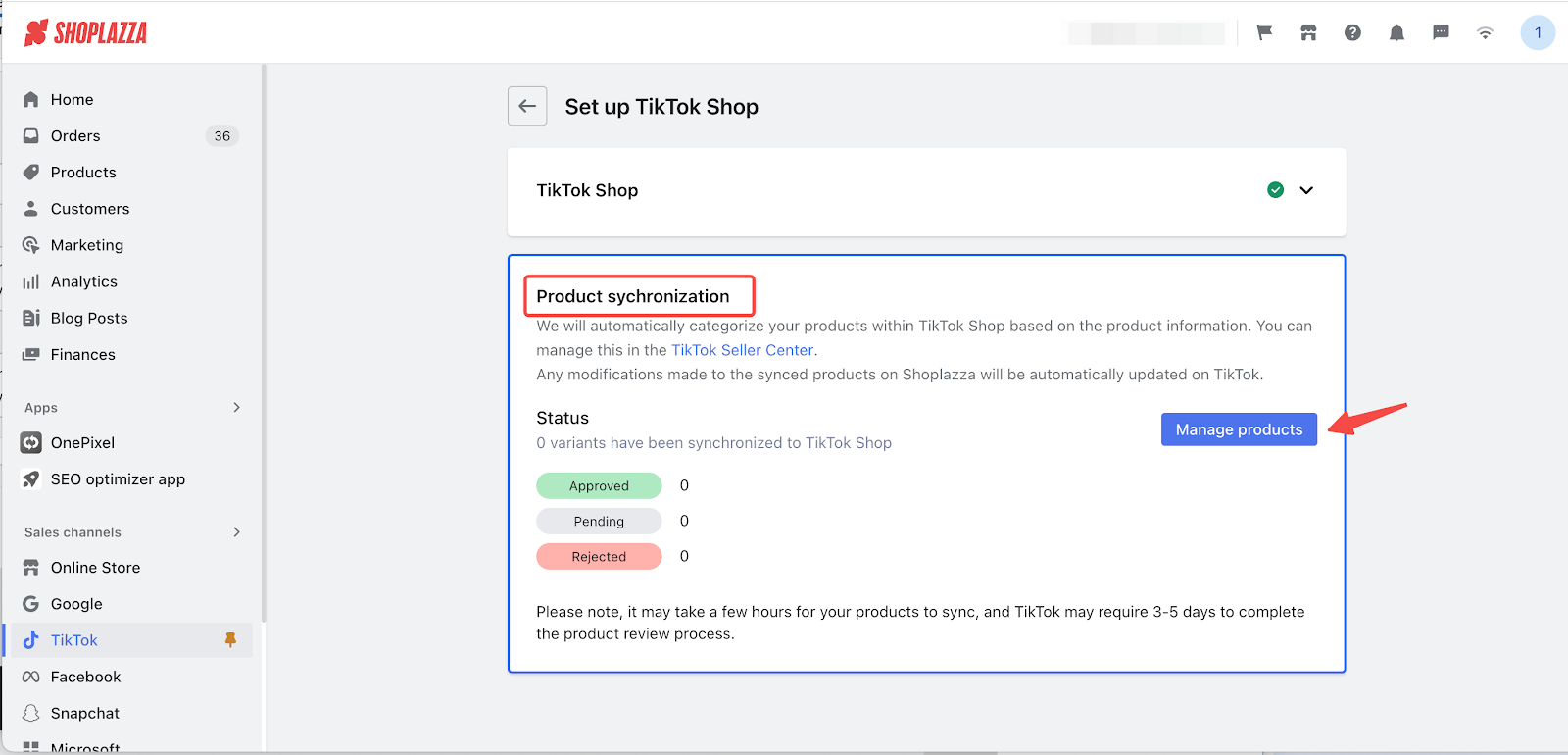

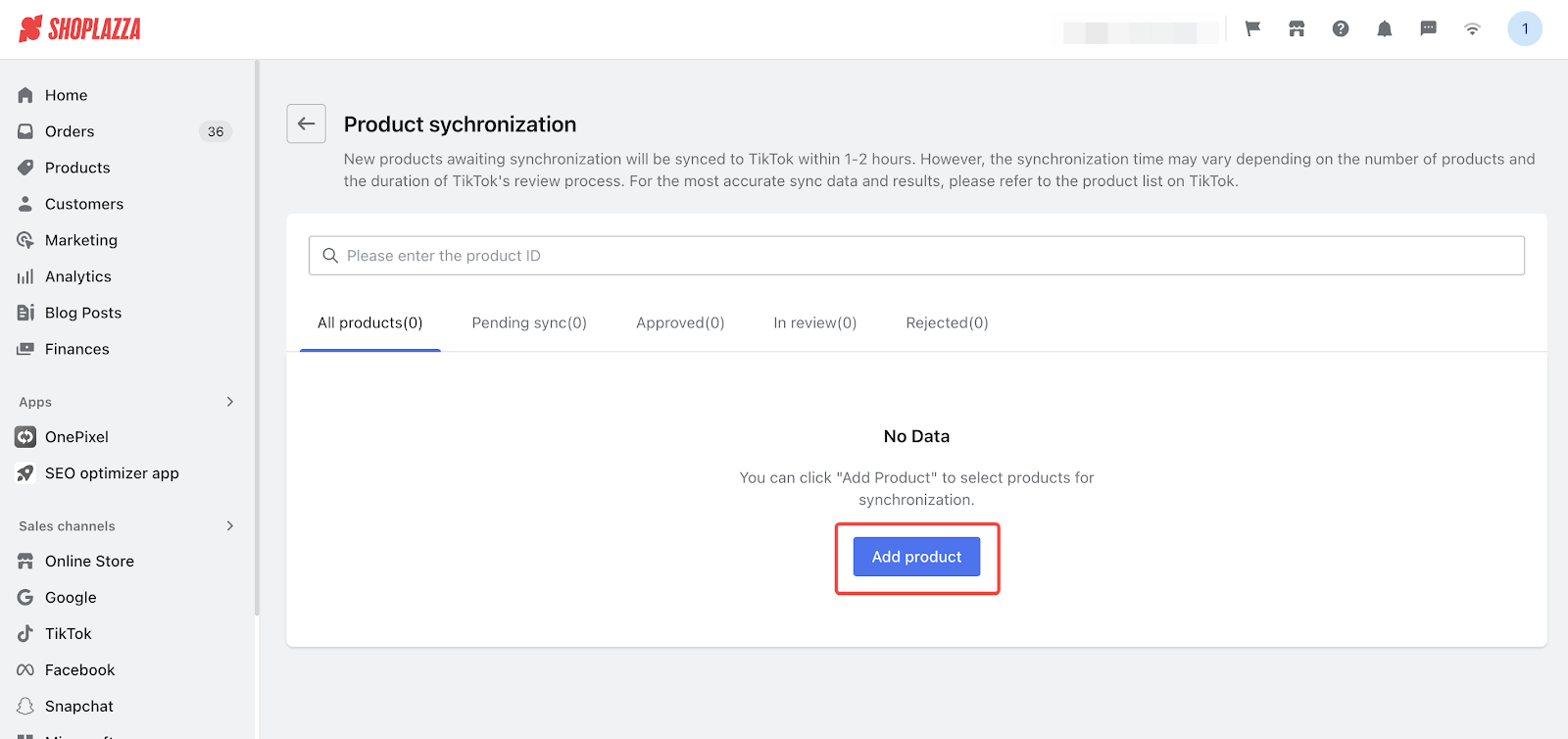

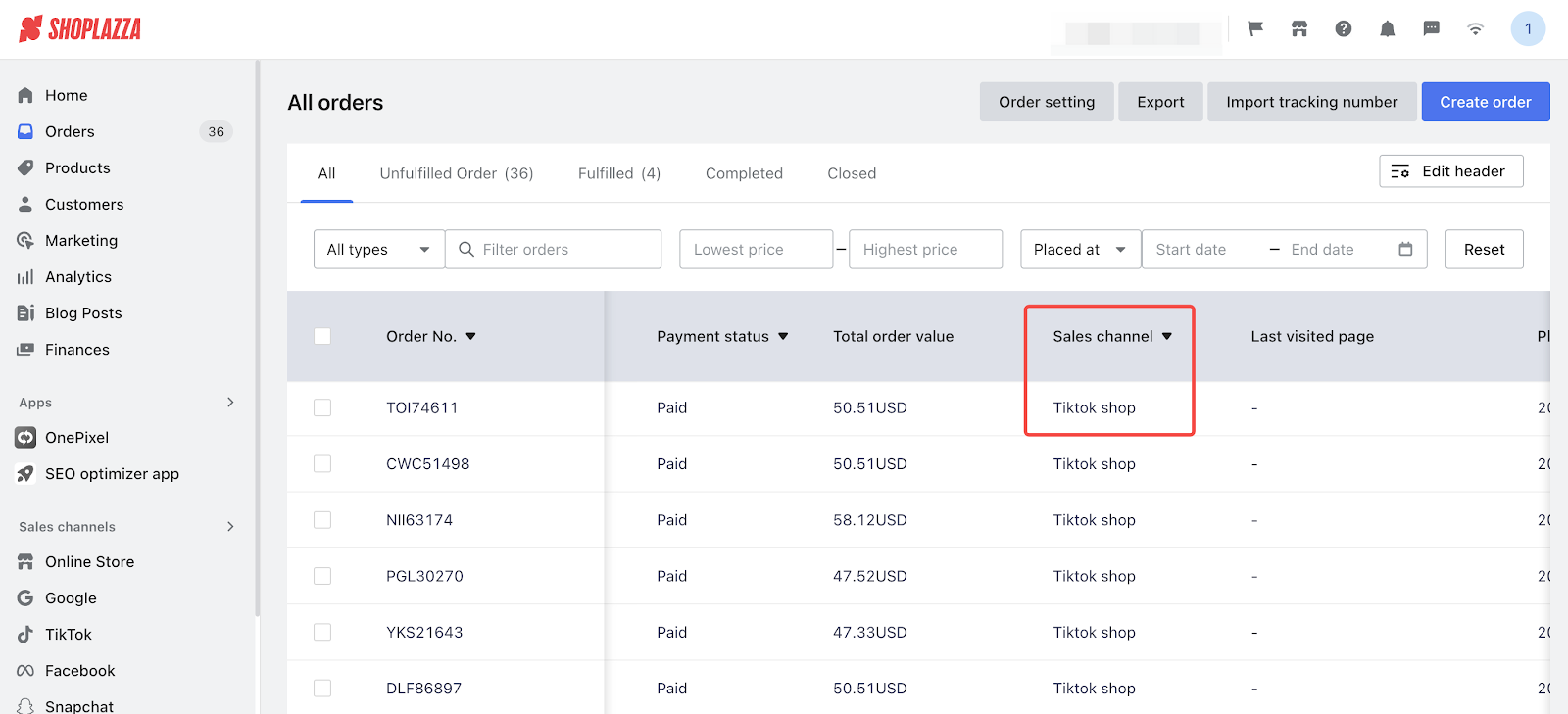

3. 【Update】TikTok Shop added to TikTok sales channel

Usage scenario

- This feature is useful when merchants want to expand their sales channels to TikTok Shop. It allows US merchants to sync their products quickly for smooth onboarding to TikTok Shop. We also offer an order synchronization solution to improve the merchant's user experience.

Usage path

- Log in to Shoplazza admin backend, go to Sales channels -> TikTok -> TikTok Shop

Feature introduction

- This feature enables connection to TikTok Shop, product synchronization, and order synchronization.

Interface screenshot or GIF

- Screenshots

Comments

Please sign in to leave a comment.